Affiliate links on Android Authority may earn us a commission. Learn more.

Qualcomm's high horse: can anyone knock them off?

Qualcomm has been the biggest player in the mobile SoC market for the past few years, powering a wide selection of Android smartphones and tablets with its range of high and mid performance processors. However, the loss of Samsung as a major customer, troubles with its high-end Snapdragon 810 processor and the growth in cost-effective smartphones has left Qualcomm to rethink their market position with a major workforce restructure.

Compounding Qualcomm’s problems, the company has posted poor financial results for the year so far and is now under investigation by the European Commission regarding predatory pricing tactics in the mobile market. With chink’s appearing in Qualcomm’s armor, is there a mobile SoC manufacturer out there who can step up to claim pole position?

Samsung

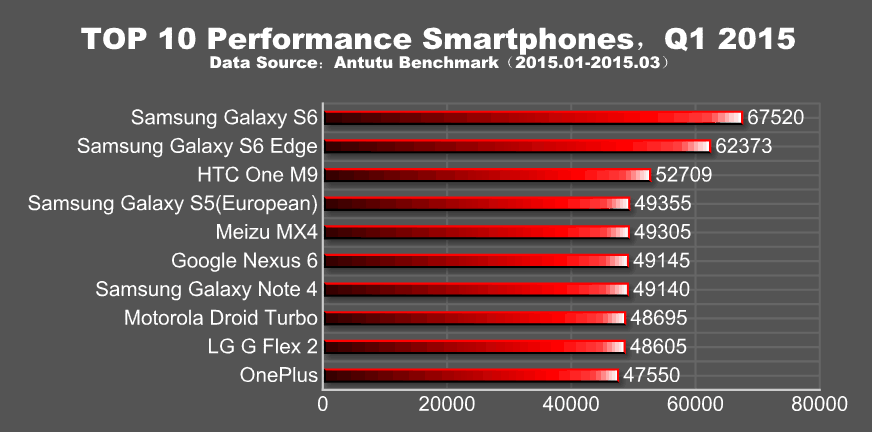

Samsung may seem like the most obvious contender, having topped the benchmarks with its Exynos 7420 processor this year. The high-end market is the most lucrative, with higher margins for both consumer and processor products. As a result, the decline in flagship smartphone sales has hurt Qualcomm’s revenue this year.

Samsung, on the other hand, has seen big gains in its semi-conductor business lately due to its own manufacturing capability. The company’s products have ended up benefiting from its cutting edge processor designs and manufacturing processes. Samsung beat Qualcomm to 14/16nm this year, as Qualcomm is reliant on TSMC’s manufacturing facilities.

The trouble with Samsung is that its Exynos line-up of mobile chips have remained virtually exclusive to Samsung phones. Only a handful of manufacturers, such as Meizu which is rumored to use Samsung’s leading Exynos 7420 in its MX5 Pro, have made regular use of Exynos processors. However, Samsung is gradually building up a portfolio of modern chips that might appeal to a larger range of manufacturers, from low-end quad-core 3470, last generation octa and hexa-core 5 series, and its high end Exynos 7 range.

However, production capacity is also potentially an issue here, with much of its supply used up on its own handsets. New orders from Apple for a new iPhone chip could use up the rest of its manufacturing space. Samsung has been making efforts to invest in additional manufacturing facilities and has been able to completely reduce its reliant on Qualcomm for its high-end phones this year, so perhaps the next step is to begin selling to additional OEMs.

MediaTek

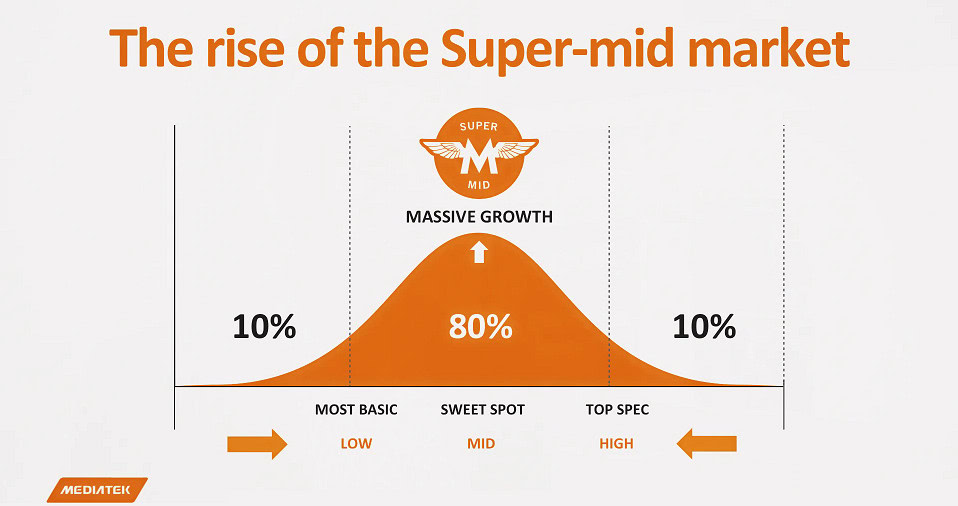

If Samsung is Qualcomm’s biggest competitor in the high-end market, then MediaTek is hot on Qualcomm’s heels in the mid-tier. The MediaTek brand has long been synonymous with low-cost mobile products, but the semiconductor company has been rolling out vastly improved mid-range processors over the past couple of years and has grabbed itself a notable portion of this market too.

MediaTek has been at the forefront of big.LITTLE ARM SoC designs, which has resulted in a range of mid-range octa-core processors capable of competitive performance at a fraction of Qualcomm’s costs.

the decline in flagship smartphone sales has hurt Qualcomm's revenue this year.

Due to the low cost nature of its SoCs, MediaTek has been been unaffected by the lack of demand for flagship smartphones and is currently capitalizing on the huge growth in emerging markets, such as China and India. As the next billion smartphone users come online, they may be more familiar with MediaTek than Qualcomm, which could secure the company a significant long-term share in these markets.

However, MediaTek’s problem remains its past controversy regarding some security issues. While things have changed over the past few years, MediaTek’s reputation is perhaps its biggest barrier to challenging Qualcomm in more markets around the world.

Nvidia

If NVIDIA’s recent financial results are anything to go by, the company is much more interested in the automotive industry these days than competing with the big names in the mobile SoC market.

Nvidia’s flagship Tegra X1 SoC boasts a cutting edge CPU design based on ARM’s Cortex range and GPU technology from the desktop Maxwell set of graphics cards. The SoC also competes with Qualcomm on display, camera, and audio features, something which not every other SoC developer can claim to do.

While its Tegra chips offer impressive gaming capabilities for its SHIELD console and tablet, NVIDIA doesn’t have a portfolio range capable of contesting the low and mid segments of the market, and is more focused on 3D performance than efficient smartphone designs these days. However when it comes to tablets, NVIDIA is still a compelling choice when stacked up next to Qualcomm’s processor.

Intel

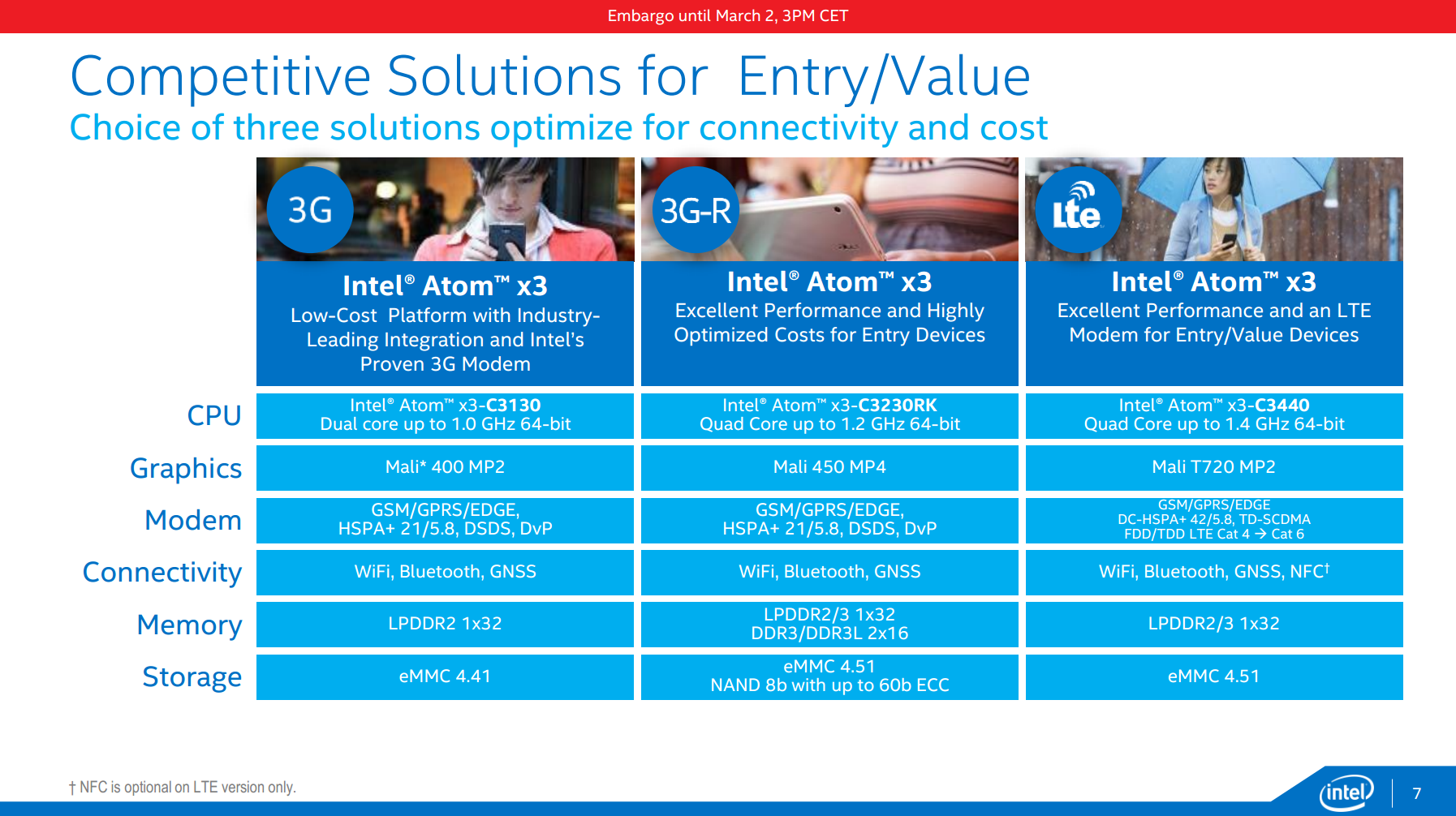

Given how long it has taken Intel to push its processor technology into just a handful of smartphones, the company is unlikely to suddenly leap into pole position. However, Intel is looking to expand into the entry level market, and may be able to steal some share away from MediaTek and Qualcomm, providing that the price is right.

Intel is finally looking to push its SoFIA processors, recently renamed to the Atom X3, to mobile devices this year, along with its “Cherry Trail” Atom X5 and X7 processors.

The company will have an integrated 3G modem alongside its processor, which might make it a more compelling chip for the low end market. However, with many regions and product categories already moving over to 4G, Intel is still a considerable way behind rivals such as MediaTek and Qualcomm.

Furthermore, its X5 and X7 remain without an integrated modem, leaving them mostly targeted at the tablet market. The Atom X3 range is targeted at phones with a retail value of less than $200 where margins are much smaller, so I don’t think that Qualcomm will be too worried.

AMD

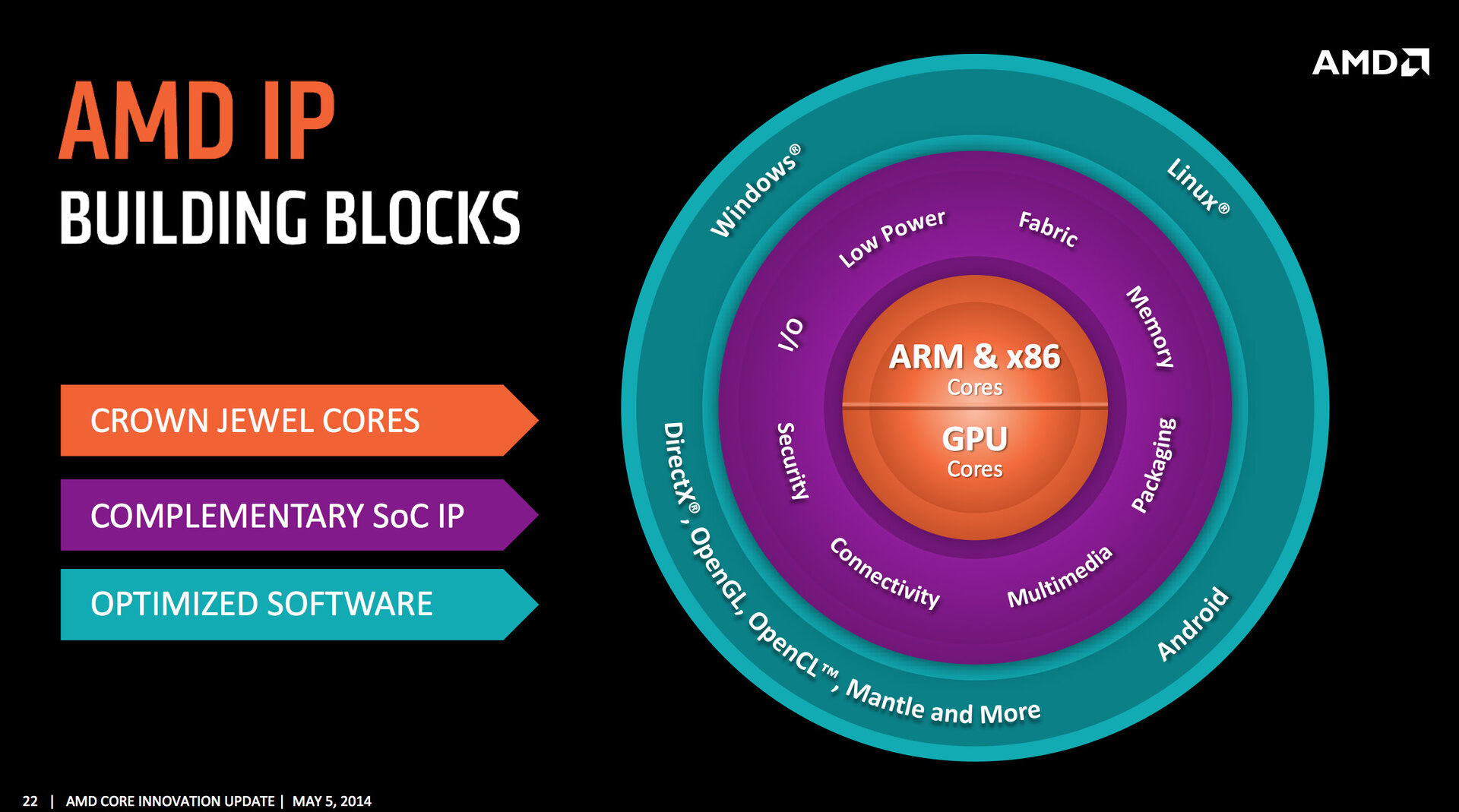

AMD is perhaps a wild card here. The company has the manufacturing legacy, the CPU and the graphics technology to make a major play for the mobile market, but has so far remained even more distant than Intel about tackling the big mobile players.

While the company may be better known for its higher TDP A-Series of laptop processors and GCN GPUs these days, AMD is also a big player in the server business, with multi-core server SoCs built from familiar ARM Cortex CPUs.

The AMD Opteron A-Series was one of the first ranges to make use of quad and octa-core Cortex-A57 CPUs, which you can find in modern mobile SoCs. That’s pretty much where the similarities with mobile chips end, but the company has the experience and know-how to put a mobile product out there if it wanted.

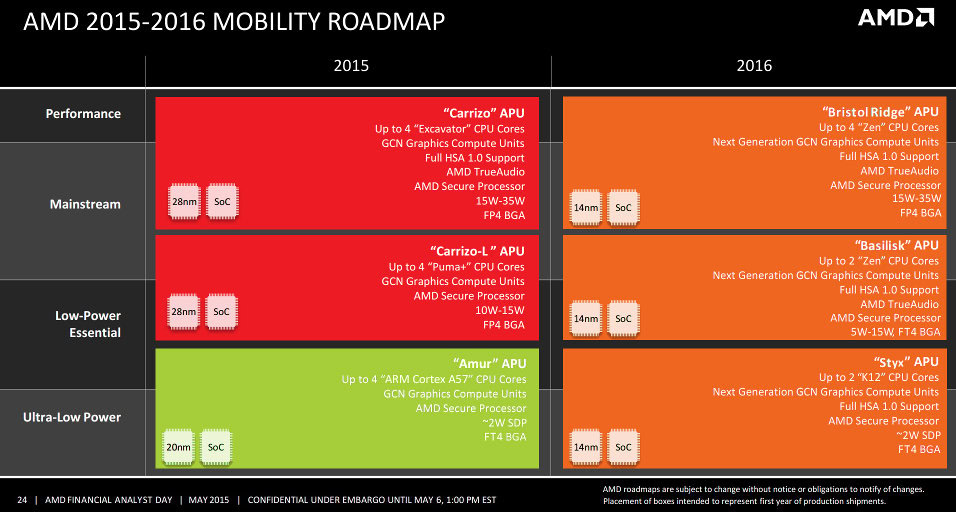

In 2016 or early 2017, depending on how well the company sticks to its schedule, AMD is expected to release its first custom 64-bit ARMv8 CPU core, codenamed K12. This is expected to be built on a 14nm manufacturing process and is rumored to be targeted at embedded applications, notebooks, Chromebooks and perhaps even Android based devices, such as tablets. That being said, servers are expected to remain the primary market for K12.

The company’s latest roadmap showcases products that will bring its GCN graphics technology down to SoCs that fit within a 2W power budget, which is right in the mobile sweet spot. It will be interesting to see if AMD can provide GPU performance that competes with energy efficiency mobile designs from ARM, Imagination Technologies and NVIDIA.

However, AMD doesn’t appear to have too much of an interest in the smartphone market, neither the premium nor cost effective segments. Recent interviews suggest that the company is betting big on mid-range laptops returning to popularity in the near future as people look for more productive computing solutions.

We probably won’t see AMD make a major play for smartphones any time soon, but perhaps continued pressures on the laptop market may force the company to revisit its approach in the future.

No-one?

While many other mobile SoC developers have been improving their product line-ups in 2015, Qualcomm may only be undergoing a temporary lull. The chip giant has its new high-end Snapdragon 820 SoC lined up for next year, which may the see company claw back ground from Samsung and reinstate itself as the performance king.

Qualcomm’s new Snapdragon 212, 412 and 612 fills out a portfolio that continues to offer something for every tier of the market, and the company remains at the cutting edge of modem, ISP and wireless mobile technology. Whether or not someone eventually overtakes Qualcomm remains to be seen, but the company will likely continue to be a major player in the mobile market for many years to come.