Affiliate links on Android Authority may earn us a commission. Learn more.

The surprising growth of used smartphones

While the global smartphone market saw a steep fall in sales in the last quarter according to all major research agencies, the used smartphone and refurbished market is gaining traction at a surprising rate.

This is important because the numbers show that the smartphone market declined by between five and nine percent in the last quarter of 2017 (depending on whose report you’re reading). This is a significant drop. But that was just the new smartphone market — research from Counterpoint’s refurbished smartphone tracker shows a 13-percent leap year-on-year. That’s 140 million units changing hands, which is close to 10 percent of the entire market.

Second-life devices now represent close to 10% of the entire smartphone market

These “second-life” devices include repaired smartphones, “rejuvenated” models, or just those collected and sold as is. Combined with the fact we’re holding onto phones longer, the increasing sales of second-hand phones is reducing new smartphone demand, as Counterpoint research director, Tom Kang, confirms:

“The slowdown in innovation has made two-year-old flagship smartphones comparable in design and features with the most recent mid-range phones. Therefore, the mid low-end market for new smartphones is being cannibalized by refurbished high-end phones, mostly Apple iPhones and, to a lesser extent, Samsung Galaxy smartphones.”

Apple and Samsung devices in the refurb market, Counterpoint says, hold close to 75 percent of the second-hand market, with Apple “leading by a significant margin.”

Apple says it doesn’t mind this at all, and I’ve previously talked about how Tim Cook’s philosophy that the “more people on iPhone the better” is exactly right for Apple’s ecosystem approach: get people in early via hand-me-downs and lock them in. In fact, Apple even tried to get a foothold in India by attempting to convince the government it could sell used iPhones to Indian consumers. India’s government disagreed.

The refurb market is further boosted by other factors too. Third-party-repair store fronts and guides from iFixit make it cheaper and easier to replace a broken screen or put in a fresh battery than ever before. Meanwhile, the right-to-repair movement is gathering steam in its attempt to make this far easier than it is now, with a lack of easy access to a device’s innards still a problem.

Another big factor for the improving fortunes of our old phones is that new phones just aren’t as tempting as they once were. Rob Triggs made a strong point recently that innovation saturation has occurred in the smartphone market, where multiple brands are embracing a safer “tick-tock” mobile strategy, replacing the need for annual upheaval.

The Samsung Galaxy S9 is the perfect example of refinement over the earlier S8 — small design improvements, better specs, and a handsome RRP, for those that just want the latest. Similarly, the iPhone 8 represents only incremental improvement over the iPhone 7, but it’s still a better device. And, as Rob mentioned, these small steps allow companies to bide their time on introducing the Next Big Thing. This approach favors perfecting tech rather than rushing new devices. Sony and OnePlus, on the other hand, are playing the much tighter six-month cycle, while LG is one example of a major shift in the industry: an end to yearly upgrades:

We plan to retain existing models longer by, for instance, unveiling more variant models of the G series or V series.

“We will unveil new smartphones when it is needed. But we will not launch it just because other rivals do,” said LG Electronics vice-chairman Cho Seong-jin.

“We plan to retain existing models longer by, for instance, unveiling more variant models of the G series or V series.”

While cameras, processors, and screens are all getting better, the vast majority of premium smartphones from the last two years are eminently capable.

There’s a growing level of sophistication to the second-hand market, where resale values are well understood. Counterpoint’s research director, Peter Richardson, added in their report that it’s a truly global phenomenon:

“Regions seeing the highest volume include the U.S. and Europe. While the fastest growing markets for refurbs include Africa, SE Asia, and India. All have been seeing initiatives from the major operators (e.g. Verizon, Vodafone etc.), OEMs (e.g. Apple), and major distributors (e.g. Brightstar) who are adding full life-cycle services.“The industry uses data analysis to predict future resale values of devices, which means consumers can be given a guaranteed buy-back value at various points during their ownership […] Overall, we expect this trend to continue gathering pace.”

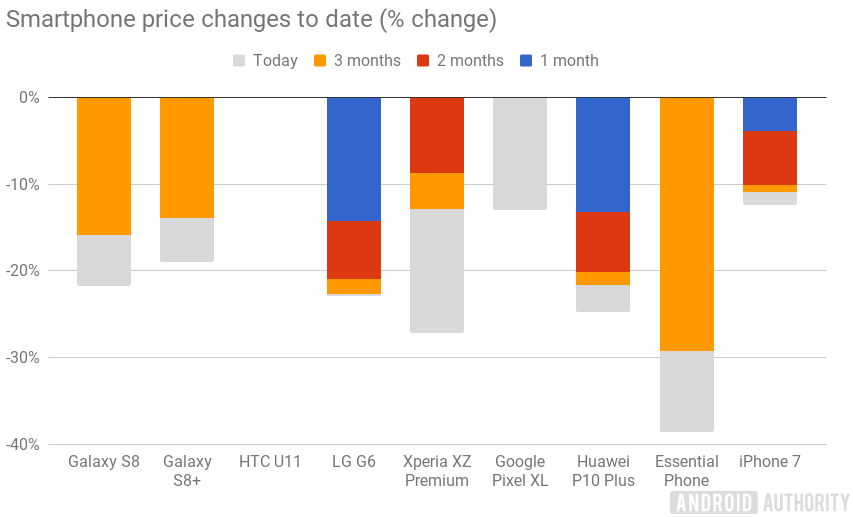

We had a detailed look at which smartphones retain their resale value best:

The key takeaway is that grabbing a phone from a well-known and trusted brand is important — Apple, Samsung, and the Google range have held up best. We also found resale price drops on 2016 smartphones were around 25 to 30 percent, while 2017 showed drops closer to 20 to 25 percent, implying that as the used smartphone market grows, resale value increases as well.

As the used smartphone market grows, resale value increases as well.

A look at camelcamelcamel.com indicates that retail value on a 64 GB iPhone X has fallen approximately 17 percent since launch. The 64 GB Galaxy S8 has only fallen around 18 percent since launch, which isn’t bad considering the S9’s subsequent debut. It is worth noting that there have been a number of sales pushing the total discount up to 21 percent.

Overall, while we can figure out some good reasons behind this, it’s still surprising. Only 25 percent of devices are making it back onto the market, which is still low. We hear a lot about planned obsolescence in our devices preventing enjoyable usage beyond the 18-24 month mark, and that may be one reason that 75 percent of devices don’t get put back on the market, along with hand-me-downs to family and friends not being tracked.

But with the sector growing, it might be time to consider the resale value of your current device, and how your next device’s value will hold up. It’s a safe bet to say that if the industry continues to struggle to create real innovation, and important elements like cameras and screens only go from very good to very very good, we’ll continue to see second-hand smartphones as genuinely good options.

For the industry that needs to keep selling premium devices, the pressure is on to make the high-end market continually enviable for those with last year’s models, and convince the mid-range community not to simply buy those used flagships instead.