Affiliate links on Android Authority may earn us a commission. Learn more.

Google shells out over $7 billion just to have its apps on your phone

When you get a new phone, how much thought do you put into the apps that come pre-installed on it? No, we’re not talking about the Facebooks and Instagrams of the world, but Google’s own apps. You probably don’t pay much mind to them because, well, they come from the same company that supplied the operating system. It makes sense that they’re on the phone, right?

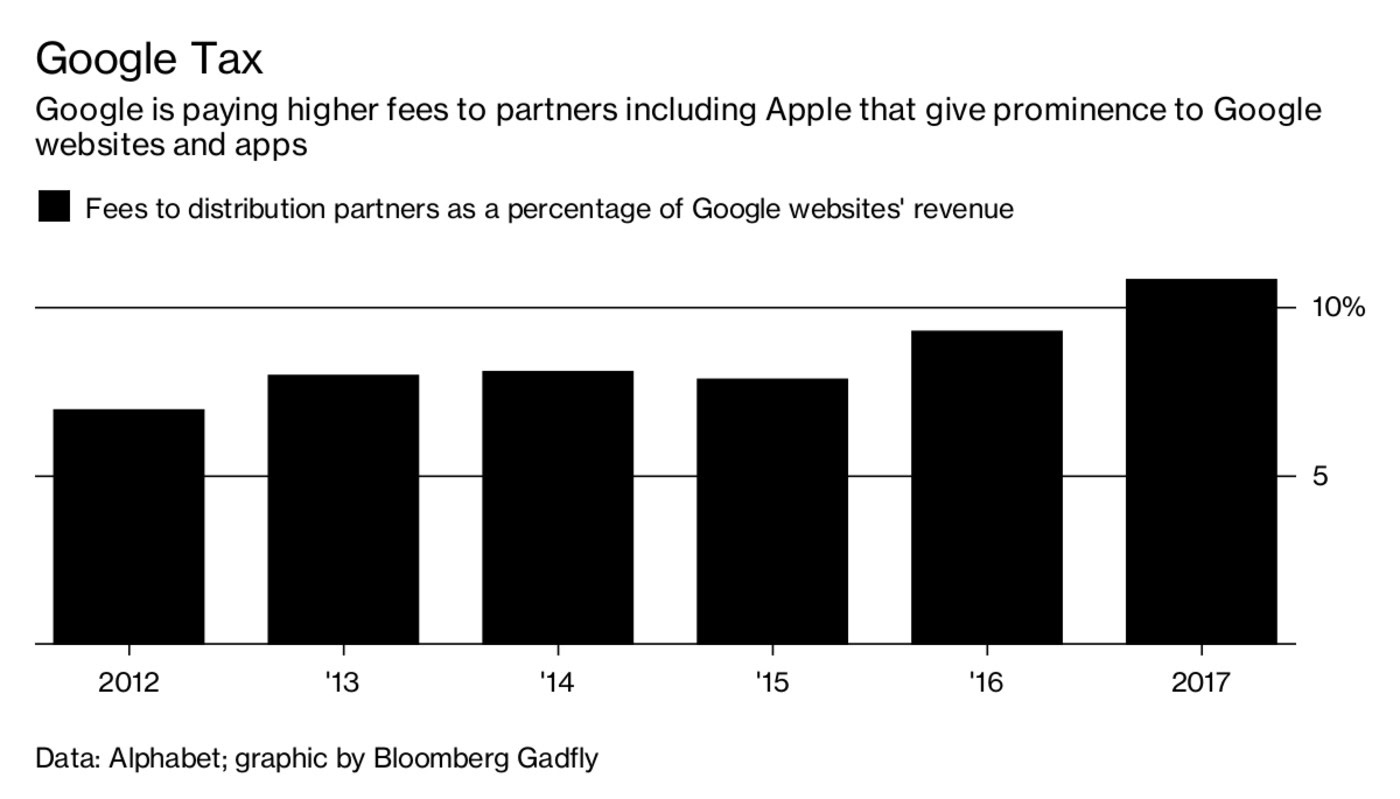

Well, it might surprise you that Google paid $7.2 billion last year in part to get its apps onto your phone. It pays Android OEMs for things like prominent search bar placement and to make sure apps like YouTube and Chrome are included on the phone. It also pays to be the default option for built-in web search boxes on Apple’s Safari browser for both Macs and iOS. All of these costs are called “traffic acquisition costs” and they’re going up. Fast.

The rapid increase in costs comes for a variety of reasons. Google is now paying three times the amount it did in 2012 to mobile-related partners like Apple for priority access and placement. Part of the increase is due to Google just delivering more ads on websites that use its ad services. Additionally, cell phones are becoming more widely available. Low-cost options continue to penetrate developing countries and iPhones become more attainable in territories like China and India. There is also speculation that a new deal that Alphabet and Apple signed plays a large part in it. That deal is estimated to be worth $3 billion to $4 billion to Apple annually.

The total amount that Google shells out for all traffic acquisition costs is now $19 billion a year. All of that money goes towards generating advertising through websites featuring Google-served ads and paying for the aforementioned mobile deals. That $19 billion number amounts to about 11% of revenue for its internet properties which is up from 7% in 2012. That rise, along with the increased risk of regulation in the US or Europe, has investors a bit worried.

Google has largely avoided any huge judgments against it beyond the €2.4 billion it was fined by the European Commission earlier this year. But now, European antitrust authorities are looking into the deals that it makes with Android manufacturers. These deals generally give Android OEMs the ability to include Google’s most popular apps, but it also requires them to include its other apps as well and set Google search as the default option. If authorities find that Google is abusing its power by entering into these agreements with phone manufacturers, they could face harsh consequences.

The potential of increased regulation in the US or Europe could really hurt Google’s bottom line. Companies now have more leverage to negotiate with Google and could have the ability to get out of some contract requirements if any judgments are handed down against it. RBC Capital Markets analyst Mark Mahaney estimated that each percentage point increase in traffic acquisition costs would cost about 1% from its earnings next year. That could cost roughly $280 million in profit. This could be part of the reason we see Google branching out into its own hardware more and more. The $1.1 billion that Google paid for HTC’s Pixel team now seems like a much better investment when you look at these rising costs and risks.