Affiliate links on Android Authority may earn us a commission. Learn more.

OLED boom approaches as more manufacturers eye up panels

After years of development and industry debate, OLED has finally hit prime time in both the TV and mobile markets. Growth is on the rise, and an increasing number of product manufacturers are now adopting OLED over alternative LCD technologies. In the smartphone industry alone, ASUS, Lenovo (Motorola), LG, OnePlus, and ZTE, have picked up OLED panels for use in their highest end products this year. Samsung is still by far the biggest manufacturer and adopter for smartphone products, but there’s been growing talk about Apple purchasing panels for its 2018 iPhone too, which could mark a major shift in the industry.

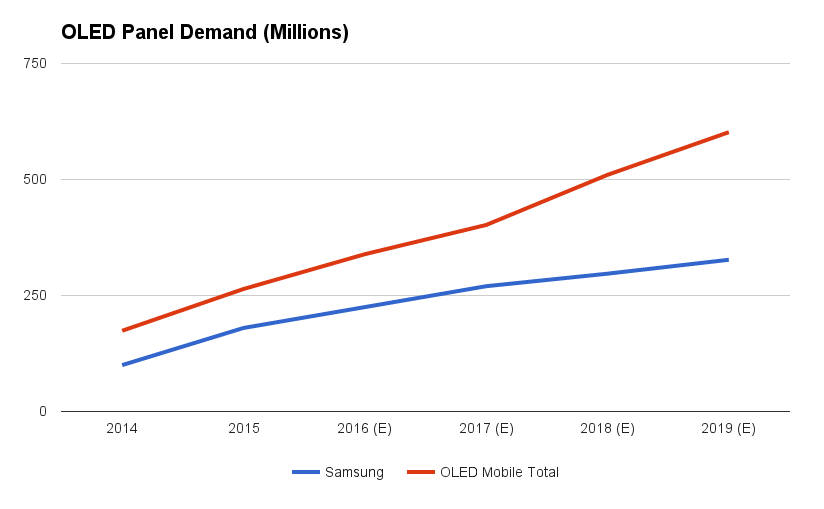

Combined, this trend has seen mobile demand for OLED hit new highs of 264 million units in 2015, which is expected to increase to 339 million panels this year and up to 602 million in 2019. As a result, a number of display manufacturers, including BEO, have been increasingly committed to AMOLED production.

Samsung has long been the leading smartphone brand making use of OLED displays, which it has been using for a number of generations in its flagship Galaxy range. However, data predicts that panels sold to other manufacturers will increase at a much greater rate in the next few years. Other manufacturers accounted for 74 million panels purchased in 2014, but they could account for 275 million by the end of 2019. Increasing production capacities and falling panel costs are helping to stimulate industry adoption.

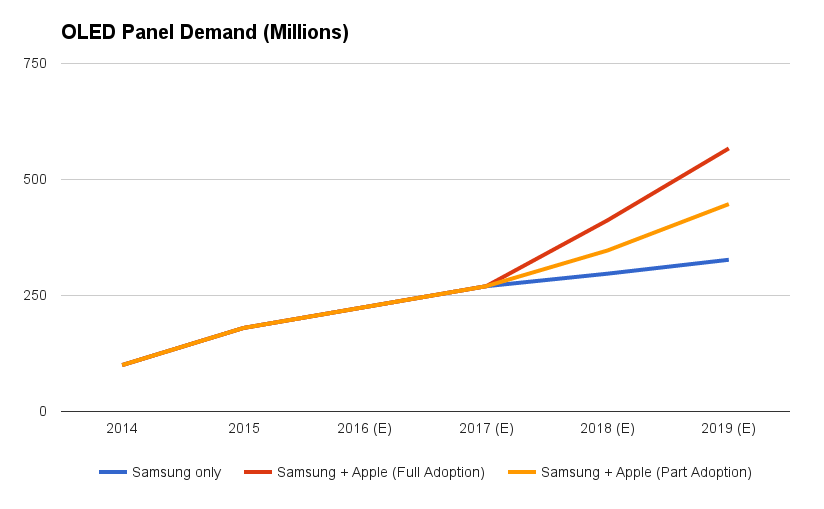

If Apple were to also produce an OLED powered smartphone, the company would instantly give a much bigger boost to panel demand. IHS predicts that small screen OLED demand would almost double. Bernstein has recently put together some interesting forecasts for OLED mobile demand, based on the likelihood of Apple fully or partially adopting OLED displays in the upcoming handsets. If Apple opts for OLED in just part of all of its future smartphones, panel demand from the two biggest smartphone manufacturers will pick up dramatically.

Along with the falling production costs and recent boosts to manufacturing capabilities, smartphone and TV manufacturers are increasingly touting the superior color gamut, viewing angles, and contrast attributes of OLED displays over LCD. Although these merits have long been hotly debated in the Android market place, Apple adopting the technology would send clear signals to the wider market and consumers that LCD is no longer the top choice for smartphone displays.

These trends are expected to push panel manufacturers away from LCD and towards OLED. Japan Display is expected to start up its own production lines next year, and Hon Hai Technology Group (Foxconn) is urging Sharp down a similar route. Although some, such as AUO and Everdisplay, are waiting to make announcements and confirm investments into new production lines and facilities until Apple’s position becomes clear. Unfortunately for some Taiwanese LCD manufacturers, falling cash flow in the previous decade leaves little prospect of investment anytime soon. Similarly, this is placing increasing pressure on LCD-only manufacturers.

As well as smartphones and televisions, OLED technology is leading display innovation in other key areas. Flexible displays, although still expensive and difficult to construct, are only achievable with OLED technology. Strides made in transparent OLED panels are also showing promise for the automotive and augmented reality markets.

[related_videos title=”Latest phones with OLED displays:” align=”center” type=”custom” videos=”698369,697734,695071,679646″]

Despite the high-end market looking increasingly towards OLED, LCD will still remain the display type as choice for lower cost models, at least for the medium term. The first reason is that although Samsung may have recently brought the cost of its OLED production down to almost LCD levels, it has taken the company 10 years and hundreds of million worth of investments to do so. Other display manufacturers aren’t quite so far along and it’s going to take time and cash to get there, the latter of which is in short supply after years of heavy competition in the LCD market. Estimates put costs somewhere in the region of $150 to $180 billion for a complete industry conversion, which could take up to 15 years to complete.

This leads into the second point. These higher production costs and large investments in the next decade will likely see manufacturers keep the price of OLED panels high to improve profitability. LCD will continue to fill in the gap at lower price points until industry wide OLED panel production matures, leading to a fall in costs and prices.