Affiliate links on Android Authority may earn us a commission. Learn more.

AMOLED display manufacturing dropping in South Korea, rising in China

- South Korea, where most AMOLED displays are manufactured, is dropping expansion in the industry due to lagging smartphone sales.

- Meanwhile, China is ramping up its AMOLED factory expansion plans to catch up to South Korea.

- Both countries are preparing for flexible AMOLED displays, which will most likely bring a major influx of production needs.

The chances are good that the AMOLED (active-matrix organic light-emitting diode) display in your smartphone was manufactured in South Korea. While AMOLED displays are made in many countries, South Korea has the most factories dedicated to AMOLED manufacturing and has been top dog for years.

But now it looks like South Korea is going to halt its growth in the AMOLED display manufacturing industry, while China looks to ramp up its growth in the same industry.

With smartphone sales seeing a drop in growth year-over-year for the first time ever, concern amongst AMOLED display creators is mounting that the market may have reached a saturation point. Since new smartphones are looking more and more like their predecessors both as far as design and specs go, people are upgrading their phones less, resulting in less need for new displays.

What’s interesting though, is that while South Korea sees the writing on the wall and is dropping expansion, for now, China is doing the opposite and investing buckets of cash into the development of AMOLED display manufacturing plants. The reason? Flexible displays.

While flexible AMOLED displays exist for marketing and prototype purposes, we are still a few years out from the first commercial devices to feature the technology. Right now, the displays are far too expensive to make production cost-efficient, so we’re going to see a kind of lull period between the peak of standard AMOLED’s happening now, and the future of AMOLED’s coming in the next year or two.

South Korea already has all the framework in place, so all it has to do is stop making new factories and cut staff down for this lull period. But China, if it wants to compete, has to build the factories now in preparation for the future flexible AMOLED competition.

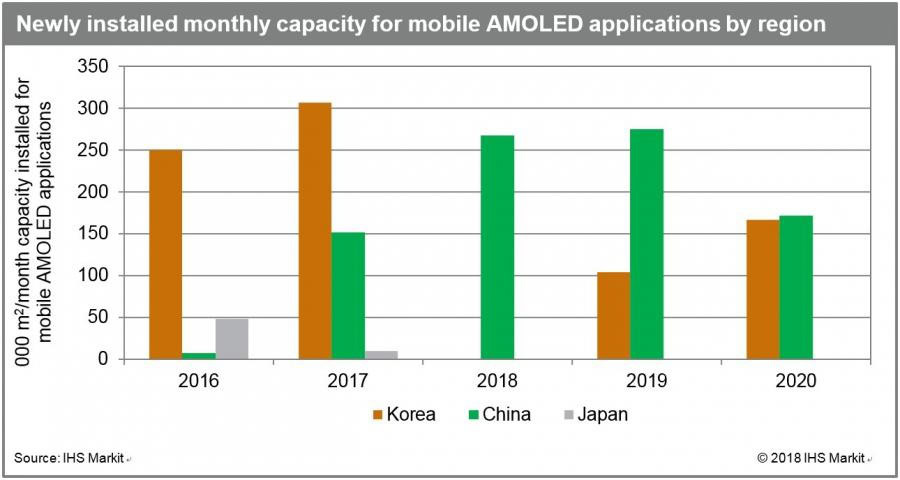

The chart below from IHS Markit shows the past and future projections of AMOLED factories in Korea, China, and Japan:

With South Korea having a two-year head start over China as far as AMOLED development goes, the country can easily bide its time to figure out its next strategy. But China has a lot to prove, as it hasn’t yet shown that it can be a viable competitor in the AMOLED display market. At least not yet.