Affiliate links on Android Authority may earn us a commission. Learn more.

Gartner: Smartphone sales growth has reached its lowest point in recent years

For years now, we’ve seen major markets like the United States and Europe become increasingly saturated when it comes to mobile devices growth. That’s why it is no surprise that a new report from Gartner suggests global smartphones sales in Q4 2015 experienced the slowest growth that this industry has seen since 2008.

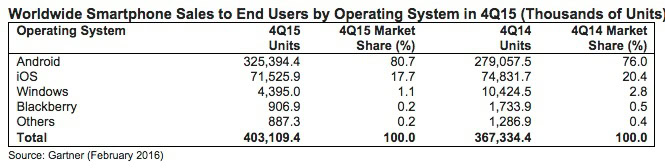

So who grew in Q4 2015? Certainly not Apple, which actually saw iPhone sales decline 4.4 per cent when compared to Q4 of 2014.

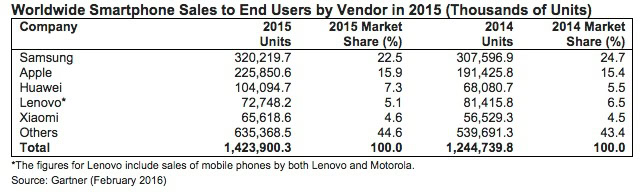

In fact, Samsung and HUAWEI were the only two of the top five smartphone vendors that saw growth that quarter. Looking back at 2015 on the whole, we see a similar picture of slowed growth. Samsung actually declined a bit for the year, from 24.7% in 2014 to 22.5% in 2015, and Apple only saw only minor growth for the whole year at 15.9% versus 2014’s 15.4% global marketshare.

Huawei, on the other hand, actually grew from 5.5% to 7.3%, seeing the biggest growth out of the top 5 mobile vendors (Samsung, Apple, HUAWEI, Lenovo and Xiaomi). With the success of the Nexus 6P and its continued growth outside of China, we can’t say we are too surprised.

The good news for Android as a platform is that it continues to grow, even if things have slowed down a bit. During Q4 2015 Android’s marketshare rose to 80.7, versus 76% in Q4 2014. In contrast, Apple’s iOS market shrank from 20.4% in Q4 2014 to 17.7% in Q4 2015.

Looking forward, we can expect Chinese and Indian OEMs to continue to chip away at the bigger players, largely due to more aggressive pricing strategies and a better understanding of emerging markets. As pricing continues to drop, the low-end and mid-range will rise as the real battleground for consumers, something we’ve already seen start to happen over the last few years. Summing up the situation, Analyst Roberta Cozza recently stated:

During the next five years we expect growth in the smartphone market to come mostly from emerging markets. Basic and lower-end smartphones will account for two-thirds of smartphone sales by 2019; in the same year, only 20 per cent of smartphone sales will come from mature markets.

While hard times might lie ahead for manufacturers as they attempt to figure out how to best grow in a slowing (and changing) market, things actually look pretty rosy for consumers. In 2015, we saw the birth of flagship-level devices at $300 – $400 price points, and we imagine things will get even more aggressive in 2016. It’s not just pricing that we’ll benefit from, though.

For companies like Samsung and Apple, growth in the premium market will come from “stealing it” from the competition. That means we can expect flagship devices to work even harder to set themselves apart and win over consumer affection, and that means more out-of-the-box thinking like LG’s magic slot. It also means companies will likely do a much better job of listening to what its fans actually want – like with Samsung’s rumored return of microSD and waterproofing.

For those in emerging markets, aggressive pricing will allow consumers in these areas to afford smartphones that provide the same kind of power we saw from flagships just 2 to 4 years ago. Case and point, the $4 smartphone we wrote about yesterday.

What do you think the slow-down means for the mobile industry? Share your thoughts in the comments below.