Affiliate links on Android Authority may earn us a commission. Learn more.

Which up-and-coming OEM has the best chance for global success?

It would be an understatement to say that consumer tech is experiencing something of a renaissance right now, particularly when it comes to smartphones. Everything is becoming slimmer, sleeker and continuously more powerful. Meanwhile, we no longer have to break the bank to stay on the bleeding edge; smaller (and/or lesser known) tech manufacturers (many of which are located in Asia) are on the rise, bringing with them a selection of impressive devices that are every bit as powerful as those made by the industry’s darlings but at a fraction of the cost.

We saw a number of great devices over the course of 2016. The Samsung S7 series remains one of the most popular and highly-recommended devices, while HTCreleased one of its best smartphones ever in the HTC10, despite its lackluster sales. However, many of the year’s most successful devices came courtesy of OEMs that are less familiar to many of us in the west, from brands including HUAWEI, Xiaomi, vivo, and ZTE.

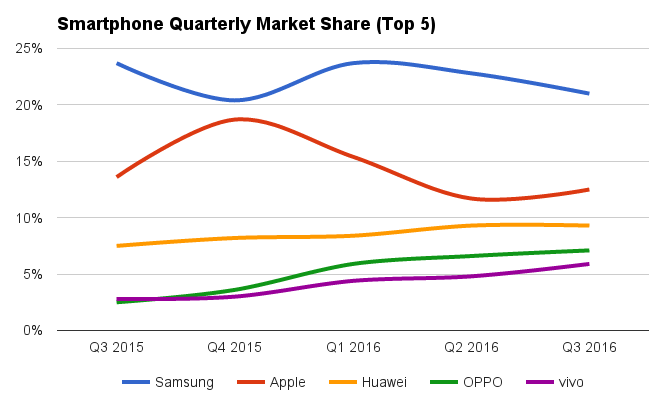

With Samsung and Apple both seeing market shares taking a dip in 2016, it’s possible that one of these growing OEMs are well positioned to take a meaningful challenge to the big two. Perhaps one of these smaller OEMs could even become the next Samsung or Apple?

What do 2016 sales tell us?

When you look at the best-selling smartphones of 2016 in the United States, you’ll notice that most of them aren’t very surprising; the Samsung Galaxy S7 Edge and S7 take first and second place respectively, while the iPhone 7 Plus, iPhone 7, Google Pixel, and Pixel XL round out the remainder of the top six. Lenovo’s Moto Z places seventh and the HTC10 is (somewhat amusingly) in tenth place. The “underdogs” of the list are ZTE Axon 7 in eighth place and the OnePlus 3T in ninth place.

Despite OnePlus’ reputation as a bit of an underdog, the company has curated a significant following in the west, especially when it comes to tech enthusiasts. Meanwhile, ZTE has been hoping to make headway in the west and 2016’s Axon 7 has certainly got the company headed in the right direction. However, HUAWEI and Xiaomi — which are, respectively, the third and fifth best-selling OEMs globally — have yet to gain traction in the US. It’s worth noting, too, that representatives of both HUAWEI and Xiaomi have stated they intend to be more competitive in western markets in 2017 and beyond.

OPPO — the fourth best-selling OEM in the world — has been experiencing some of the most impressive growth rates of any tech manufacturer with current sales being up 145 percent for the current quarter. TCL Communication — most familiar as the Alcatel brand — is at number eight for global sales, having recently acquired the Palm brand from HTCand begun a hardware partnership with BlackBerry. India-based Micromax is in tenth place globally and is the only OEM from outside of China to show up in the top ten best-performing OEMs, Samsung and Apple notwithstanding.

One notable brand that has made intermittent quarterly appearances among the top ten global smartphone brands is vivo. For example, during Q1 2016, China-based vivo cracked the global top ten, landing in seventh place due to the release of the Xplay5 and Xplay5 Elite, the latter of which was the first phone ever to contain 6GB of RAM.

The two biggest global smartphone brands that aren’t charting in the United States are HUAWEI and Xiaomi. Beyond those two, OPPO, TCL/Alcatel, Micromax, and vivo are four others that often chart globally.

To be clear, the fact that an OEM can be in the top ten globally yet absent from the US top ten is not a mistake. Although the United States is a major market, growth in China and India, in particular, has offered OEMs the opportunity to expand without necessarily having to compete in the US. For those brands on both lists — like Samsung and Apple — sales are strong both within the United States and abroad.

In case you’ve not been tallying, here’s where we are: The two biggest global smartphone brands that aren’t charting in the United States are HUAWEI and Xiaomi. Beyond those two, OPPO, TCL/Alcatel, Micromax, and vivo are four others that often chart globally while not being very well-known in western markets. But which of these is/are best positioned for global success? Let’s take a closer look.

Huawei

It’s difficult to say whether HUAWEI could be considered an ‘up-and-comer’ for the very fact that the company is one of the top-selling smartphone brands in the world. However, the casual Android user in the United States is probably not familiar with HUAWEI, even though the China-based OEM released some really great hardware in 2016. Between HUAWEI and spin-off brand HONOR, the company was responsible for the HUAWEI P9, Mate 8, HONOR 8, Mate 9, and 2015’s Nexus 6P, which remained popular well into 2016 and is still a favorite among Android purists today. And even though we’re only a few weeks into 2017, HUAWEI shows no signs of slowing if the recently-released HONOR 6X is any indication.

Perhaps the most compelling evidence that HUAWEI is on the cusp of global success is how quickly the company’s sales numbers have been climbing. According to Forbes, HUAWEI is seeing a 10 million increase year-on-year increase in quarterly sales, reaching a total of 140 million smartphone sales over 2016. By comparison, Samsung’s sales have, more or less, remained steady while Apple has actually been seeing a decline. Meanwhile, reviews of HUAWEI’s recent smartphones have been unanimously positive among major news outlets. As was the trend in 2016, HUAWEI’s strength seems to be in delivering premium specs and build while undercutting the high cost of competitors’ hardware.

On top of that, HUAWEI has been showing industry leadership qualities through its in-house Kirin processor development, camera advancements with Leica, and its partnership with Amazon’s open virtual assistant API to deliver the world’s first Alexa AI powered smartphone. Out of all the companies in our list, HUAWEI is certainly the closest rival to Apple and Samsung in terms of in-house innovations. We shouldn’t be surprised if HUAWEI becomes a recognizable and highly regarded brand in western markets.

Xiaomi

If HUAWEI would be the least surprising of our up-and-coming OEMs to achieve global success, Xiaomi — also based in China — would be the second-least surprising. Often called “the ‘Apple’ of China”, Xiaomi turned heads with the Mi Mix, which was the bezel-less concept smartphone everyone was drooling over when it was given a limited release in November. Aside from this glimpse into the very near future, Xiaomi had several solid releases in 2016, including the Xiaomi Mi 5, Redmi 3, and, later in the year, the Mi 5S and 5S Plus. Out of what so clearly was the kindness of their hearts, the company even gave us something to plug the Note7-shaped holes in our hearts with the Mi Note 2.

When it comes down to it, the main thing that’s keeping Xiaomi from becoming a major player in the United States is that the company has been building up its sales channels and collecting essential patents . Each of the devices mentioned above — minus the Mi Note 2 since the device is also targeted as business users — failed to get a US release, so unless you don’t mind your LTE coverage taking a hit due to missing bands, you probably wouldn’t want a Xiaomi device. However, the company might yet decide to target the untapped potential that the United States represents, at which point Xiaomi would undoubtedly become a force to be reckoned with.

We may be waiting a while for further expansion from Xiaomi though, as the company has recently stated that it has grown “too fast”. The company notes that it needs to slow down and focus on its existing markets in order to ensure sustainable growth in the long term. While Xiaomi was fast to rise, it’s looking like closing the gap on the big two is going to take more time.

Oppo

While not very well known in the United States, OPPO is huge in China and other Asian markets. In fact, smartphones are just one type of tech for which OPPO is known in China; the company is also respected for its Hi-Fi audio technologies as well as high-quality home theater systems and Blu-Ray players. When it comes to smartphones, OPPO’s main 2016 releases — the OPPO F1 and R9s series’ — have been well-received and in fact saw the company double its Chinese market share last year.

However, we’re still waiting for an OPPO smartphone that really pushes the industry forward in the same way that Xiaomi’s Mi Mix is a push for smaller bezels or HUAWEI’s partnership with Leica is a push toward better smartphone photography. Furthermore Asia, particularly China, remains the only major market for OPPO. The company’s product portfolio doesn’t extend into North or Latin America, Europe, or the Middle East to anything like the extent of its Chinese sales. Instead, much of this job seems to have been left to its OnePlus sibling, which is also owned by BBK Electronics. While OPPO may be making huge strides in China, the rest of the world might be a harder sell.

TCL Communications

As previously stated, TCL Communications markets smartphones under the brand name Alcatel, which might be familiar due to the company’s sleeper hit in the Idol 4S. In fact, the Idol 4S was often favorably compared to the OnePlus 3, ZTE Axon 7, and the HONOR 8 in terms of quality and bang for buck. Otherwise, 2016 was a quiet year for Alcatel despite having a new partnership with BlackBerry, which resulted in a few BlackBerry releases under the DKTEK moniker.

Obviously, we shouldn’t take the Idol 4S and DTEK50 as signs that Alcatel is about the become the next Samsung; however, the company has shown that it knows how to make an attractive, reasonably-capable budget device, and if 2016 showed us anything, it’s that “budget flagships” are revolutionizing the smartphone market. While these BlackBerry handsets have been a little underwhelming for some, striking the right business deals could help TCL grab some notable global market share in the future. When a $400-something phone can be among critics’ picks for the best smartphones of the year, it’s not beyond the realm of possibility that Alcatel could be our next up-and-comer. At the very least, it’s too soon to rule the possibility out completely.

Vivo

As a subsidiary of BBK Electronics, vivo is a sibling of OPPO and OnePlus and is looking to break into regions outside of its Chinese home-market. In the US, vivo has been pursuing some strategic partnerships with western brands and companies, including MTV and several blockbuster films. In India, the company is handily in the top five manufacturers and has managed to overtake many local OEMs thanks to an aggressive campaign that involved higher payment for prominent display space and branding in stores, along with giving a larger cut to retailers.

If I were a gambling man,, my money would be on vivo as the up-and-comer to watch as we move forward.

Despite having relatively little time in the smartphone market after being established in 2009, vivo has proven to be very forward-thinking and boundary-pushing with the release of the vivo X1 in 2012; at the time, the X1 was the world’s thinnest smartphone and the first smartphone to feature a Hi-Fi audio chip. Then in 2013, vivo debuted the world’s very first QHD display on a smartphone with the vivo Xplay 3s. And let’s not forget that vivo was the first to put 6GB of RAM in a smartphone.

To date, vivo’s sales have garnered the company an intermittent spot in the global top ten, but the company’s sales trend is definitely pointing upwards. The brand is increasingly looking like a force to be reckoned with in Eastern markets and the company’s attention is starting to turn to the West.

Micromax

There’s something to be said for a company that can crack the top ten smartphone brands in the world despite the fact that said company only targets a handful of markets. India-based Micromax first started selling mobile phones in 2008 and has been one of the major smartphone manufacturers in the country, even rivalling Samsung for the top back spot in 2014.

However, more recently Micromax has seen its market share in India come under increasing pressure from low cost competition from China, which includes OPPO, vivo, and Lenovo. While there’s always the possibility that Micromax might expand its reach, it’s unlikely that Micromax will be anything more than a regional brand for the foreseeable future.

Wrapping up

Taking each company on its own merits, almost any of them could be the next global success for one reason or another. The Xiaomi Mi Mix shows us that Xiaomi could be the up-and-coming OEM that ushers us into the next era of smartphone technology. Similarly, vivo has a history of cutting-edge innovation in the smartphone sector, so it could be just a matter of time before vivo is a recognizable global brand. OPPO and Micromax are probably the least likely of the aforementioned OEMs to reach Samsung-like levels of success due to their narrow market reach and apparent lack of interest in emerging markets. However, HUAWEI has shown us that the company already has what it takes to be a global success.

Of all the OEMs mentioned, it’s quite clear that HUAWEI is closest to being the next Samsung; after all, the company is already third among the top ten best-selling OEMs in the world and only needs to accumulate a following in western markets. However, if I were a gambling man who wanted to place a somewhat riskier bet, my money would be on vivo as the up-and-comer to watch as we move forward.

But now I want to hear from you. Which OEM do you think will be the next big global smartphone brand? Are there any OEMs not mentioned here that you think we should watch? Leave your thoughts in the comment section below.