Affiliate links on Android Authority may earn us a commission. Learn more.

Apple's latest earnings have good news for Google

Depending on where one looks, Apple either had the best quarter ever at the end of last year, or else has finally started to come down from its high horse of smartphone sales. While the company did manage to make more money than ever before – $18 billion dollars in profit is no small sum – when details emerged about iPhone sales in an earnings call with CEO Tim Cook earlier this week, the big take away was that – save for China – iOS phone sales declined in every market. In contrast – save for China – Android sales have surged.

Indeed reports have been coming down the line for some time now that iPad sales have begun to slow over the past years, and many felt Apple charged too prominent a premium for its iPad Pro, released last fall, which has a comparable cost to an standard MacBook or higher end mobile PC. The fact that the product’s stylus, the Apple Pencil, was not included with the purchase only further intensified this situation for some, as did the high price for the Pencil.

Despite the high profits however, there is seemingly a big blend of trouble brewing at Cupertino when it comes to money to be made going forward. This piece will consider the details surrounding Apple’s current situation, explain why Google’s strategy is proving to be more successful, and evaluate how the marketplace metrics might look come this time next year.

The spin is in

It should surprise no one that, despite data suggesting otherwise, Apple was more than willing to spin the situation the company is in. Mr. Tim Cook presented the case as follows: Hordes of Android users are switching over to iPhones, and that the company – when considering the total number of iPhone users prior to the release of the 6 and 6 Plus – has a major majority of potential customers who have not yet even upgraded to an iPhone 6/6 Plus or iPhone 6S/6S Plus. Specifically:

“We were blown away by the level of Android switchers that we had last quarter. It was the highest ever by far. And so we see that as a huge opportunity…The number of people who had an iPhone prior to the iPhone 6 and 6 Plus announcements — and so this was in September of 2014 that have not yet upgraded to a 6, 6 Plus or 6s or 6s Plus is now 60%. So, another way to think about that is 40% have, 60% have not.”

The problem is that, despite the spirited talk, data provided by Kantar Worldpanel ComTech indicates something far different is going on as far as Apple’s smartphone sales are concerned: Google’s undisputed dominance. In fact, the chief of research at Kantar, Carolina Milanesi, had the following to say:

Apple loyalty in the U.S. is at its highest since 2012, reinforcing the fact that customer retention is not an issue. However, customer acquisition from Android has gone from 13% in 4Q14 to 11% in 4Q15, and the contribution that first-time smartphone buyers make to Apple overall sales numbers went from 20% to 11% over that same period.

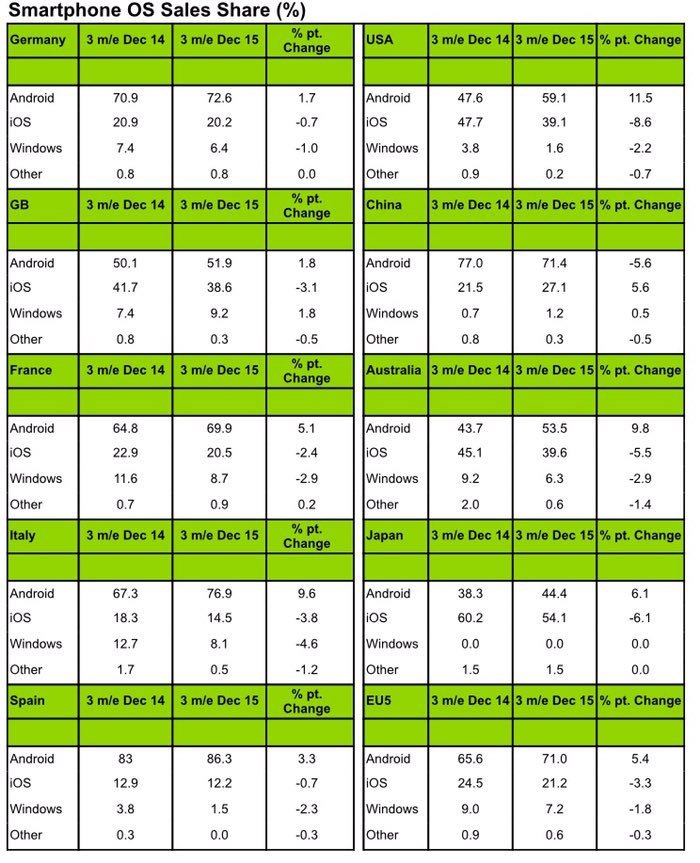

Thus despite Tim Cook boasting about impressive side shifting from Android to iOS, the numbers are actually declining. The following data from Kantar illustrates the point quite clearly:

Curious how, save for China, all countries listed above saw iOS sales decrease. This goes a long way to illustrate the belief that Apple’s golden days of smartphone sales may be at an end. As Business Insider pointed out in a recent piece, there is additional evidence to support this claim via Raymond James research:

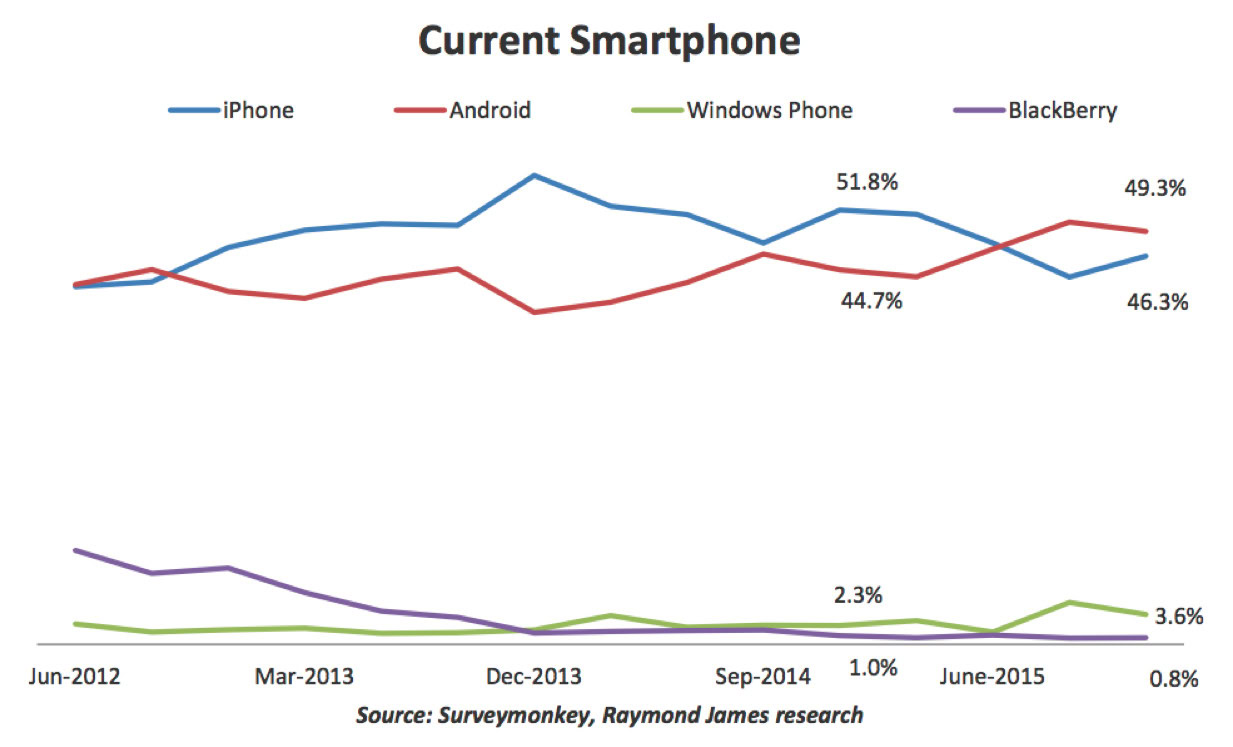

The above graph shows that Android has gradually reached new heights over the past few years, whereas Apple on the other hand, has never managed to regain the peak it once did in the Fall of 2013 when the iPhone 5S and iPhone 5C released.

There will inevitably be a number of Android users who make the switch to Apple’s ecosystem. Some of them, like Joshua Vergara, will switch back to Android, but most probably won’t. Does it make sense? Sure. Consider that before 2014, Apple didn’t have a larger screen iPhone, and thus there are untold numbers of customers who basically “caved” and went to Google’s mobile OS simply out of a desire to use a larger product.

For those who switched and were unhappy with Android, or else still found iOS to be more to their liking, it would have made perfect sense to revert back to Apple’s camp when the iPhone 6 and 6 Plus released. But then again, those who were on contracts may have just waited until the 6S and 6S Plus landed. Anyone who gave in at the launch of the iPhone 5S in 2013 would have thus reached the end of their contract when Q4 2015 dawned.

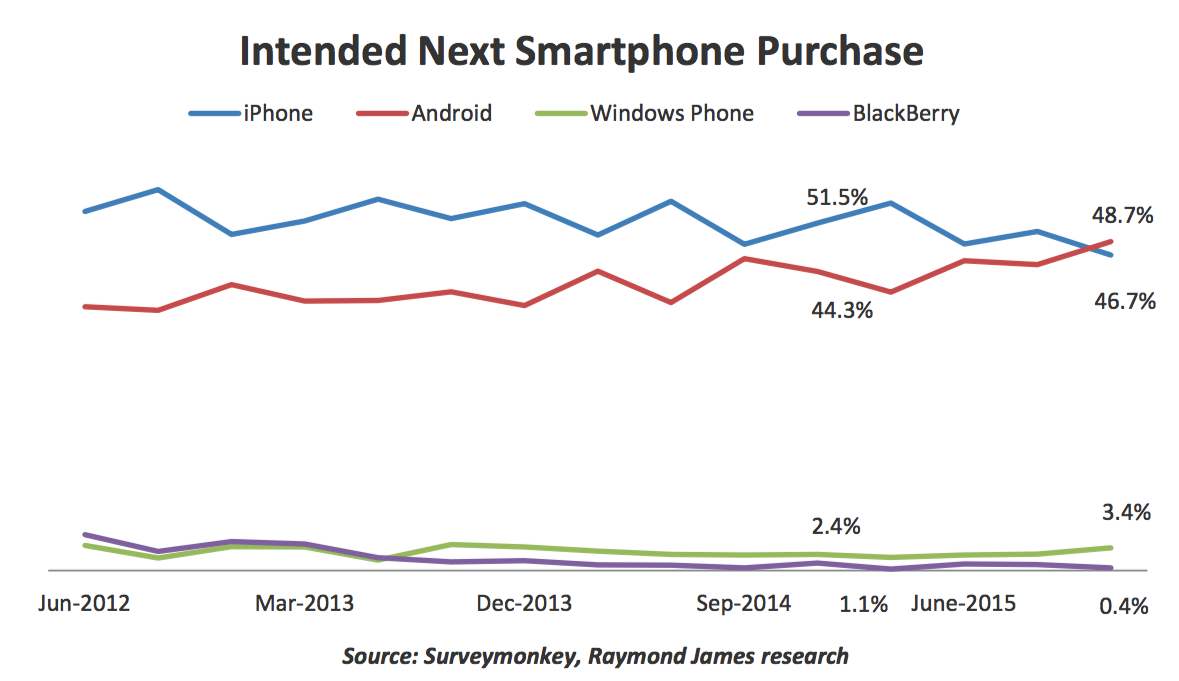

Even so, data from Raymond James suggests that even if Android users are “jumping ship” there isn’t enough to make a difference as the current trend shows increasing loyalty for Google’s OS while Apple paradoxically is experiencing a downshift:

It could very well be that, perhaps surprisingly, now that Apple’s big screen smartphone debut is behind it, customers are finally starting to get fed up with the limitations of the hardware and software. This could be the lack of widgets, the closed ecosystem, the high prices, the lack of “normal” NFC, the design or any number of other possibilities. In a sense, now that customers with “size envy” have gotten what they wanted, they suddenly find themselves realizing they are tired of the iPhone altogether.

The size factor itself

Another factor that may be contributing to the “end” of Apple’s smartphone sales stronghold is the size factor itself. In any given place, look around and chances are there will be someone – perhaps many people – who are still using an iPhone 5, iPhone 5S, or iPhone 5C. Chances are also high that, if asked, these users will indicate they have not chosen to upgrade because (1) their current phone still works, (2) their contract isn’t up, or (3) they don’t want a large screen iPhone, be if the 6 or the 6 Plus.

In an almost ironic twist of fate, by “going big” Apple has turned its back on countless iOS fans who once loved the company because it still made small smartphones. This mentality is largely behind the rumors that continue to surface about Apple launching a new 4-inch smartphone, now referred to as the iPhone 5SE. The idea is that the device will be essentially an iPhone 5S but with more modern internals.

While this could definitely go a long way to help Apple’s sales, the chances are less likely given that such a product will inevitably be sold at a lower price point than the 6S and 6S Plus. Meanwhile, there are countless Android products in any number of given sizes and form factors that accommodate the needs of those who feel “displaced” by Cupertino.

A victim of its own success

The final consideration of Apple’s iPhone sales may also ultimately stem from the fact that the iPhone Plus may have been “all that and a cup of coffee” and as such there was less of a burning desire to update last year. This goes even further when one considers the idea that 3D Touch is arguably nothing more than a desperate marketing gimmick. To put it one way, for all but the most adamant of supporters, Apple may have already “peaked” in terms of its mainstream users mindset; once people have their basic needs met, there is far less utility value in seeking to satisfy minor quibbles.

On the other hand, when looking at Android, manufactures like Samsung have – almost ironically so – made a case for upgrading simply from the use of metal and glass. The Galaxy S6 was the first Samsung phone of its kind, and that had people talking about it endlessly. To this day customers still debate the decision to remove microSD and a user-replaceable battery. How fitting then, that the Galaxy S7, which will launch in under a month, is rumored to include microSD support and possibly be waterproof to boot. Samsung has created its own way to keep consumers coming back on a bi-annual cycle.

Likewise, even Google is getting in on the game. Last year saw the Nexus 5X and Nexus 6P. This pair of products met two different types of consumer’s needs, as well as added major functionality in terms of the Nexus Imprint fingerprint sensor, granular permissions along with a number of other OS tweaks. This year has only just begun and already rumors are surfacing about the potential for HTCto make new Nexus devices.

The Android anomaly

Based on the data contained in this piece, it would indeed seem logical to say that Android OEMs are raking in the cash. Yet this is exactly what is not happening. Samsung, for example, had an unfavorable Q4 2015, as did LG. Unsurprisingly, poor smartphone sales factored into both equations. Even Xiaomi, which has been seen as an unstoppable juggernaut in China, failed to meet the lofty sales expectations it set for itself. So the question is, if Android is doing better than ever before, where is the money going?

Unfortunately with so many products and OEMS – The Wall Street Journal claimed there were over 1000 last year – it is difficult for any one to make an unprecedented , obscene profit compared with the situation just a few years ago. The average price is going down, the average specs are going up, and much like it was argued earlier, just like with Apple, many existing users may be satisfied with what they have now.

The real “money” may yet to be made though, as Apple has finally, essentially, admitted that pricing considerations are now being taken into account with respect to customer spending. In addressing the issue of Cupertinio’s anticipated 11% decline in revenue for Q1 2016, the company’s CFO, Luca Maestri, said:

“Inevitably over time, higher prices affect demand and so we’re capturing that in our guidance. So, I would say these are the major reasons and the drivers for the guidance on revenue.”

Tim Cook expanded on this sentiment, explaining that:

“I think you can tell from the numbers that Luca is talking about just on the currency side and that’s before thinking through the effect that price increases can sometimes have on the business over a period of time, it’s clear that the economic piece is large.”

Because Apple’s customers may have finally found satisfaction with the iPhone 6 and iPhone 6 Plus, because Android products are getting cheaper yet Apple products are either remaining the same or in many markets getting more expensive due to local pricing issues and exchange rates, it finally seems as if Apple’s golden days have peaked. If the company refuses to lower its obscenely high profit margins – the likes of which allow it to have 95% of the industry’s profits – it’s possible users will simply switch to Android when the time comes to upgrade.

The switch

Just looking at how mid-range devices have become mini powerhouses in their own regards last year, it would follow that they will only get more and more powerful. If the average consumer is faced with the prospect of getting another $700 iPhone, or getting a $200 Android device that has similar if not better – specs come next year, why would they stick with the iPhone?

The Apple brand? Sure. But if the company’s star is starting to fall, that brand may not hold nearly as much value come 2017. The ecosystem? Possibly, but many users don’t buy apps and thus can get the same free ones with Android. The design? Maybe, but then again products like the Galaxy A7 and countless offerings from Chinese OEMs all use premium parts yet cost less than an iPhone.

Wrap Up

Suffice to say, Apple is facing some very tough competition as 2016 gets started. The company is looking at a double-digit decrease in revenue predicted for Q1 2016. It admits that over 60% of its customer base has not updated to a new iPhone since the iPhone 5S/5C era. It admits that price is now factoring into customer’s buying considerations. It is facing diminished product loyalty and sales growth. All this while Android has seen an almost universal increase in sales growth and an increase in loyalty.

This almost certainly means that Apple with either aggressively try to compete with its rivals, or else continue to do its own thing and watch as its market share and brand value erodes once again while its chief competitor reaps the benefits. At the same time, rumors of the company developing a self-driving car and now even a VR headset seemingly make greater sense as the company tries to literally create – or perhaps just innovate – the next big profit center for its emerging empire.

Interestingly enough however, various companies have already jumped onto VR, everyone from Sony to HTCto Facebook to Samsung to even Google. And likewise self-driving cars are already well into planning stages by some companies. It is quite feasible that, unlike the iPhone and iPad where Apple “gave” the world the “new” product formats, its future business models will be based on the “me too” approach taken by the Apple Watch – which released months after Android Wear was introduced and especially after the original Galaxy Gear hit, and even the iPhone 6 Plus.

Of course, to Apple’s credit, with some of these products – namely the wearable segment and large screen tablet – much of the industry’s actions seem like trying to preempt Apple itself. The question will then become who can make the product(s) that sell the best. While several years ago it would arguably be Apple hands down, with new product genres it’s anyone’s guess given that Cupertino’s smartphones may have finally reached the pinnacle of their (sales) performance power. 2016 will be interesting, indeed.