Affiliate links on Android Authority may earn us a commission. Learn more.

Report: Chinese OEMs accounted for 40% of phone sales in 2014

These days it seems like there is a lot of focus on two big issues in the mobile world: China and Samsung. Specifically, Chinese mobile brands and their explosive growth, and the gradual sales decline that Samsung is facing as a result. Names like Xiaomi, HUAWEI, and OPPO have little brand value (if any) to people residing outside of Asia, but inside the continent things are a very different story, especially in major developing countries like China and India. The latest bit of news only confirms this.

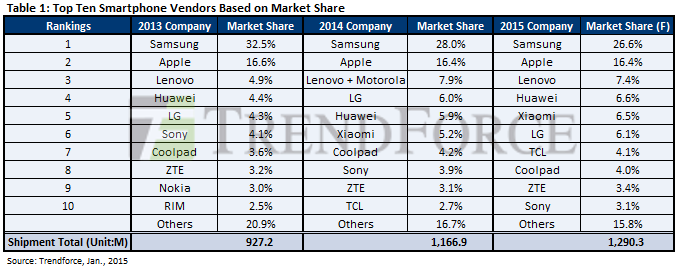

Now is a very good time to be a phone maker, according to a report by IT analyst firm TrendForce. Specifically, in 2014, global smartphone shipments increased by 25.9% over those in 2013, totaling 1.167 billion units. Now is also a very good time to be an OEM in China, as the same report indicates Chinese makers comprised almost 40% of that total, with combined shipments at 453.4 million units. Take a look:

Let’s examine the major components of this chart.

Samsung: While the Korean conglomerate has obviously held onto its #1 position for the past three years, it’s no small print to read the writing on the wall: its market share is eroding, having fallen from 32.5% at the start of 2013 to 26.6% at the start of 2015. While sales of the flagship Galaxy S5 were anything but stellar, the handset still managed great results in the USA. In Asia, however, where Chinese OEMs are stealing the thunder with extremely low prices and nice hardware, things are a bit different. This is exactly why Samsung was so eager to release the all-metal Galaxy A series there last year, and soon the Galaxy E series as well. While Samsung will definitely turn heads should it be able to release a truly flexible product this year, the assumed high price point won’t exactly save its market share.

Apple: Interestingly enough, Apple hasn’t really seen any semblance of change, especially in the past year. This may be in part a result of the company’s increased efforts to add new carriers around the world each year. With respect to the past year, the iPhone 6 Plus saw Cupertino’s first phablet, which released to a very warm reception. This is no doubt a cause for concern for Samsung as the iPhone 6 Plus is a direct competitor to its Galaxy Note series, even without the stylus; all those iOS users who might have migrated to the Note could very well have (or are planning to) returned to Apple to procure its phablet.

Lenovo: Despite it taking almost an entire year to complete the acquisition of Motorola, Lenovo remains the #3 vendor despite the fact that few of its products are available to markets outside of Asia. With Motorola now in tow, the company has direct access to the company’s comfort zone in North America, and can now benefit from products such as the Moto X, Moto G, and Moto E, not to mention the Nexus 6, thus offering the potential for next year’s results to show growth. It should be noted that Motorola and Lenovo are listed together in 2014 because the merger had been announced, though as mentioned, it wasn’t completed until more recently, hence 2015 reading just one company.

LG: Perhaps the biggest non-Chinese success story here, the other Korean company has seen its market share increase due to products such as the LG G2 and G3, not to mention some more creative offerings such as Flex (though how much of a difference that made on the balance sheet is another matter). As the first major company to offer a 2K display on a mobile phone, for all intents-and-purposes, LG’s G3 out-speced the Galaxy S5 given that only the Korean Category 6 Broadbad LTE-A variant S5 made use of a 2K panel: the rest of the world had to make due with a lowly 1080p. With the Flex 2 coming out soon, and the G4 around the bend, the company is potentially set to have another good year. And considering the company’s flexible situation that is supposed to unfold, it might end up being a period of increasing growth.

Sony: Despite flagships like the Xperia Z3 and Z3 Compact receiving heaps of praise from critics around the world, Sony just can’t seem to keep its head above water. The company lacks the marketing presence that Samsung has (perhaps a result of its management, perhaps a result of its financial situation) and seemingly makes more news about its mishaps and price points than it does anything smartphone related. Then again when you release a new flagship every six months, even the most die-hard of supporters may call it quits. Although Sony is allegedly going to slow down its product cycle this year, with rumors floating around that it might be looking to offload its smartphone business, there is also a possibility it won’t even be on the charts come this time next year.

Xiaomi’s latest high-end offering, the Mi Note.

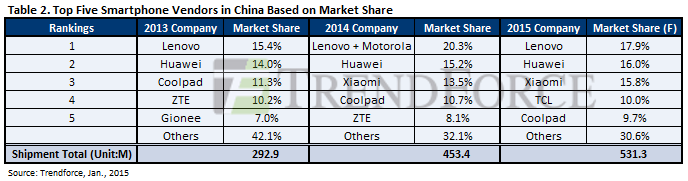

China: With a whopping six companies in the top ten spot, the OEM collective in China is absolutely on fire. Let’s take a more in-depth look at its domestic figures via another chart from TrendForce:

The big force to be reckoned with here is actually Xiaomi, for its astounding rise to 15.8% market share in just a couple of years. With head-turning products like the just-announced Mi Note series, it’s easy to see why. Assuming the trend here continues, a similar increase in 2015 might actually put it ahead of even Lenovo/Motorola, come next year’s report. Much has been made of various Chinese OEM’s business models, wherein they sell devices primarily (or exclusively) online, and for an extremely low cost despite providing relatively good-or-better specs. This has allowed them to access a large number of users within the country who might live hours away from any kind of flagship store, but who may have internet access.

2015 will very likely see these companies take more market share away from external rivals, with the most likely culprits being Samsung and Apple, but with LG also potentially at risk. This is true not only inside China, wherein the country is rapidly modernizing and holds the world’s largest potential market of customers, but also around Asia where companies like Xiaomi and HUAWEI are very eager to get a stronghold on the other major Asian customer explosion: neighboring country India. Should Samsung cede even more Chinese and Indian market share to HUAWEI or Xiaomi, its 2015 financial results could very well make 2014’s look like a walk in the park.

Wrap-Up: So there you have it: 2014 was a fantastic year for smartphones and Chinese OEMs, but not so much for Samsung or Sony. Any thoughts on the results? Surprised? Not?