Affiliate links on Android Authority may earn us a commission. Learn more.

180 days into the US ban, is HUAWEI too big to fail?

On May 15, 2019, the US government added HUAWEI to its now-infamous “Entity List” of companies that are barred from buying American products. Ostensibly, the reason is a vaguely defined, but hard-to-dismiss risk to national security.

This was no mere bureaucratic nuisance. Within days, all hell broke loose: Google confirmed it had suspended HUAWEI’s license, and in quick succession, many other companies and organizations cut ties with HUAWEI, the world’s top telecom company.

With the avalanche of bad news, some were quick to predict HUAWEI’s demise, but the company has so far vexed the death-watchers. Six month in, HUAWEI is not exactly thriving, but it’s still doing incredibly well. By many measures, it’s growing.

HUAWEI is still raking in billions

In the first nine months of 2019 HUAWEI generated revenues of 610.8 billion yuan (~$87.3 billion), up 24.4% compared to the same time last year. That’s impressive growth for a company that’s fighting for its life, even though it’s slower than the 39% yearly growth rate HUAWEI boasted in Q1 2019.

HUAWEI looks set to comfortably clear $100 billion in revenue by the end of the year. That’s a significant milestone because it exceeds what HUAWEI founder Ren Zhengfei publicly predicted the company would make in 2019. In other words, the company is beating its own expectations.

How is this possible?

A lot of it has to do with HUAWEI’s strong performance in its telecom infrastructure business – its 4G and 5G base stations are still selling briskly, despite calls from the US for allies to shut out HUAWEI out of their networks.

HUAWEI makes about half of its revenue from its consumer division, mainly smartphones. The company shipped 185 million units this year. HUAWEI won’t say how many of those phones were sold in the last few months, but research firms Canalys and Counterpoint both estimate Q3 shipments of 66.8 million units. With a year-on-year growth of 29%, HUAWEI not only held ground, it actually closed in on Samsung. It’s clear that, had it not been blacklisted, HUAWEI would’ve easily beaten Samsung to become the world’s biggest smartphone maker.

HUAWEI not only held ground, it actually closed in on Samsung

China calling

HUAWEI has its home market to thank for this surprisingly strong performance. Chinese customers have rallied around HUAWEI with patriotic fervor, giving the company a huge 66% boost in sales compared to last year. This allowed HUAWEI to claim 42% of the Chinese market in Q3 2019, a record high. By comparison, and perhaps not accidentally, Apple lost two percentage points, marking its weakest sales in China in five years. Samsung, meanwhile, has all but disappeared from the market, with under 1% in sales.

While patriotic purchases can explain HUAWEI’s success in China, the company still sold around 25 million smartphones in other markets in Q3. In countries where Google apps are a must-have, HUAWEI is pushing its older models, as well as releasing a few new models with Google apps, despite lacking – in theory – a license to do so. In practice, it appears that HUAWEI is tweaking and rebranding previously certified phones, which allows it to release “new” models and maintain some momentum in the market.

HUAWEI is also using other product categories to keep its name in the news and its shelves stocked, including well-received products like the FreeBuds 3 and the GT Watch 2.

Self reliance paid off

In order to sell all these products, HUAWEI first needs to make them. Its investment in its own silicon has proven invaluable in this regard, as HUAWEI doesn’t depend on US-based Qualcomm for essential SoCs and modems. Furthermore, HUAWEI continues to work with Arm and will be able to use the next-gen Arm v9 architecture, which will provide the foundation of mobile chips coming out in 2020 and beyond.

The company also has a stockpile of components it doesn’t manufacture itself – according to Canalys, HUAWEI had been stockpiling components for around a year by the time US placed it on the blacklist.

Huawei's investment into is own silicon has proven invaluable

Dark clouds

On Day 180 of the US ban, it’s clear that HUAWEI is more resilient than many had given credit it for. Thanks to its strong proprietary technology, deep penetration of global markets, and fortified position in China, HUAWEI has been able to survive conditions that would’ve killed any other company. But that doesn’t mean that HUAWEI can survive the ban indefinitely.

How long will those component stockpiles last? Will the US continue to allow HUAWEI to update its existing products? Can HUAWEI keep up with competitors while fighting to survive the ban? Will the constant bad publicity turn consumers off, for good? These are all tough questions we have no way to answer right now.

The next few weeks will bring some clarity on HUAWEI’s fate, for better or worse.

On November 19, a temporary 90-day waiver that allowed HUAWEI to do some business with US companies is set to expire. Back in September, the US government signaled that it’s unlikely to renew this waiver again. If HUAWEI doesn’t obtain a renewal, it won’t be able to push out system updates to existing Android products, in another blow to its smartphone business.

If HUAWEI doesn’t obtain a renewal, it won’t be able to push out system updates to existing Android products.

On the same day, the FCC is set to vote on rules that would prevent HUAWEI from doing any business with US carriers, as well as require the removal of already installed equipment. At the very least, this will be another escalation of the US’ stance against HUAWEI and China’s 5G ambitions in general.

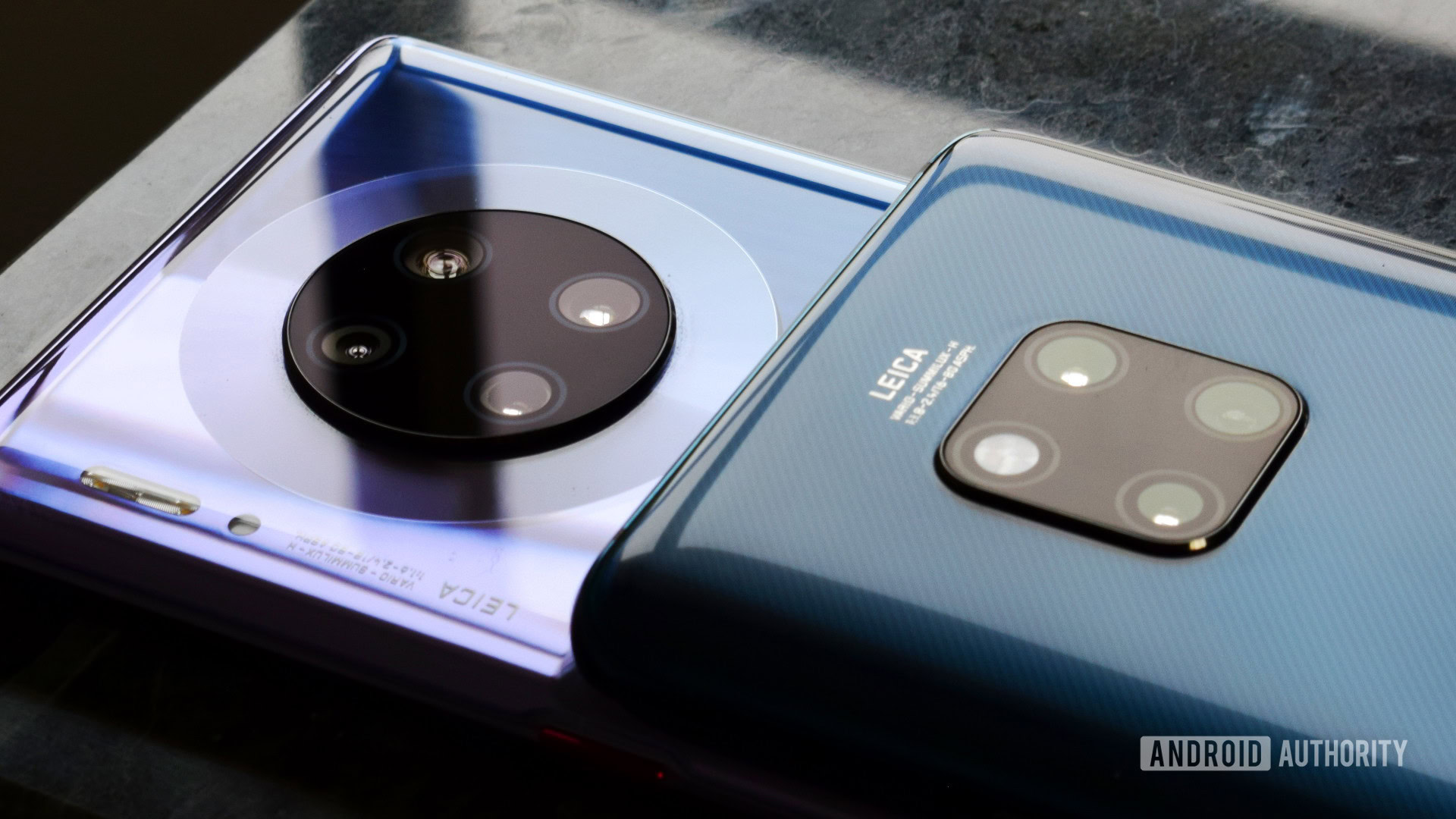

HUAWEI is also due for an update on its Mate 30 Pro plans. The company has delayed the release of its flagship product in Europe and other markets outside of China. Without Google apps on board, the phone will be a tough sell. But HUAWEI can’t delay it indefinitely, unless it resigns itself to ceding hard-won ground to the competition. We reached out to HUAWEI about its release plans, but we didn’t receive a comment.

Light at the end of the tunnel

Finally, and this could be the light at the end of the tunnel, the Trump administration suggested it may give HUAWEI a respite, by granting export licenses to companies who want to sell non-sensitive products to HUAWEI. On November 4, US Commerce Secretary Wilbur Ross said that licenses “will be forthcoming very shortly,” saying that the government received 260 license applications. Google presumably applied for a license, but it’s up to the US government to decide whether Android and Google’s apps are security-sensitive or not.

In addition, US and China are said to be closing in on a “phase one” deal that would roll back some tariffs and potentially ease the trade tensions between the two countries. While no one will publicly admit it, HUAWEI’s fate appears to be tied to the success – or failure – of these negotiations.

HUAWEI may not be too big to fail, but it’s definitely big enough to survive a prolonged blacklisting by the world’s greatest economic and political power. The question is, for how long?

Thank you for being part of our community. Read our Comment Policy before posting.