Affiliate links on Android Authority may earn us a commission. Learn more.

Why the US market is so hard to crack

2017 hasn’t been very good year so far for LeEco, the China-based smartphone company with big ambitions for the US market. After struggling to pay its US staff and laying off a third of its regional workforce, firing employees in India, selling its expensive Silicon Valley property, canceling its acquisition of Vizio, and shutting down its EcoPass video service, the company has had more than its share of bad headlines already.

Many of LeEco’s current problems stem from what’s looking increasingly like a miscalculated bid to enter the lucrative US smartphone market, combined with the company’s huge rate of expansion. LeEco apparently hoped to generate over $100 million in revenue following its October 2016 launch in the US, but has allegedly managed just $15 million in that timeframe. Even so, LeEco plans to stick around and fight it out in the country.

Misunderstanding the market

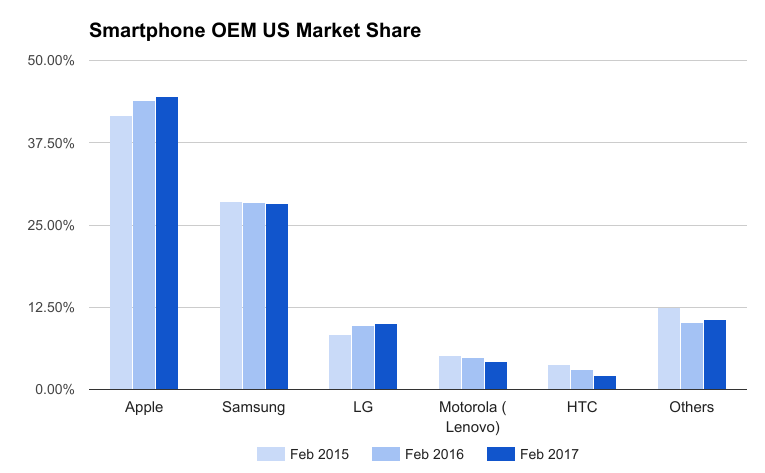

If following the world of smartphones over the years has taught me anything it’s just how rigid the US smartphone market is compared with much of the world. Consumer interest is still predominantly focused on premium tier flagships, with Apple and Samsung catering to the bulk of the market. Then there’s the tough carrier, patent, and regulatory requirements that make it difficult for smaller companies to gain a foothold.

With the focus firmly on premium products, there’s also a certain expectation associated with the buying experience. Perusing the Apple Store or chatting to your local carrier rep is part of the buying experience for many in the country. Hammering the refresh button on a web browser hoping to strike it lucky is not what the majority of US consumers look forward to when buying a new phone.

LeEco appeared to have misunderstood this key difference when it originally launched its smartphone range in the US using the “flash sale” method. While popular in India, China, and some other regions, this isn’t a phenomenon that US customers are familiar with and not one that competes well with the convenient, premium experience that many consumers have come to expect when buying a phone. LeEco eventually dropped this in favor of selling through stores such as Amazon and Best Buy, but this was only ever part of the retail challenge facing the launch.

Like it or not, carriers remain the gatekeepers of the US smartphone market.

The US remains stubborn in its reliance on carrier-subsidized handsets and physical store locations. Without the likes of T-Mobile, Verizon, or Sprint plugging LeEco’s wares, the company was only ever going to have a shot at a relatively small target audience.

When you study the cautious talk of US expansions plans from the likes of HUAWEI and Xiaomi, you can see where LeEco jumped the gun. As is rather common of Chinese handsets, the company’s Le Pro3 and Le S3 smartphones don’t have the support of CDMA based carriers, instantly locking out customers on Verizon, Sprint, and Boost networks. However, the company still retained ambitious launch plans.

Meanwhile, Xiaomi has been stocking up on patents, some related to cellular modem technology, and HUAWEI has been gradually testing the waters in the US with small GSM only launches. HUAWEI only recently signed up its first carriers (Rogers, Fido, Bell and Videotron in Canada), all while gradually improving its modem technology to match local standards, possibly with an eye to getting carriers onboard soon.

Spread too thin

Of course, there’s more to LeEco’s current financial woes than a few months of misjudged handset launches. The company is also developing and maintaining a much larger product portfolio than most other smartphone companies, but it may be spreading its efforts far too thin to have the meaningful impact that the company is after.

Alongside smartphones, LeEco offers a range of TVs, media boxes, Bluetooth speakers, and headphones. The company is also investing heavily in the autonomous vehicle market, and debuted its LeSEE Pro last year.

Alongside smartphones, LeEco offers a range of TVs, media boxes, Bluetooth speakers, and headphones. We’ve even seen oddities such as an Android-powered bicycle. The company is also investing heavily in the autonomous vehicle market, having debuted its LeSEE Pro concept car in the closing months of 2016.

Then there’s the company’s large video and entertainment business, maintained from the days of LeTV, which includes television, film, and sports broadcasting in China. LeEco also has history providing music streaming and cloud storage, which was all packaged into its ill fated EcoPass platform that offered consumers exclusive content from partners including Sling TV, Machinima, and Seeso. The company had big plans for upselling content and services to customers to help generate profits from its low cost smartphones, but this strategy is heavily reliant on getting phones in consumer hands in the first place.

The company has also been expanding into new territories at an extraordinary rate. As well as making moves into the US market, the company recently put an Asia Pacific expansion on hold, as well as trying to increase its market share in China and India. Then there’s the cancelled Vizio merger, and the large number of expensive business properties that the company has bought up.

Unfortunately for LeEco, capital to fund these expensive investments has repeatedly been thin on the ground. The company has been lurching between investor rounds, having recently secured another $2.2 billion from a selection of Chinese backers. However, that doesn’t appear to be enough for the company to afford its luxurious expansion plans, with staff layoffs and property sales dominating news about the company in the past month.

LeEco has been attempting to expand very quickly, but the sheer number of undertakings has resulted in a loss of focus and put a strain on the finances required to make breakthroughs in tough markets like the US.

Learning from its competitors

This isn’t to say that it’s impossible to carve out a niche in the US market with some clever planning. Apple and Samsung aren’t the only two brands operating in the country, after all.

A good example is to look at the relative success of brands like BLU and ZTE, two companies that have managed to carve out sustainable niches for themselves in the lower cost smartphone market. ZTE’s Axon 7, for example, managed to stand out not only because it does a good job at undercutting the competition, but also because it offers consumers a better audio experience than most, held a Nougat preview program for fans, unlocks phones on request, and hopped in early with features like Google Daydream. That’s a fair number of selling points, which helps to curate interest and a dedicated fanbase.

LeEco has plans for upselling content and services to customers, but this strategy is heavily reliant on getting phones in consumer hands first.

Similarly, OnePlus has managed to secure itself a dedicated US following, despite lacking store support and data on CDMA carriers. Although not competing with the big players for market share, this support gives the company a platform with which to expand.

LeEco’s selling point is its range of extra services and its vision to tie all of its technologies together at some point down the line. However, there’s already a lot of competition for video streaming services, cloud storage, and wireless audio gear, and many consumers aren’t so easily convinced of these proprietary platforms compared with the range of options already out there. On the smartphone front, the Le range is OK if you’re in the market for a low cost model, but lacks the refinement and features to compete with what’s on offer from super-mid and flagship rivals in the country.

It seems likely that LeEco’s issue stems from splitting resources, talent, and efforts between its automotive, video, smartphone, and other initiatives, to thinly. Readjusting to focus on mobile as its main goal, as many successful smaller smartphone brands do, might give the company the Western platform it needs to make a success of its other products.

Wrap up

Although LeEco’s recent spate of bad news and financial difficulties highlights the problems faced by relatively unknown smartphone brands looking to make inroads in the US, the company is far from alone. HUAWEI, Xiaomi, OPPO, and others are all taking measured approaches to entering the US market, with various plans to tackle the difficulty of CDMA networking patents, carrier support, storefront shelf space, and of course the marketing dominance of the big two brands.

In the years to come, these companies may finally crack a formula that sets them on a level playing field with Samsung and Apple, but we’re not there yet.

Do you believe that any outsiders have what it takes to secure a notable market share of the US market? Will anyone be able to loosen Apple and Samsung’s grip on the market? Sound off your thoughts in the comments below.