Affiliate links on Android Authority may earn us a commission. Learn more.

What is Tether (USDT)? Here’s everything you need to know about stablecoins

Cryptocurrencies such as Bitcoin and Ethereum are often designed with a particular purpose or use-case in mind. Tether, also commonly referred to as USDT, is no exception to this rule — it is a digital currency that is designed to trade at exactly 1 US dollar at all times.

Even though the overall crypto market is notorious for gaining or losing 10-30% of its value in a single day, Tether does the exact opposite. By design, the token has no utility or function besides having its value pegged to the dollar. In fact, Tether was the first token to earn the title of a stable cryptocurrency, or stablecoin for short.

In the following sections of this article, let’s explore how Tether works, why it has exploded in popularity, and when you might want to use a stablecoin instead of actual US dollars.

See also: The best cryptocurrency apps for Android

Understanding the basics

Before we understand how Tether functions under the hood, here are a few common terms in the cryptocurrency industry and what they mean:

Stablecoin: A stablecoin is a cryptocurrency token designed to maintain a 1:1 peg with a particular asset or fiat currency. For example, a stablecoin tracking the US dollar will always trade at $1 by design. Fluctuations in stablecoin prices are rare if they even occur at all.

Blockchain: In the context of cryptocurrencies, a blockchain is essentially a ledger of transactions distributed across computers globally. Some blockchains, like that of Ethereum, also allow users to attach data to each transaction. Since transactional data can never be modified once recorded, developers can create entire apps or tokens on top of these existing blockchains.

Decentralization: You’ll often hear cryptocurrencies such as Bitcoin described as decentralized. The term essentially means that the digital currency in question is not controlled by a singular entity, such as a government. Instead, the network is governed by the votes of individual users — ensuring that no single party or group can assume control.

How does Tether work?

In the highly volatile cryptocurrency trading world, tokens such as Tether offer a familiar unit of account that is also compatible with the digital currency ecosystem. This means that, like any other cryptocurrency, USDT can be stored in software wallets, exchanged for goods and services, transferred between individuals, and used in pretty much any scenario where you would use other forms of money.

Launched in 2014 under the title ‘Realcoin,’ Tether was the world’s first stablecoin. Its developers pioneered the idea of having a Bitcoin-like digital currency that wouldn’t fluctuate in price. As per the token’s original white paper, Tether is intended to carry over the advantages of traditional cryptocurrencies. This includes features such as borderless transactions and the ability to trade without involvement from a third party.

Tether is fundamentally a very simple cryptocurrency. Instead of developing their own blockchain network, Tether’s developers decided to use the Bitcoin blockchain as the underlying foundation. As the project’s original white paper states,

“Tethers exist on the Bitcoin blockchain rather than a less developed/tested ‘altcoin’ blockchain nor within closed source software running on centralized, private databases.”

But how does Tether manage to trade at a constant $1?

Put simply, Tether is backed by a central reserve that contains assets to back up the value of each token. This 1:1 pairing is what prevents Tether’s price from falling or rising in the open market.

In its simplest form, a stablecoin’s reserve can be a bank account where actual cash is held as collateral for the issued tokens. However, as of June 2021, 62 billion USDT tokens exist in circulation. Naturally, it’s impossible to expect Tether’s reserves to hold $62 billion worth of cash. Even Apple, one of the world’s most valuable companies, only maintains around $200 billion in liquid cash.

Instead, Tether’s reserves only include a small percentage of cash, while the rest is either commercial paper, treasury bills, or other investments.

In theory, any USDT holder could request redemption of their tokens against actual US dollars. In practice, however, tokens are only bought and redeemed by large cryptocurrency exchanges. These transactions are usually worth millions, so end-users are expected to buy and sell their tokens on these exchanges instead.

To summarize, stablecoins are unlike traditional cryptocurrencies as they are not speculative in nature. By enforcing the concept of a 1:1 reserve, they are inherently stable and resistant to price fluctuations.

Notably, though, there is definitely some risk to holding Tether or any other stablecoin. If the reserve assets are ever insufficient or non-existent, the peg against the US dollar could collapse. This could also have a cascading effect, where negative sentiment surrounding the token could cause the valuation to drop below even the amount held in reserve.

See also: The best crypto wallets for Android

Tether: A unique class of cryptocurrency

Even though Tether functions like any other digital currency, it is philosophically unlike most cryptocurrencies on the market today. This is because it is backed and controlled by a singular entity, which makes it highly centralized. Tether Limited, the company that created the cryptocurrency, has also been criticized for its lack of transparency on multiple occasions.

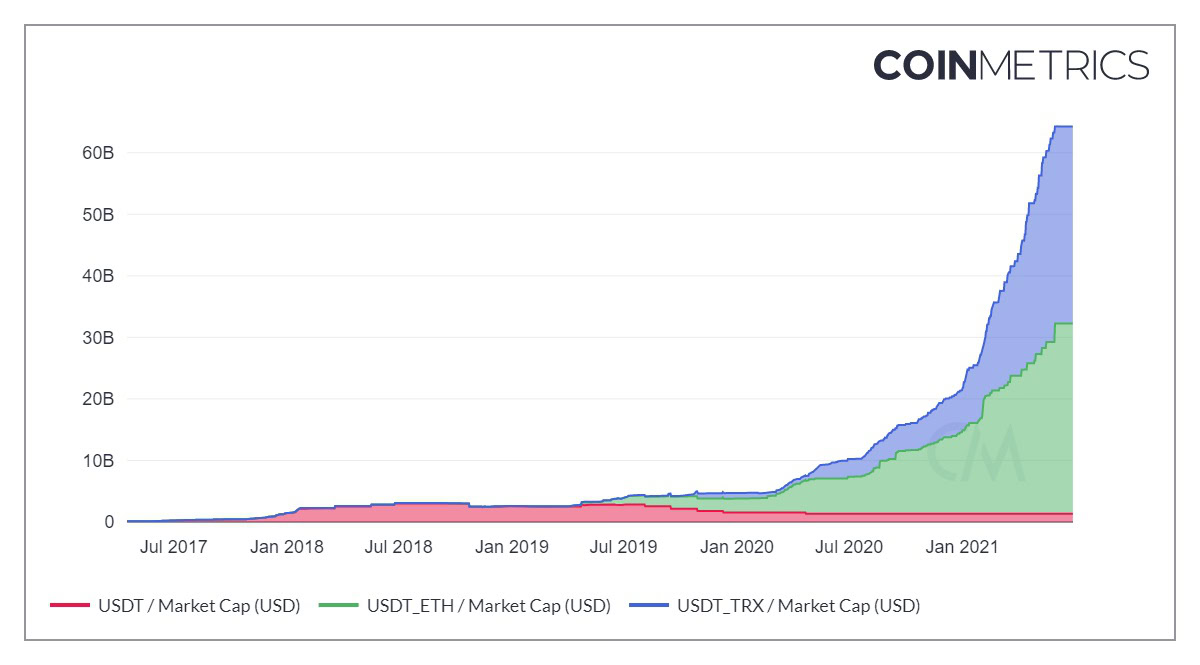

On the surface, however, Tether does share the characteristics of any traditional cryptocurrency. As mentioned previously, Tether tokens are issued on existing blockchains. In fact, USDT has been issued on as many as eight different blockchain platforms over the years, including Bitcoin, Ethereum, and Tron.

Consequently, you can more or less take Tether’s cryptographic security for granted as the tokens themselves cannot be counterfeit or hacked. Most USDT tokens now live on the Ethereum blockchain, which is universally regarded as secure and tamper-resistant. However, what is much less concrete is Tether Limited’s claims of having adequate dollar-based reserves for every single USDT token it has issued to date.

The cryptocurrency movement is built on the foundations of decentralization and trustlessness. Tether, however, is the antithesis of these ideologies as a single opaque entity controls it. Furthermore, even without the aforementioned risks, Tether Limited’s actions have only made the stablecoin more controversial over the years.

Before exploring these events, though, let’s explore Tether’s role in the modern cryptocurrency landscape and how it became so popular.

The rise of USDT: How Tether became the de facto stablecoin

A popular use case for stablecoins involves cryptocurrency trading. If you need to liquidate your Bitcoin or altcoin during a crash, stablecoins such as Tether offer a quick and stable substitute to the US dollar. With Tether, you don’t have to rely on slow and expensive bank transfers where your funds may be tied up for several days at a time.

Despite its shortcomings, Tether has managed to streamline the global cryptocurrency trading industry. More specifically, it improved liquidity across many cryptocurrency exchanges. This is especially true in international platforms such as Binance, which cater to traders from dozens of countries. By using USDT-based trading pairs, exchanges aren’t forced to create a new fiat-specific market for each and every cryptocurrency.

For example, a Thailand trader can use the BTC/USDT pair to trade with someone from Argentina or Nigeria without even knowing it. Standardization with stablecoins such as Tether ensures that a particular cryptocurrency’s liquidity isn’t split up into multiple regional trading pairs like BTC/EUR, BTC/USD, BTC/AUD, and so on.

However, Tether is not the only stablecoin in existence. In fact, there are hundreds of digital tokens pegged to the US dollar, euro, or some other fiat currency. They all provide the same underlying functionality, so why does Tether continue to grow while most of its competitors remain stagnant?

The answer is rather straightforward. Similar to Bitcoin, Tether enjoys an unparalleled early mover advantage. The token has existed for over half a decade at this point, which means that almost everyone recognizes it and is willing to trade it in exchange for other cryptocurrencies.

What’s wrong with Tether? Or, why is Tether so controversial?

Since the token’s inception, Tether Limited had publicly proclaimed that each USDT token was backed by one US dollar in its reserves. However, it failed to back this claim with any definitive proof. The company also refused to conduct an external audit of its reserves for several years, which led to even more skepticism in the cryptocurrency community.

These concerns were further exacerbated in 2017, when the Paradise Papers leak revealed that Tether Limited was deeply linked to the cryptocurrency exchange, Bitfinex. Until then, the two companies refused to acknowledge any relationship. Post the leak, however, an official statement was released that confirmed Bitfinex and Tether Limited shared the same CEO.

While nobody knows why this fact was kept hidden, many speculate that Tether Limited wanted to distance themselves from Bitfinex in a bid to appear credible. Only one year before the disclosure, the exchange lost 120,000 bitcoins (worth around $72 million) to a security breach.

A couple of years later, in 2019, the New York Attorney General accused Bitfinex of usurping Tether’s reserves to cover an undisclosed $850 million loss. The companies were forced to pay a fine of $18.5 million and eventually cease operations in New York. Around the same time, Tether Limited silently updated its website to state that its 1:1 USD reserves also included non-cash assets such as corporate loans.

Tether’s controversial history has also led to fallouts with banks and financial institutions. Once a client of Wells Fargo, Tether Limited has changed its banking partner numerous times over the past few years. It is currently working with Deltec Bank & Trust in the Bahamas after a failed relationship with Puerto Rico-based Noble Bank.

Tether alternatives worth considering

Given Tether’s controversial history, it’s understandable if you are a bit hesitant about trusting the project. Luckily enough, the market has several other stablecoins — each with its own pros and cons:

USD Coin: Functionality-wise, USD Coin (ticker USDC) is no different from Tether. Both are designed to trade at one US dollar. Unlike Tether, however, USDC is backed by the US-based payments giant, Circle. While not a perfectly decentralized solution, it is viewed as the lesser of two evils among cryptocurrency enthusiasts.

DAI: Among the first decentralized stablecoins, DAI also maintains parity with the US dollar. Instead of assets stored in a bank account, DAI’s peg is backed by Ether (ETH) tokens. This is all achieved with the help of a smart contract on the Ethereum blockchain, so no middlemen or central authority is involved.

Paxos: PAX, or Paxos, is yet another centralized stablecoin competing with USDC and USDT. The company’s main claim to fame is that it was the first US regulator-approved stablecoin. It also offers PAXG, which is a stablecoin pegged to the value of Gold. Like Tether, the two Paxos tokens also use the Ethereum network for record-keeping.

Should you use Tether?

With over $60 billion worth of USDT already in circulation, Tether is one of the most valuable cryptocurrencies in the world. Even with compelling alternatives available, most digital currency traders have stuck to Tether, at least for now.

If you’re a frequent cryptocurrency trader, chances are you will have no option but to trade with USDT unless the exchange has enough liquidity for your fiat currency. Furthermore, most high-profile exchanges still have limited support for other stablecoins.

Tether has managed to maintain its 1:1 peg to the US dollar in recent years except for a handful of rare instances. This means that traders and exchanges have had no practical reason to switch over to a different stablecoin. The liquidity and recognition USDT pairs provide appear to outweigh most criticisms against Tether’s parent company.

Still, alternative stablecoins such as USD Coin (USDC) and Dai (DAI) have begun surging in popularity of late — especially on decentralized finance platforms such as Uniswap. Furthermore, institutional and accredited investors will likely gravitate towards more reputable stablecoins. While Tether will likely continue to be prevalent in the years to come, its overwhelming dominance may finally diminish.

Tether can be purchased on just about any cryptocurrency exchange — in exchange for fiat or cryptocurrencies. However, before you buy some, keep in mind that USDT tokens are not insured. If a cryptocurrency exchange loses your tokens to a hack or Tether loses its peg overnight, your money will be irrevocably lost. To that end, do your due diligence before purchasing, just as you would for any other investment.

The future of stablecoins

Finally, no discussion about stablecoins is complete without mentioning private offerings and Central Bank Digital Currencies (CBDCs).

In 2019, the Chinese government acknowledged that it had been developing the ‘digital yuan’ — a tokenized version of its currency. Since then, dozens of central banks worldwide have expressed interest in developing a similar system. In fact, Venezuela was the first to actually launch a stablecoin. Supposedly backed by the country’s oil and precious metals reserves, the Petro failed due to a general lack of faith in the Venezuelan government.

Around the same time, a slew of tech companies and financial institutions announced tokens that would mimic the functionality of stablecoins. Facebook’s Libra (now Diem) and JPMorgan’s JPM Coin are the most well-known examples of upcoming private cryptocurrencies.

However, one thing to watch out for is that almost all of these tokens will be proprietary in nature. While functionally still stable, China’s digital yuan, for example, will not be decentralized or based on blockchain technology. To that end, you can probably expect these tokens to be even more opaque than Tether but perhaps more trustworthy, depending on the issuing country.

Frequently asked questions

Q: Can I redeem Tether’s USDT tokens for actual US dollars?

A: Theoretically, yes. However, Tether Limited only works with large institutions and companies such as cryptocurrency exchanges. If the amount you’re looking to exchange is worth less than $100,000, you’d be better off trading your tokens on a cryptocurrency exchange like Coinbase. The good news is that you will receive exactly $1 per token, barring any exchange fees — which are typically around 0.2%.

Q: Has Tether ever lost its peg against the US dollar?

A: Tether has indeed lost its peg on more than one occasion during its early years. Of late, however, growing adoption and widespread recognition have allowed the peg to maintain equilibrium at $1.

However, as a general recommendation, you shouldn’t treat stablecoins as a safe long-term asset. A black swan event could cause these tokens to lose their peg against the US dollar. While unlikely, this would leave you with no recourse — no company, exchange, or bank guarantees a stable exchange rate in perpetuity.

Q: Why does Tether trade at a premium on some exchanges?

A: Some regional exchanges can have Tether trading at $1.1 per token instead of $1. This can be due to the imbalance between supply and demand, where traders pay a premium for a small, shrinking local supply. The mismatch is especially prevalent in areas where US dollars are typically difficult to come by, like in the case of many developing countries.

In these scenarios, international investors usually can profit from arbitrage — which involves buying tokens at $1 and selling them for a higher value on smaller exchanges.

Q: Which wallet do I need to use for Tether?

A: As mentioned above, Tether does not use its own blockchain. Instead, it lives on multiple blockchain networks — including Ethereum and Tron. The wallet you need to use depends on the exchange you withdraw from.

Certain exchanges, like Binance, will allow you to withdraw your USDT tokens on a blockchain of your choice. For now, the ETH-based Tether (also known as USDT-ERC20) appears to be the de facto blockchain. To that end, you can use any Ethereum wallet, like Metamask, to store your USDT tokens.

Once you receive your USDT tokens in your private wallet, don’t forget that you will also need some Ether (ETH) to pay for any future transaction fees from that wallet.