Affiliate links on Android Authority may earn us a commission. Learn more.

10 best investment apps and finance apps for Android

Investing is difficult to get into at first. It’s basically the act of putting your money into a thing with the intention of earning more money from it. There are a bunch of ways to do so, including 401k plans, the stock market, mutual funds, investment bonds, and all sorts of other things. People who invest intelligently can get supplemental income, retire someday, and really take control of their finances. Here are the best investment apps for Android.

Please note, this list is primarily for US folks since that is where the majority of our readership lives. However, many of these apps are available to people in other countries as well. Also, nothing in this article is financial advice. This article is for information purposes only.

The best investment apps for Android

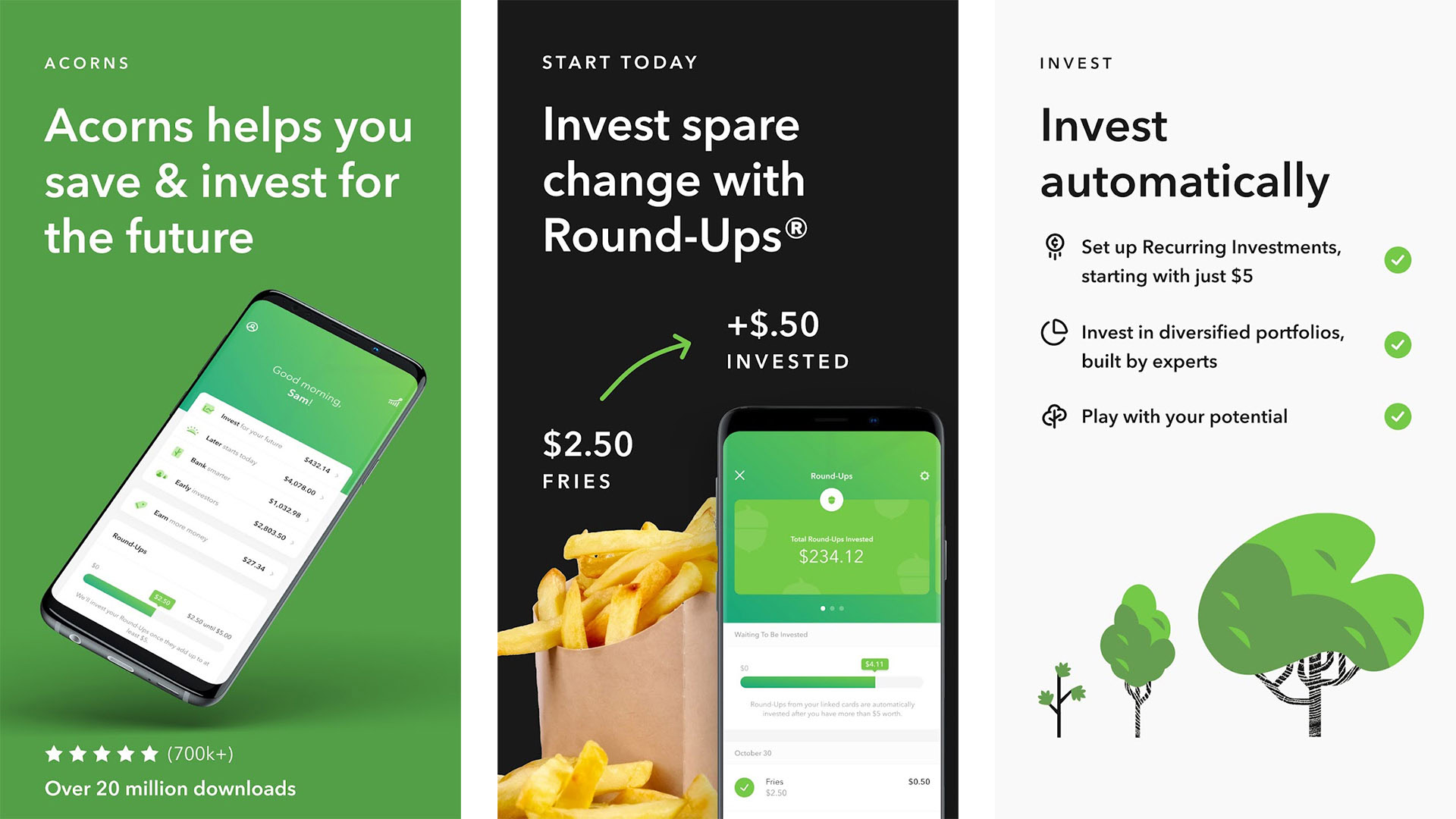

Acorns

Price: Free / Varies

Acorns is an excellent investment app for beginners. It basically keeps track of all of your transactions, rounds each purchase up to the next dollar, and uses those few cents per purchase to invest your money. You accumulate some decent money over a long period of time. The app is entirely free for college students and has a relatively low fee for non-college students. Acorns also includes CNBC coverage, a rewards program, and some other stuff to help you get started with investing.

Google Search

Price: Free

Knowledge is power and nothing matters more than knowledge when investing. Google Search is your friend in these instances. You can look up companies to see what they’re all about, find SEC filings, the latest news, and other such things with the push of a button. Google Search also has built-in support for stocks. You simply need to search the symbol and you can see the latest prices. This one is more for active investors rather than passive ones because learning something quickly is the difference between getting out fast with a profit or too slow with a loss.

Price: Free / $3.99 per month / $29.99 per year

Reddit is another excellent place for investors for a variety of reasons. There are subreddits for personal finance, the stock market, and various topics like that. You can easily go in, ask questions, get answers, and learn how investment really works. Additionally, most brokerages and investment firms have their own subreddits where you can interact with other customers, ask questions, and figure out how your tools work. We obviously don’t recommend following Reddit for financial advice, but it’s a great way to learn from the experience of others.

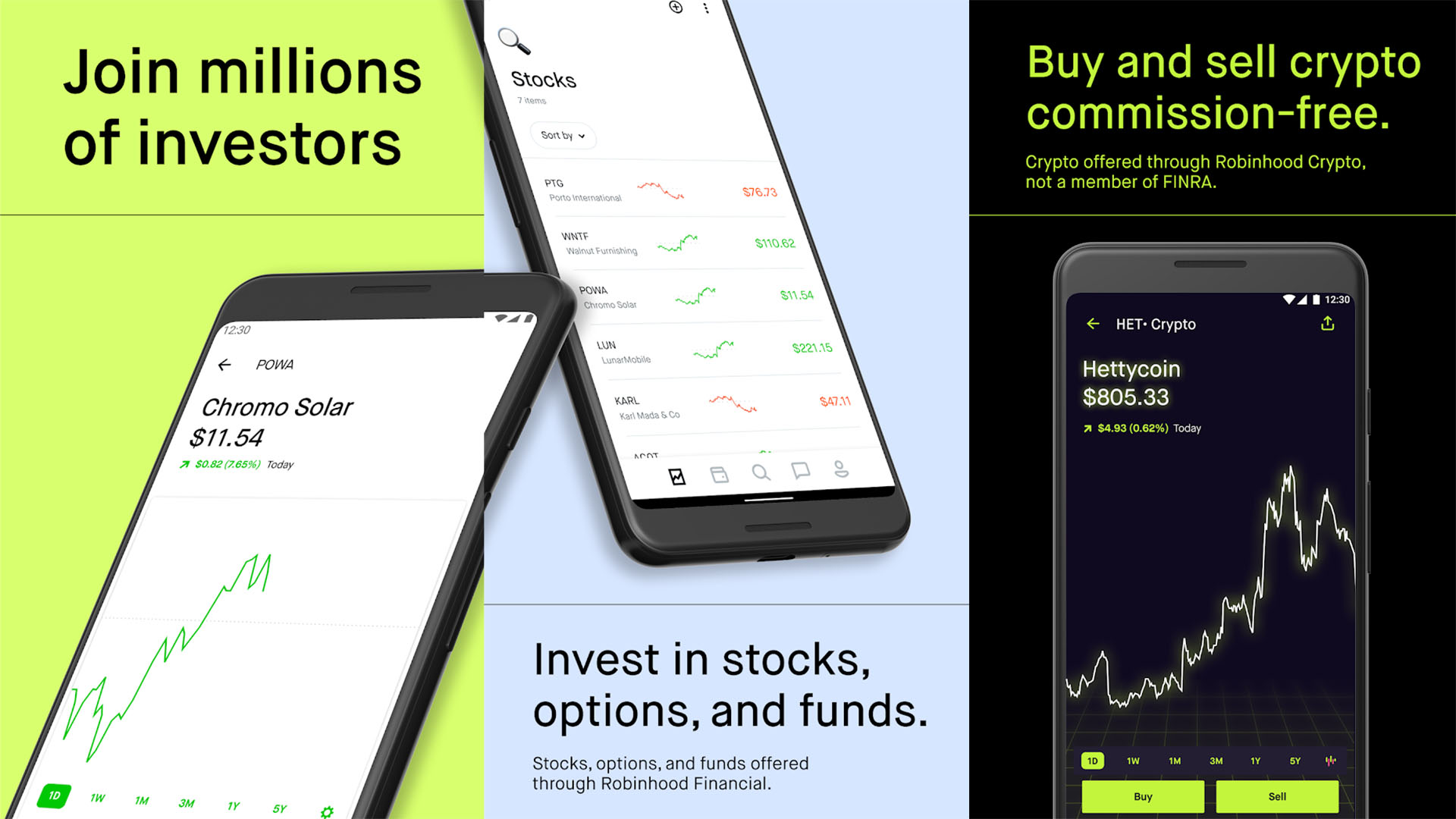

Robinhood and Webull

Price: Free

Robinhood (linked at the button) and Webull (Google Play) are brokerages that let you trade stocks on the stock market. Robinhood is the easier of the two while Webull is slightly more stable. Both apps let you deposit money, trade stocks, and withdraw money when you’re done. You can also trade options and cryptocurrency, the latter being rather rare in the brokerage space. These user-friendly, all-in-one solutions are often scoffed at for gamifying the stock market space. However, they are very simple to use. They’re both good for dipping your toes into the stock market.

Robo-Advisor apps like Fidelity

Price: Free / Varies

Robo-Advisors is a neat way to invest your money. They use automated, algorithm-driven services to invest your money. There are a variety of brokerages with this feature. Some of the ones with excellent track records include Fidelity (linked at the button), Vanguard (Google Play), and M1 Finance (Google Play). These apps also let you manually trade stocks so you can see if you can beat your bot advisor. Fees, minimum requirements, and other stuff like that vary from brokerage to brokerage. Most of these services, especially Fidelity, also let you trade stocks, buy mutual funds, start 401k plans, and other such things. These services make for great all-in-one investment apps.

Read more:

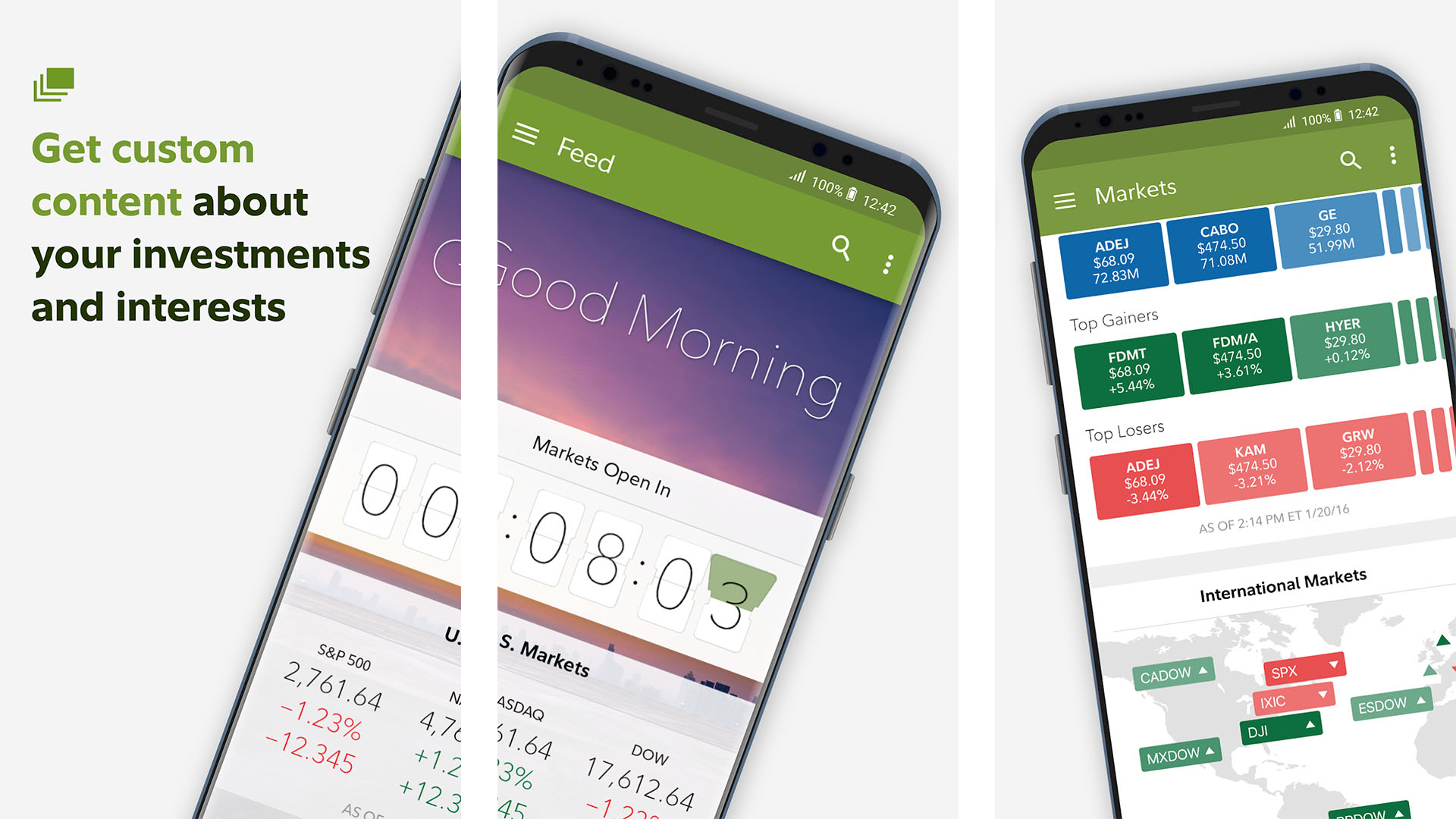

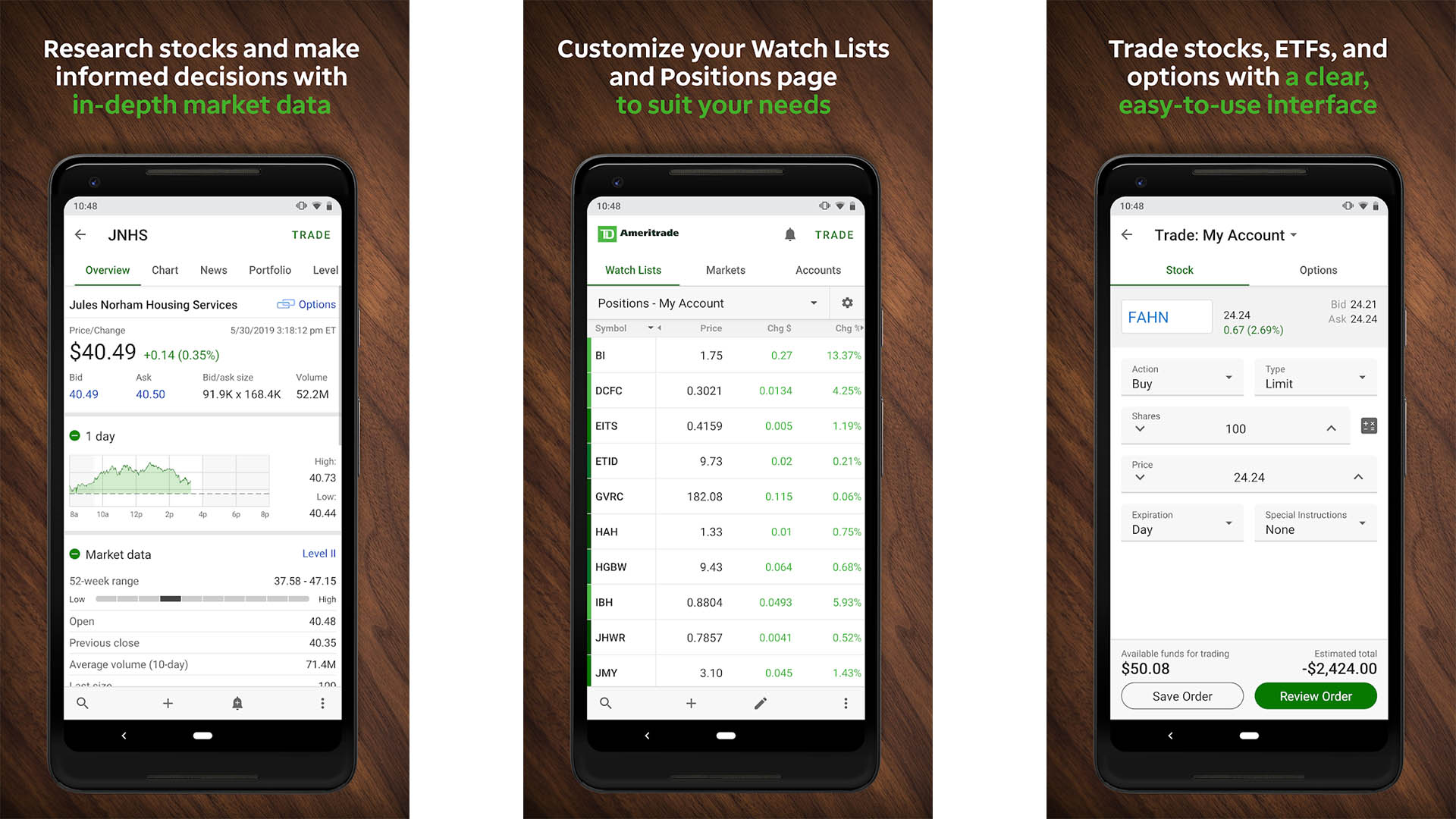

Traditional brokerage apps like TD Ameritrade

Price: Free (usually) / Varies

Traditional brokerages were terrible experiences on mobile not that long ago. That’s why Robinhood became popular to begin with. However, most brokerages have simplified their UIs, made a lot of their trading tools more accessible, and lowered their costs. Some examples of traditional brokerages include TD Ameritrade (linked at the button), E*Trade (Google Play), and others. Brokerages not only let you trade in the stock market, but often let you manage your 401k, mutual funds, and other such investments. You’ll want to make sure any new brokerage account has the features you need before signing up so you can be sure you can manage everything all in one place.

Wallet

Price: Free / $5.99 per month / $21.99 per year / $49.99 once

A big part of investing is making sure you have actual money to invest. For that, you may need something like Wallet. Wallet is a money-management and budgeting tool. You link up your bank accounts, see how your money gets spent, and then try to cut back so you have more money to invest. Wallet (and apps like them) don’t actually let you invest any money. However, the more you invest, the higher your potential for gain. Financial management is super boring, but it’s an important part of investing.

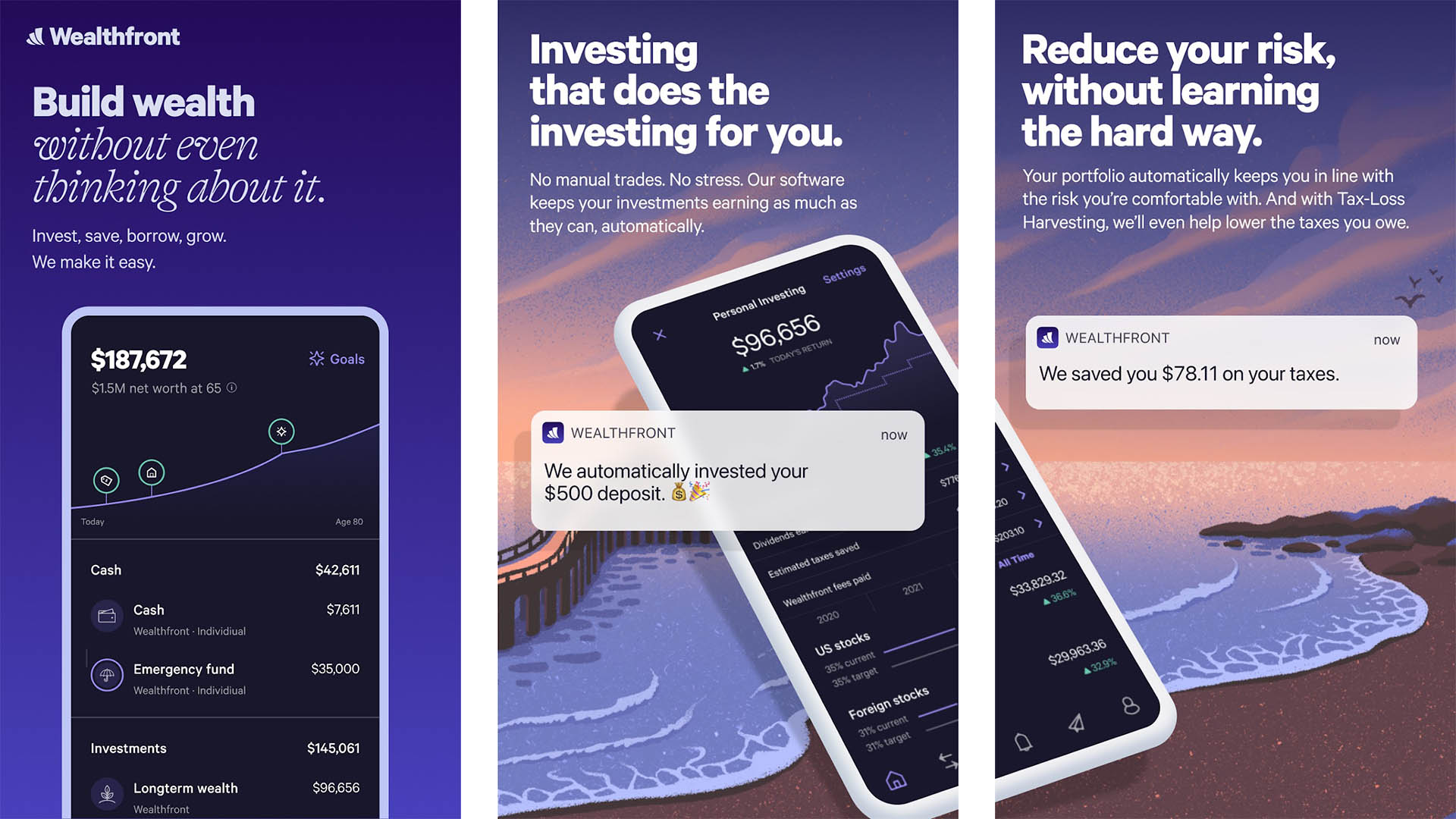

Wealthfront

Price: Free / Varies

Wealthfront is a little bit like Acorns. The difference is you put money into this one manually for the service to automatically invest on your behalf. Wealthfront gives you two options. You can invest in a portfolio they made or design one yourself. Wealthfront then handles all of the trading on your behalf so you can, hopefully, see your money grow. We like this one because it also links your bank accounts so you can see all of your finances in a single app. That gives you more power to make better decisions financially.

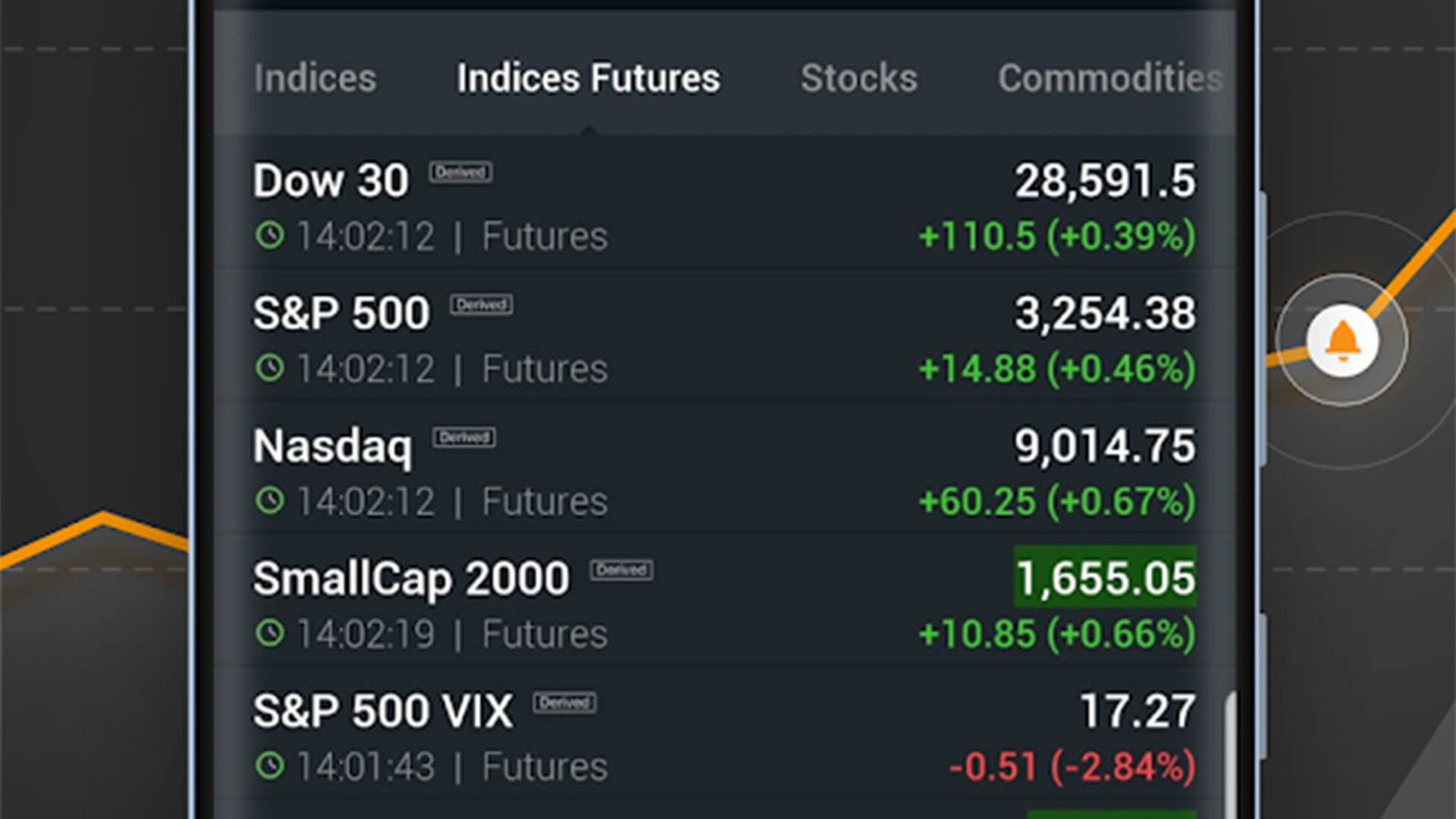

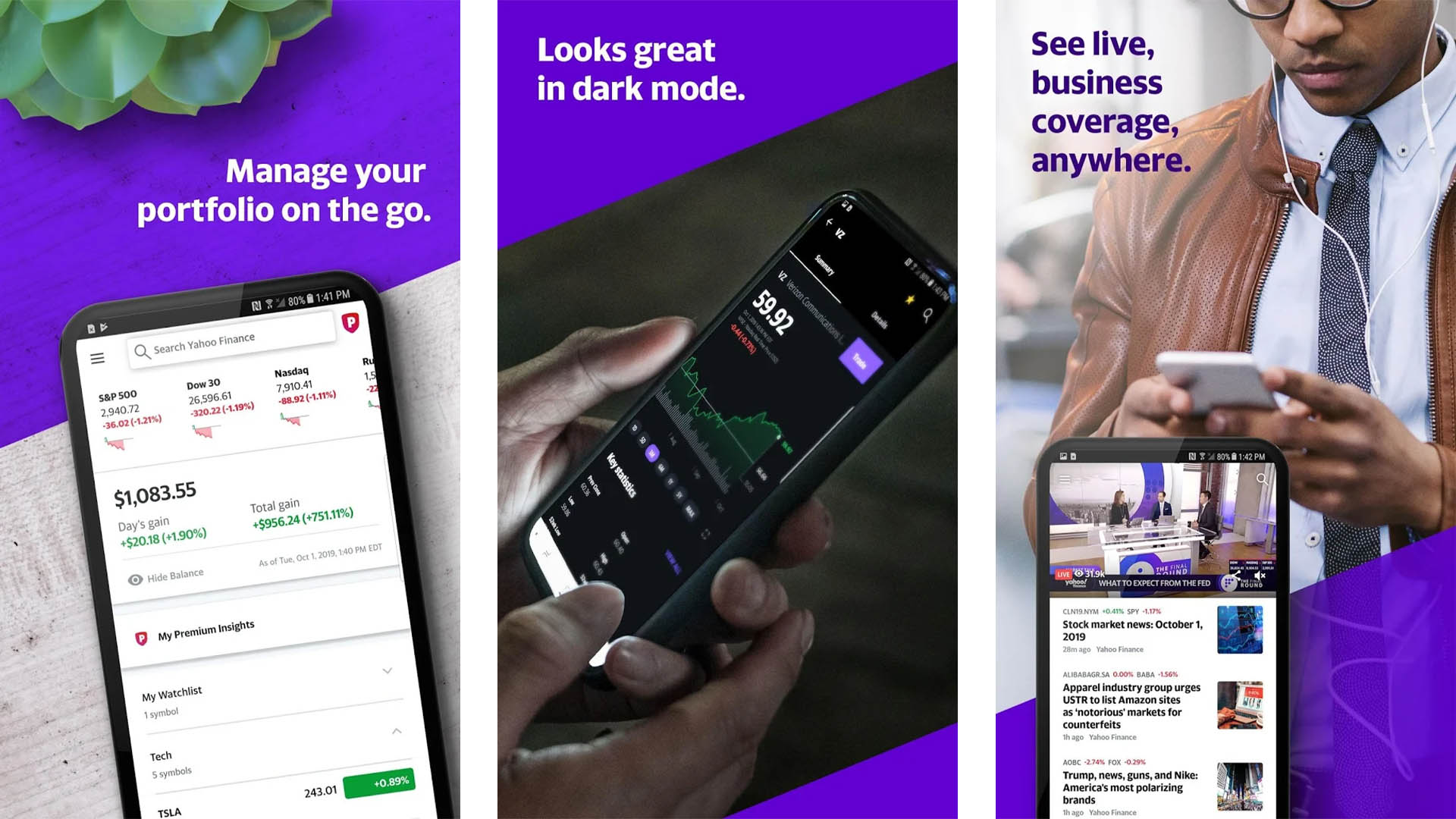

Yahoo Finance (and similar apps)

Price: Free / Varies

Yahoo Finance is an excellent beginner app for investing. It doesn’t let you trade or invest any money. However, it’s a great one-stop shop for checking the stock market, seeing the latest news, checking out historical trends, and other stock market metrics. Plus, you can link your brokerage accounts directly to Yahoo Finance so you only have to open one app to check everything. The app does have the occasional bug, but in over two years of use, I haven’t had anything happen so bad that it cost me any money. We especially recommend this one to Robinhood users because Robinhood’s news feed and stock information can be a little anemic and Yahoo Finance augments that experience nicely. There are other options in this space as well, like Investing.com and others. However, Yahoo Finance works more than well enough.

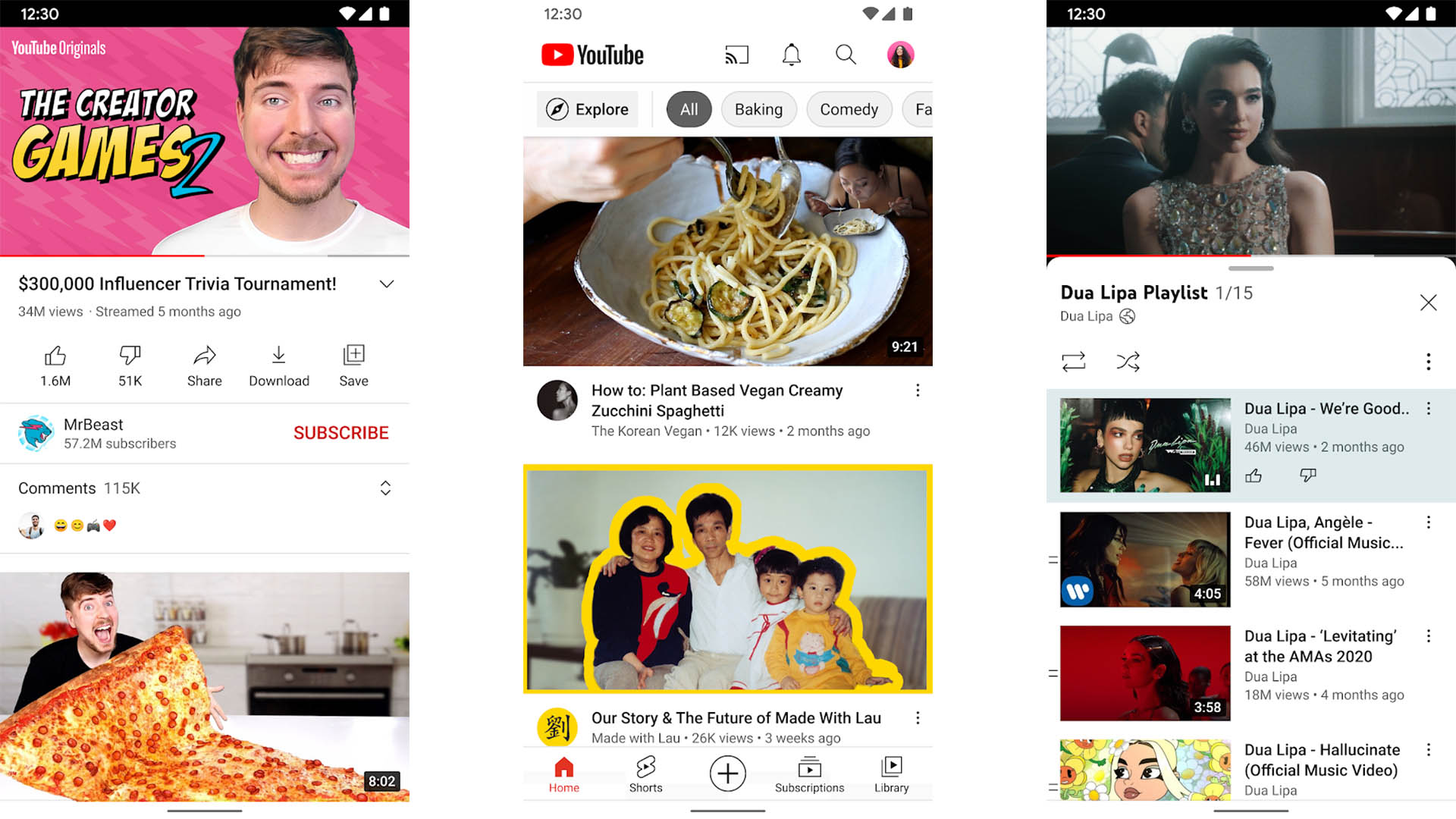

YouTube

Price: Free / $12.99 per month

YouTube is an underrated tool for investing. The app has thousands of creators that do tons of videos about various types of investing. You can learn how 401k plans work, how mutual funds work, how the stock market works, and all sorts of other stuff. I watched this series to learn how stock options work. Videos like those can answer a lot of basic questions much faster than other sources. There are many who make guesses about stock market prices and such, but we recommend proceeding with extreme caution when viewing those. In any case, this is a great spot to learn about the basics of investing so you can decide how you want to proceed with it.

Bonus: Investing games

Price: Free (usually)

There are a variety of games on the Google Play Store that let you invest fake money in the real stock market. You don’t earn any real money this way. However, games like these are great educational tools to let you move around and learn how things work without losing any real money. There are a bunch of games like this, but some of the best ones include Investr (linked at the button), Learn by MyWallSt (Google Play), and Wealthbase (Google Play). All three games do the same thing. They give you fake money for you to fake invest, but it uses real stock market data to do so. Games like these are great for beginners, but advanced investors probably don’t need something like this.

If we missed any of the best investing apps for Android, tell us about them in the comments! You can also click here to check out our latest Android app and game lists.

Thank you for reading! Try these out too: