Affiliate links on Android Authority may earn us a commission. Learn more.

Latest report shows market gains for HUAWEI this year

Market research firm TrendForce has just published its latest findings for the smartphone market in 2015. The results show gains for the booming home grown Chinese brands, while some of the big international brands have seen their shipment forecasts cut.

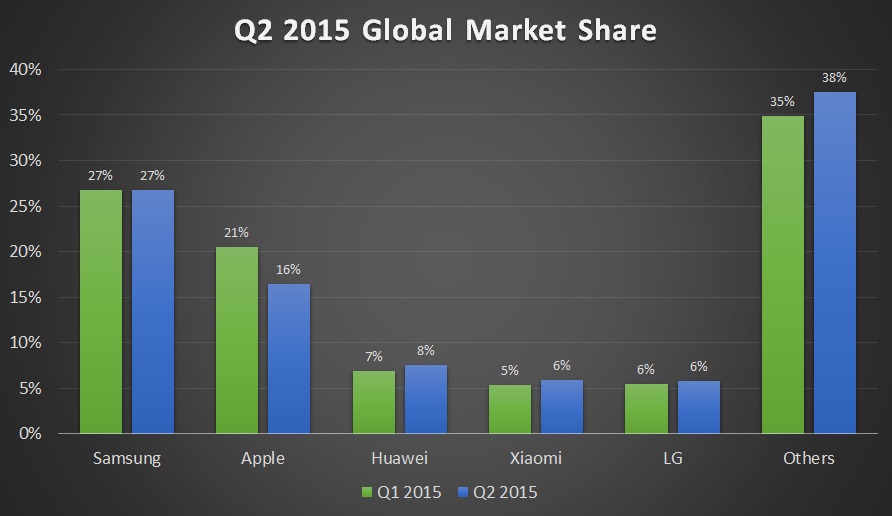

Looking at the big picture first, TrendForce has revised its entire forecast for 2015 shipment growth, down from 11.6 percent to just 8.2 percent. Apparently, a negative global economic outlook and falling demand are responsible, and looks to be hitting the premium brands the most.

As for the international names, Samsung is said to be experiencing mixed fortunes. Quarter on quarter growth for total shipments is expected to hit an impressive 26.8 percent, due in no small part to the launch of the Galaxy S6 and S6 Edge. However, annual shipment forecasts have been lowered to 45 million units this year, due to increased competition in the low-end market and a mark down in expected yearly demand for Samsung’s latest flagship.

It’s not all been bad news for Android OEMs though. Chinese manufacturers continue to show strong signs of growth. HUAWEI and Xiaomi have now taken a place in the global top 5.

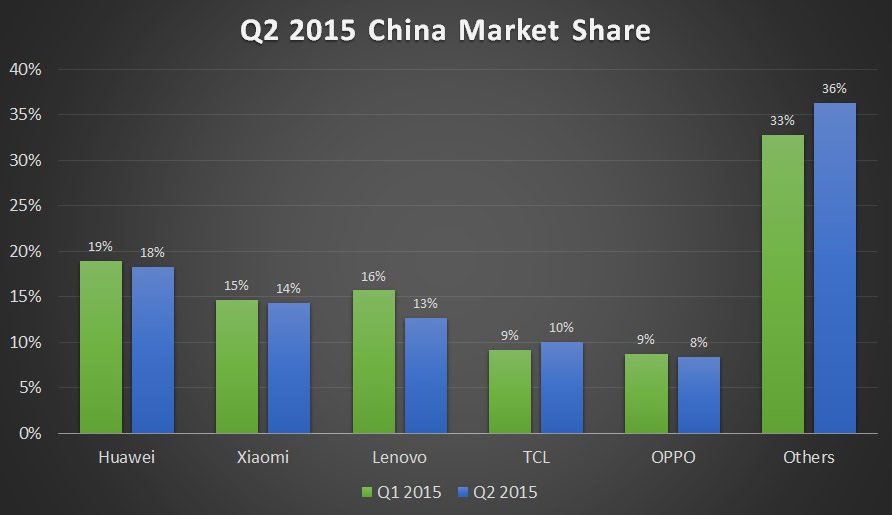

HUAWEI has become the China’s number one smartphone brand this year as well, with an estimated annual shipment growth of nearly 40 percent. The company is expected to be the first Chinese company to sell 100 million phones in 2015.

Xiaomi has shipped 34 million units so far this year and has also continued to see its global market share grow. Although it is looking unlikely that the company will hit its 100 million units target. OPPO and VIVO could also see their sales grow by 30 percent or more this year, thanks to their more unique product positioning.

However, Lenovo has fallen out of the top five this year to sixth place, with shipments expected to decline by around 25 percent this year. It is possible that we may begin to see some consolidation in the Chinese market, as competition continues to drive prices down.

With the year half way through, the trends from last year look set to continue. Strong competition in the Chinese market is still resulting in high demand, while some of the more expensive manufacturers are still struggling to differentiate their products from their previous generations.