Affiliate links on Android Authority may earn us a commission. Learn more.

WhatsApp finally rolls out payments in India

- WhatsApp is now rolling out payments in India.

- The service uses India’s UPI platform to facilitate transactions.

- It will roll out in a graded manner.

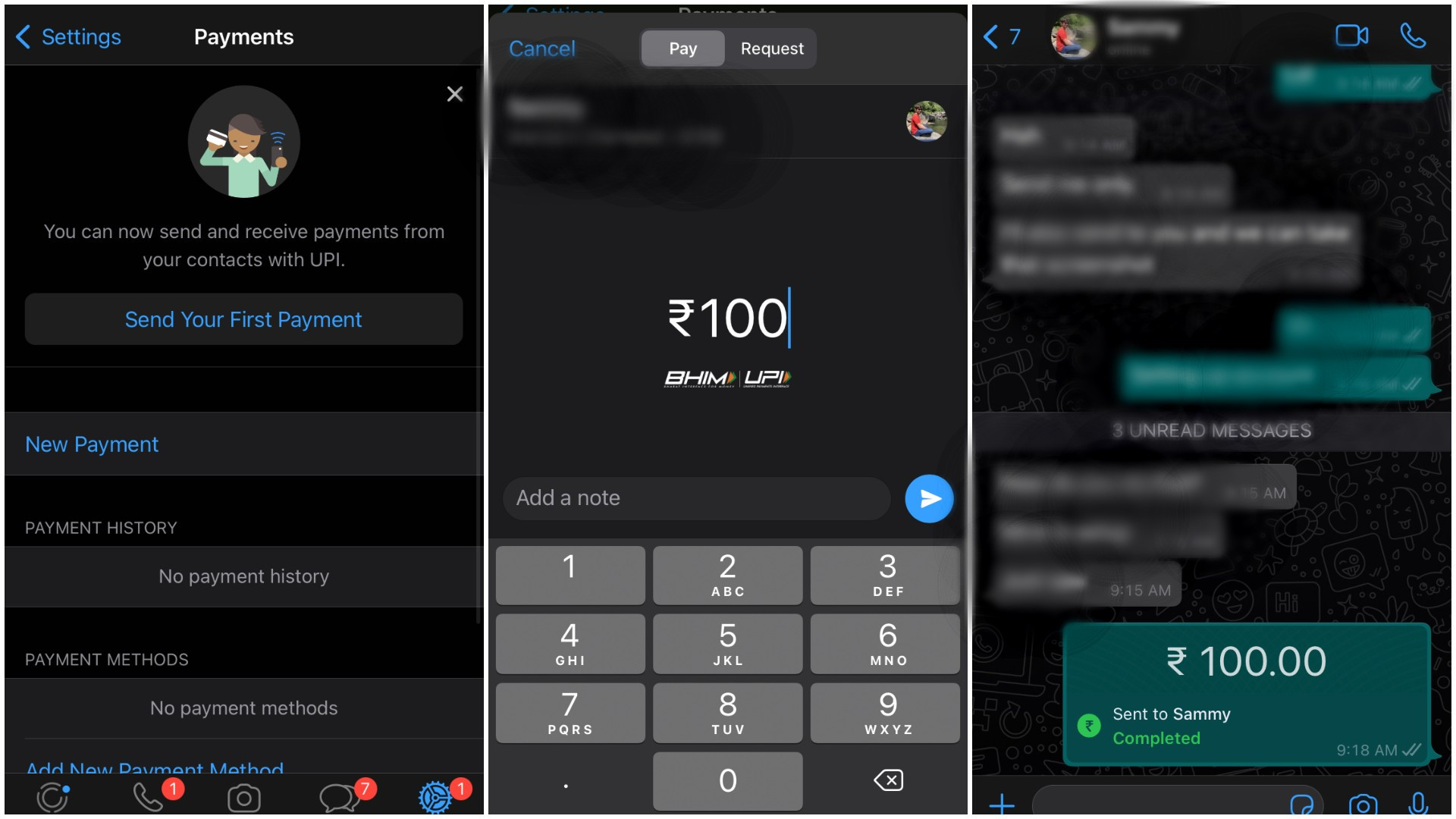

WhatsApp has finally rolled out its payments platform in India. You can now use the Facebook-owned messaging app to send and receive money across the country.

Just like Paytm, Walmart-owned Phone Pe, and Google Pay, WhatsApp Payments also use the Unified Payment Interface (UPI) platform. The service is now available on the latest version of the iOS and Android app.

To send money through WhatsApp Payments, you’ll need to have a bank account and debit card in India. WhatsApp sends instructions to banks to initiate the transfer of money between accounts via UPI. So when you’re setting up your WhatsApp Payments account, you’ll be asked to verify your phone number, and a system-generated SMS will be sent from your phone for linking your UPI ID to the service.

When you’re done setting up your account, you’ll be able to send money to your WhatsApp contacts or any other bank account with a UPI ID.

WhatsApp is currently working with ICICI Bank, HDFC Bank, Axis Bank, State Bank of India, and Jio Payments Bank to facilitate UPI payments. The messaging platform has over 400 million users in India, but according to the National Payments Corporation of India (NPCI), it can only roll out payments in a “graded manner,” starting with a maximum user base of 20 million.

WhatsApp first started testing its payments service in India back in 2018. With its wider rollout, the service will have to compete with Google Pay and Phone Pe, which control most UPI transactions in India. UPI has become the most popular digital payment system in the country, but soon NPCI will enforce a cap on the number of transactions a single app can process.

No one payment app will be allowed to process more than 30% of the country’s total UPI transactions. This means that Google Pay, Phone Pe, Amazon Pay, and now WhatsApp will have to figure out how to limit transactions on their platforms.

Also read: The best Android apps you can get right now