Affiliate links on Android Authority may earn us a commission. Learn more.

State of the smartphone industry: top trends in 2014

Yet again this year has yielded some impressive smartphones, but not all of them have come from the familiar brands. Chinese manufacturers have continued to improve their offerings, while Samsung has reported its poorest earnings in years. Android One looks set to bolster the mid-range market in India, and Apple is hoping that it hasn’t missed the “phablet” trend.

We all have our own opinions about which handsets are best, but they don’t always match up with what everyone else is buying. Fortunately we’ve managed to grab a hold of a ton of data on the smartphone market this year, revealing some very interesting trends and developments.

Note: We’ve compiled the data in this report from multiple sources that are publicly available online or have been made available to us.

The big picture

Before we delve into this year’s big winners and losers so far, let’s see how smartphone sales are doing in general.

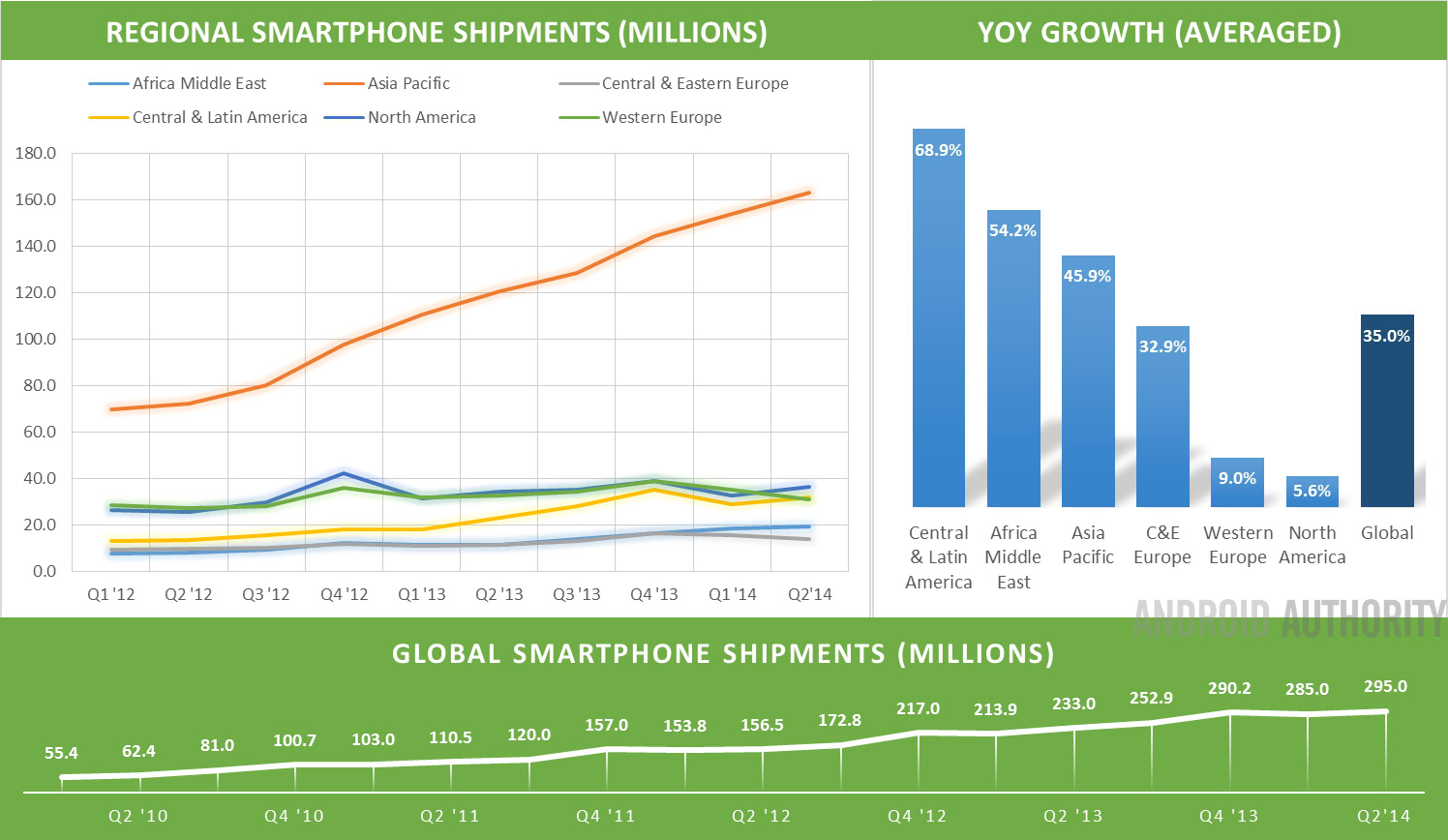

Overall global smartphone shipments were up 27 percent for Q2, compared with last year, and reached 295 million units in the second quarter of this year. We have already passed the 1 billion devices a year mark, and growth does seem to be slowing somewhat compared to previous years, depending on which region you look at.

Geographically, Africa and the Middle East are witnessing the fastest levels of growth last quarter, up 68 percent on last year, with Central & Latin America following on 38 percent, and Asia Pacific territories up 35 percent YoY. North America continues to show strong signs of saturation, with only a 6 percent increase in shipments in the last 12 months. The averaged YoY growth for the last four quarters can be seen above.

Apple’s global market share fell to 11.9 percent last quarter

Asia Pacific still accounts for the greatest number of smartphone shipments and also shows one of the strongest levels of growth. This accounts for the surge in popularity that we have seen from more cost effective Chinese manufacturers, such as Xiaomi and HUAWEI. Perhaps we can use this to at least partially explain why big players, such as Samsung and Sony, have been losing global market shares and profits over the past few months, which we’ll take a closer look at in a minute.

As we can see from the data already, typically strong regions for the established premium smartphone players are experiencing the slowest rate of growth, whilst emerging markets continue to surge forward. Years of high cost premium devices appear to have taken a toll on Western consumer appetites for smartphones, and slowing levels of innovation appear to be denting consumer demand.

Whilst the wide range of Android devices makes this trend less of an issue for the operating system as a whole, some Android brands have had their market shares squeezed over the last few quarters. Over the past 18 months or so the Android ecosystem has become increasingly diverse, with more than 10 brands now occupying the largest combined share of the smartphone market.

Apple’s limited range of products has made iOS far more susceptible to changing tastes. As a result, Apple’s global smartphone market share sat at just 11.9 percent last quarter, compared with 17.6 percent at the end of 2013 and 22 percent at the end of 2012.

Changing regional tastes

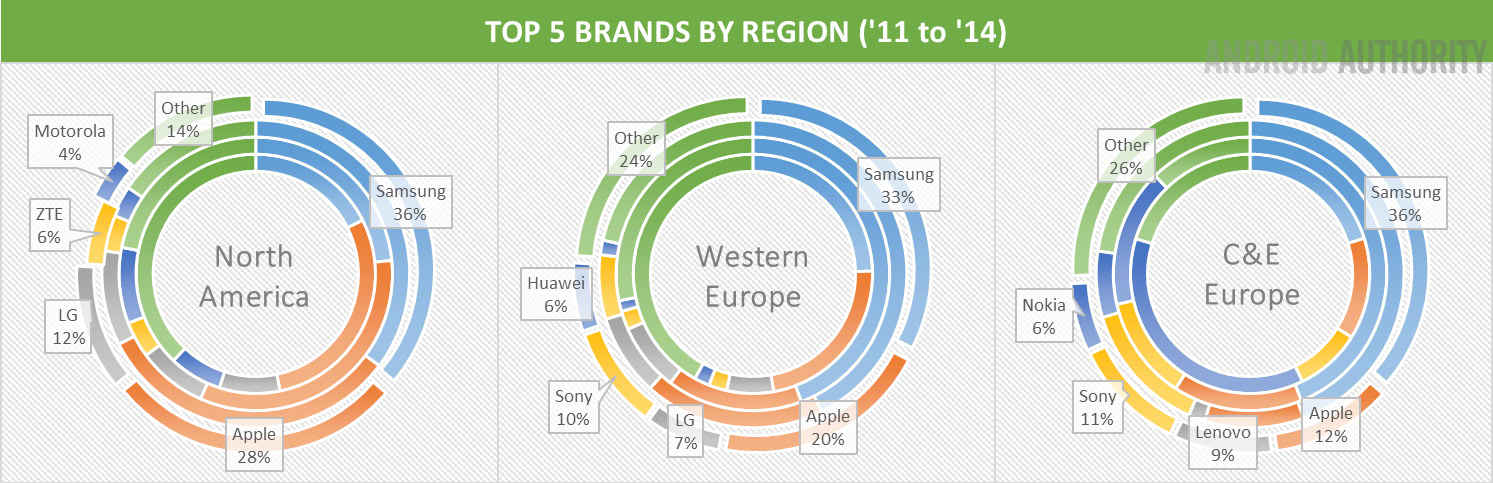

Despite the wide range of handset manufacturers operating in the market today, they aren’t spread around the world entirely evenly.

Whilst some observers are under the impression that smartphone innovation has stagnated over recent years, big brands, such as Samsung, Apple, LG, and Sony, still make up the largest market segments in North America and Europe. However, year on year growth for Apple hit a brick wall come the end of 2013. The company ended up on just 9 percent growth in North America compared with 2012, and 13 percent in Western Europe. This year Samsung has faced similarly slow growth of just 9 percent in the second quarter and also saw shipments in Europe fall by a massive 27 percent.

Familiar brands in the West, such as LG, HTC, Motorola, and Sony, each occupy 2 percent or less of the Asian market

Matching up with the negative sales and financial results for Samsung, we can see a cut back in the company’s market share in Europe this year. Interestingly though, the US market remains relatively unchanged over the past 12 months. When analysing Samsung’s recent performance, it is worth looking at the inner part of the chart to see just how quickly the company has grown since 2011.

Whilst Apple’s head start in the smartphone game has seen its share of the market stay relevantly constant lately, Samsung is experiencing a full stop on its exceptional rate of growth, which obviously looks bad if you compare data in terms of year on year growth or profit forecasts. However Samsung is far from disaster, it remains the largest manufacturer in every regional segment.

LG was the best performer in North America last quarter, in terms of growth, and managed to increase its market presence to 11.9 percent. However, HTC, Sony, and Motorola have seen their shipment figures remain virtually flat, partly due to the lack of new device releases. Recently announced smartphones from these companies should see an upturn in shipments come Q3 and 4.

Looking at Asian, Latin American, and Middle Eastern markets we see Samsung sitting in an even more dominant position. However, the rest of the market is far more mixed than in Europe and North America. Apple regularly falls into third place or lower in these regions, owing to its uncompetitive price point and lack of product diversity to suite regional consumer tastes.

Asia Pacific is especially diverse, and the full figures show an even greater number of manufacturers, including HUAWEI and ZTE, hovering on around the 8 percent mark. As we saw earlier, Asia is by far the largest market segment in terms of shipments, meaning that even small percentage shares turn into big shipment numbers. Hence why this is where we are also seeing the largest growth in smaller manufacturers.

Familiar smaller brands in the West, such as LG, HTC, Motorola, and Sony, occupy just 2 percent or less of the Asian market each, despite holding much larger market shares in the US, Canada, and Europe.

One conclusion that you could draw from this is that Western markets are still infatuated with the older, more familiar brand names. Staple home electronics names like Sony and LG still hold significant weight in the West, whilst Asia is keen to experiment with its new home-grown smartphone talent. The other half of the story is that availability of these newer brands is much more limited in Europe and the North America. As these brands grow in strength, and a few winners emerge from Asia over the next couple of years, Chinese manufacturers could turn their aim to these markets. It will be interesting to see how Western brand loyalty stands up to stiff price competition from China.

Rise of the Chinese OEMS

From the data above, it’s not surprising that we have been hearing a lot of OEM success stories coming out China. The region is booming, and the local manufacturers are managing to carve themselves out a share of the pie.

Combined with market saturation in the previously booming Western markets, we are seeing the rise of a few new players, which in the longer term might even upset the two biggest companies in the industry.

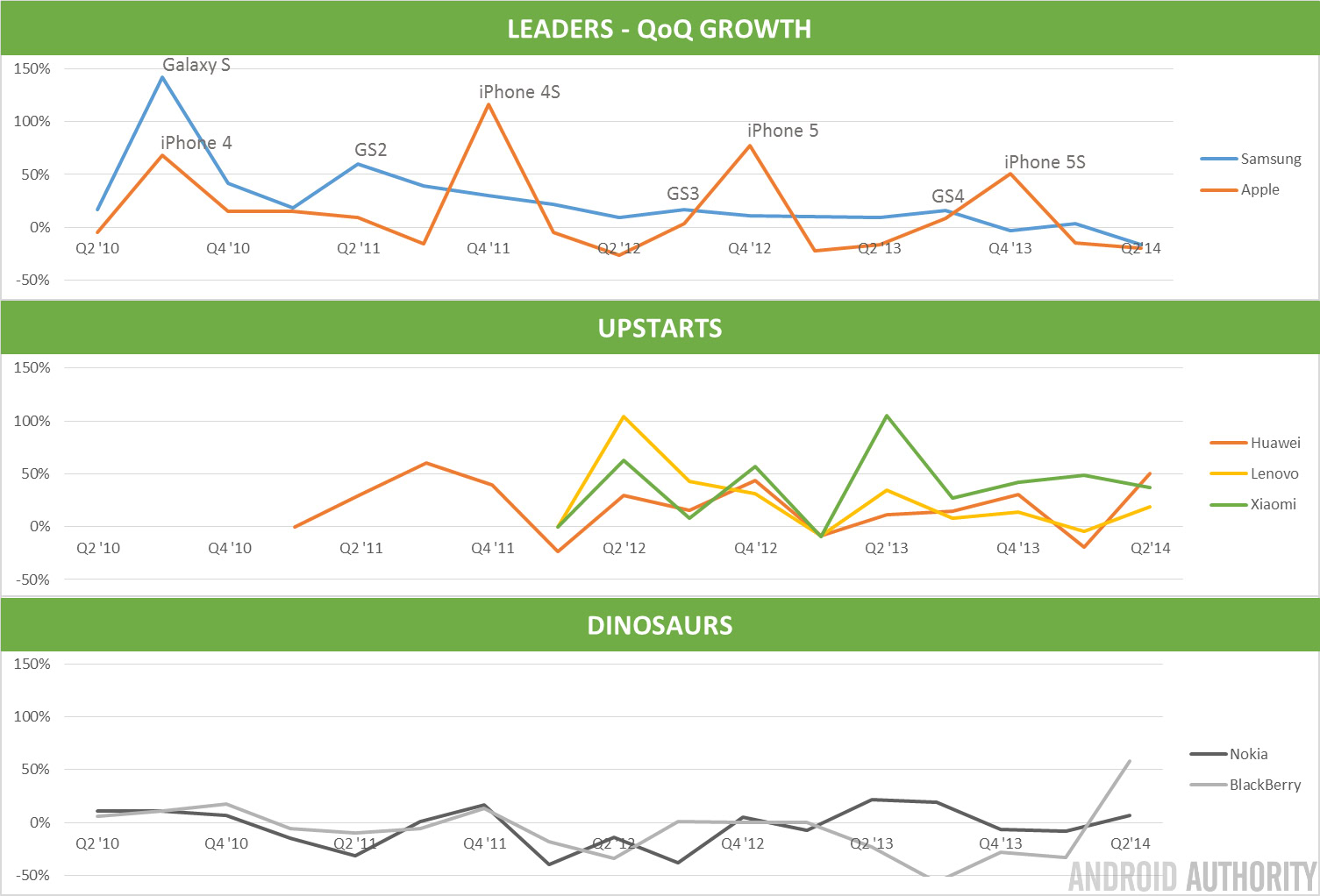

The chart below shows quarter on quarter changes in sales for various smartphone companies, not total sales, market share, or revenue. But it does show something quite interesting about how each of the companies appeals, or fails to appeal to the consumer.

Looking at Apple and Samsung, you can see spikes in demand after each major handset release. The is particularly evident with Apple products, suggesting strong demand from a dedicated core of consumers and brand loyal fans, followed by a sharp decline as the iPhone fails to strike a chord with a broader audience. Samsung’s peaks are less pronounced, partly due to its wider product portfolio, which helps the company maintain demand throughout the year. Importantly, Q2 2014 was the first time that Samsung witnessed less demand than the month before, whilst Apple dips in and out of this negative area in the months following the launch of a new handset.

It is also important to note that the peaks for Apple and Samsung are gradually declining, signalling that each iterative launch is struggling to lift demand. Another key signal of saturation and a lack of interest in premium brand products.

The Chinese manufacturers, on the other hand, see more sporadic levels of demand, but are all managing to show quarter on quarter growth that is consistently higher than both Samsung and Apple. The lack of consistency is indicative of a lack of brand loyalty, where units are shifted solely on whether they match consumer appetites at the time.

The Chinese manufacturers are operating in a much more cutthroat corner of the market, but this competition is driving the manufacturers to deliver devices best suited to what the market desires. It remains to be seen whether this trend will last into the long term, although there don’t appear to be any signs of saturation yet.

Blackberry and Nokia have been consistently in decline for the past few years, with very little sign of brand loyalty remaining.

Apple and Samsung need to adapt

With the iPhone 6 launching around the world as we speak, Apple is no doubt banking that finally caving in to consumer demands for larger devices will reignite the company’s dwindling growth. Whilst Apple might may more units than the iPhone 5S and 5C, the product isn’t industry leading and is unlikely to inspire consumers to switch over to iOS. Therefore iPhone 6 is only likely to click with existing Apple customers, and does nothing to help the company break into the fastest growing regions. Despite the Western media’s infatuation with Apple, the figures show that Xiaomi is now a bigger deal in the world’s largest smartphone market.

Samsung is facing a similar problem, and has been for some time. Consumers are refusing to pay top dollar for marginally improved handsets and marketing gimmicks. The fastest growing regions are more interested in products which offer value for money.

The key takeaway from all this juicy data is that the everyday smartphone brands that we are most familiar with are undoubtedly behind the curve. Not necessarily in terms of hardware, but in terms of being where the market is. Western consumers are set in their ways and saturated, the real opportunities for growth lie in Asia, Latin America, and Africa.

And, despite what blinkered Apple and Android pundits believe, this isn’t all about price and “poorer” developing nations simply buying budget Android handsets because they can’t afford anything else. HUAWEI, Xiaomi, Lenovo, ZTE, and the rest, and producing handsets with hardware that match and sometimes exceed the staple brands. With prices that offer consumers a better value proposition, thanks to the lack of gimmicks.

Brand loyalty only lasts for so long. The big OEMs need to realise this sooner rather than later.