Affiliate links on Android Authority may earn us a commission. Learn more.

Bitcoin explained: The controversial digital currency worth billions

Bitcoin has been touted as a revolution in the world of money. You may have also heard it described a dozen different ways, sometimes in a good light and other times in less savory terms. It’s easy to dismiss Bitcoin as just another failed attempt to put money on the internet. Looking under the surface though, it offers a radical solution to a decades-old problem.

In this article, let’s take a comprehensive look at the world’s most valuable cryptocurrency and where it is headed.

Understanding the basics

Before we dive into Bitcoin and all its specifics, here are a few terms you should come to grips with first:

Cryptocurrency: Cryptocurrencies are essentially digital tokens that have some monetary value. These valuations are often quoted against fiat currencies, similar to how 1 EUR is worth 1.2 USD. They are usually based on some form of decentralized technology to eliminate intermediaries and authorities such as central banks.

Digital wallet: A digital wallet acts as the key to your balance on a cryptocurrency network. Just like in real life, digital wallets can be used to send or receive money between you and other people or businesses. A wallet can be either a desktop program, mobile app, or dedicated hardware device.

Blockchain: Blockchain is the technology that underpins Bitcoin and most decentralized cryptocurrencies. A blockchain is often described as a ledger of transactions, which is distributed across a network. They are designed to record valid transactions without a central authority and prevent reversal of old entries.

What is Bitcoin and how does it work?

Bitcoin (ticker BTC) is a decentralized peer-to-peer payment network. In simpler terms, it is digital money without the backing of any government, central bank, or authority.

From a practical standpoint, Bitcoin is pretty similar to cash in that you can acquire some amount of it (including a fraction like 0.01 BTC) and then either hold it in a wallet or exchange some for goods and services.

Think of Bitcoin as a global ledger of transactions. Many explanations online state bitcoins are “stored” in a digital wallet. However, what you really have is a balance on the Bitcoin network.

The wallet software simply acts as the ‘key’ to your balance, allowing you to spend or transfer it as you see fit. Ultimately, the whole coin ownership analogy is nothing more than an abstraction.

The cryptocurrency moniker came around for this exact reason. Under the hood, Bitcoin wallets are a model example of public key cryptography.

If Bitcoin is nothing more than a global ledger, you might ask how the network prevents malicious or fraudulent entries. For instance, a user shouldn’t be able to spend Bitcoin if they don’t own any, nor should they be able to siphon funds from an account they do not control.

The solution is rather clever — and it’s called a consensus mechanism. Across the global Bitcoin network, a group of volunteers maintain an always-updated copy of the Bitcoin ledger. Another group, called miners, verify new transactions and broadcast them to the rest of the network.

Bitcoin relies on a system known as Proof of Work (PoW) to validate new transactions. Every 10 minutes or so, new transactions are collected in what is known as a “block”. Miners across the network then have to spend computing power to calculate a mathematical proof unique to that block. The process is entirely random and there is only one winner, so the first miner to provide a valid proof is rewarded with some amount of Bitcoin. This is known as the block reward.

The consensus mechanism ensures that miners are economically incentivized to compete against each other for a reward, rather than colluding to attack the network. Without it, anyone can append malicious entries to the ledger. The consensus algorithm is what made Bitcoin the first successful implementation of blockchain technology.

Read more: What is Blockchain?

What makes Bitcoin special?

Bitcoin was the world’s first cryptocurrency, but it certainly isn’t the only one on the market today. Despite this fact, it manages to hold a formidable lead, accounting for half of the entire market’s valuation. You may wonder — what makes Bitcoin so lucrative to users and investors, even with the abundant competition?

While there’s no single right answer to this question, Bitcoin has several properties that make it extremely unique and valuable, including:

- Decentralization: Bitcoin does not rely on banks, administrators, or central authorities. This means that economic or geopolitical instability has no bearing on the functioning of the Bitcoin network.

- Trustlessness: No two participants on the Bitcoin network are expected to trust each other. This is in stark contrast to traditional financial networks, which often rely on a chain of trusted intermediaries.

- Transparency: Every transaction on the Bitcoin network is publicly broadcasted and recorded across thousands of computers. You can audit this data at any time through an online blockchain explorer.

- Immutability or Tamper-resistance: Once recorded to the blockchain, transactions cannot be modified. This eliminates the possibility of “double spending” or reversing once-legitimate transactions.

- Censorship Resistance: Transactions on the Bitcoin network are never discriminated against. As long as the fee is set to a non-zero amount, miners are economically incentivized to process the transaction. Even if miners in one country are ordered to block certain transactions, validators from other regions will process them sooner or later.

- Availability: Bitcoin is omnipresent, with users and miners in all countries. It cannot disappear, break down, or go offline. Modern economies, by comparison, have a single point of failure.

Even though some of these properties aren’t necessarily unique to Bitcoin, you would be hard-pressed to find another currency or asset that excels at all of them.

Bitcoin also benefits from the network effect, which dictates that an asset’s value increases as more and more people begin using and attributing value to it. Think back to the internet from the early 1990s and how it has grown exponentially in terms of both, user count and value, since then.

When hedge funds and Fortune 500 firms consider adding cryptocurrency to their investment portfolios, most gravitate towards Bitcoin because of its long standing reputation. If you think Bitcoin development is slow and unexciting, consider that it is also the most mature, technology-wise.

Addressing common Bitcoin complaints

Isn’t Bitcoin slow and inefficient?

The latter half of the past decade has witnessed Bitcoin garnering a notoriety for being slow and inefficient. You may have heard that the network can only process a small number of transactions every second — a metric that is exceeded by many other cryptocurrencies and dwarfed by traditional payment platforms such as Visa or PayPal.

Furthermore, Bitcoin is often criticized for its energy-intensive nature. Many critics point out that cryptocurrency mining consumes more electricity than entire nations. And these are not small nations either. At an estimated 130 TWh, Bitcoin’s electricity usage surpasses that of Norway, UAE, and the Netherlands.

However, most Bitcoin proponents take up an either unfazed or mildly defensive stance on these issues. What’s more — a significant chunk of the cryptocurrency community regards these so-called deficiencies as intentional design choices.

This is because of something known as the blockchain scalability trilemma. Put simply, it dictates that a network can only really achieve two out of the following three properties simultaneously: decentralization, security, and scalability.

Back in 2017, the debate surrounding Bitcoin’s inefficiency splintered the cryptocurrency community into two warring factions. One group believed Bitcoin needed to increase the size of blocks in order to fit more transactions. However, the other side argued that doing so would weaken Bitcoin’s decentralization by inflating the size of the blockchain.

Notably, the Bitcoin blockchain’s size has already grown to hundreds of gigabytes. An exponential increase would make copies of the blockchain difficult to download and store for most people.

Failing to garner enough support from within the Bitcoin community, large-block advocates forked Bitcoin to create Bitcoin Cash (BCH) in August 2017. Both communities traded blows throughout the 2017 bull run, but the original Bitcoin cryptocurrency won in the end. The market capitalization of BCH trails that of Bitcoin by hundreds of billions of dollars in 2021.

For the world’s flagship cryptocurrency, the community has unanimously decided that scalability isn’t as much of a pressing concern as stability is. After all, if Bitcoin crumbles and fails due to a rushed upgrade, it doesn’t matter how fast your transaction settlement times are.

As for the electricity consumption debate, that remains a concern. Over time, however, many speculate that miners will be forced to switch to renewable energy to keep costs low (more on that in a bit).

Why is Bitcoin so expensive?

Bitcoin’s price is regulated by the simple economic principle of supply and demand. At the time of writing this article in mid-2021, each Bitcoin is valued at around $30,000. This is significantly higher than many other cryptocurrencies, so what’s fueling the demand if using it as a currency is so impractical?

Bitcoin is unlike most currencies in that it is a finite resource — there will only ever be 21 million in circulation. Even better, the rate at which new Bitcoin enters the market is entirely predictable.

For the first four years of Bitcoin’s existence, each block yielded miners a reward of 50 BTC. Nearly a decade later, however, that figure has dropped to a paltry 6.25 BTC. In that vein, we’ll have to wait until the year 2140 for the final Bitcoin to be mined.

Every bitcoin is worth around $30k, making it not the most practical solution for everyday purchases.

This is all because Bitcoin’s block reward is designed to drop in half every four years or so. This phenomenon, known as a ‘halving event’ in the cryptocurrency industry, has far-reaching implications.

Most importantly, miners are paid half as much to do the same amount of work. To stay profitable, either the costs of running their operation has to drop in half or Bitcoin’s price needs to double. Luckily for miners, both tend to happen.

Not only has mining equipment become extremely efficient over the years, but the three Bitcoin halving events so far have also triggered exponential growth cycles for the cryptocurrency market.

Bitcoin’s fixed supply and scheduled halvings have made it a perfect store-of-value asset in the eyes of many investors, large and small. In an age where holding fiat currency is quickly becoming undesirable due to inflation and devaluation, many are flocking to safe-haven assets such as gold and Bitcoin instead.

Unlike gold though, cryptocurrency can be easily stored, authenticated, and transported. The barrier to entry is also considerably lower, especially since you can buy a tiny fraction of cryptocurrency. It’s not surprising then that Bitcoin is often called ‘digital gold’, even though its true utility extends far beyond.

Are criminals using Bitcoin to finance illicit activities?

Bitcoin was released in the aftermath of the 2008 economic crisis, which was predominantly fueled by the housing and mortgage bubble of the early 2000s. Satoshi Nakamoto, the pseudonymous creator of Bitcoin, hinted that the cryptocurrency was designed to enable independence from central banks and governments. Libertarian views aside though, has Bitcoin’s lack of central authority allowed criminals to take undue advantage of it?

Indeed, some of the earliest and most prominent use-cases of Bitcoin involved the sale of illegal goods and services. However, it’s worth remembering that most emerging technologies, including the Internet, suffered from the same problem in their early days. The actions of a few bad actors don’t necessarily represent the cryptocurrency industry as a whole, especially several years later.

Besides, remember how every transaction on the Bitcoin network can be audited? Well, it turns out that experts have become incredibly skilled at narrowing down identities based on publicly available blockchain data. Because of this, most nefarious users have long since migrated to alternative cryptocurrencies.

According to Chainalysis, illegal activity on the Bitcoin blockchain accounted for less than 1% of all transactions in 2020. At this point, it’s probably safe to say that physical cash is far more untraceable than Bitcoin.

Bitcoin alternatives worth considering

If you’re still concerned about Bitcoin’s inefficiency or lack of anonymity, it’s worth noting that competing cryptocurrencies aim to alleviate these issues. Some strong Bitcoin alternatives include the following:

- Ethereum: In addition to being the second largest cryptocurrency, Ethereum is on the path to become a highly efficient cryptocurrency. The ETH 2.0 network upgrade is expected to cut the network’s energy consumption drastically, while making transactions much more economical for end users.

- Monero: If you’re looking for anonymity, Monero is considered to be the gold standard. The cryptocurrency and its development is hyper-focused on user privacy.

- DAI or USDC: These are stablecoins, which means they are designed to not fluctuate in value. If you’re purely interested in sending money internationally, stablecoins will offer you faster and cheaper transactions as compared to the banking industry’s SWIFT system. Both DAI and USDC are pegged in value to the USD, so they always trade at a flat $1.

Buying Bitcoin: What you need to know

Now that you are all caught up on the essentials, you’re probably thinking about a potential Bitcoin investment. While it’s impossible to make a general recommendation, keep in mind that cryptocurrencies are generally volatile – significantly more than any equity or debt instrument, in fact. Day trading Bitcoin is usually a recipe for disaster, so maintaining a longer investment horizon may be your best bet.

While there are various ways to acquire Bitcoin, cryptocurrency exchanges are the most convenient option these days. Internationally known platforms such as Coinbase, Gemini, and Kraken are universally regarded as the safest option. Depending on where you live though, you may have to settle for a smaller local exchange.

Many traditional stock brokers, including Webull and Robinhood, also offer cryptocurrency trading. Cash App and PayPal let you buy Bitcoin too, but lack the features of a full-fledged broker.

If you’re looking to invest long-term, you can consider withdrawing your holdings to a private Bitcoin wallet on your desktop or smartphone. Exchanges have lost their users’ cryptocurrency to security breaches on several occasions in the past, with many even declaring bankruptcy in the process.

Read more: Best Cryptowallets

Do note that self-custody is also a double-edged sword. Write down your wallet’s backup phrase when prompted and keep multiple copies of it somewhere safe – maybe even a bank locker if you’re as paranoid as I am. Remember: If you lose access to both your wallet and the backup, nobody can help you recover your holdings.

The future of Bitcoin

Bitcoin has matured significantly since it was first released. In 2017, the first derivative products hit the market, putting Bitcoin on the map of institutional investors. Since then, companies such as Microstrategy and Tesla have bet billions of dollars on Bitcoin, alongside hedge funds like the Grayscale Bitcoin Trust (GBTC). Large financial institutions, including the likes of VanEck, are now working on a Bitcoin-based ETF as well.

Significant work has also been done to improve Bitcoin’s viability as an everyday payments system. Most notably, the Lightning Network is a project that aims to establish a payment protocol on top of the primary Bitcoin network.

Often referred to as a second layer scaling solution, Lightning could offer nearly instantaneous transactions at a fraction of the cost. Widespread adoption, however, is a natural pre-requisite for it to work.

Speaking of mass adoption, El Salvador became the first country to enact a law recognizing Bitcoin as legal tender in 2021. While the law generated a fair amount of international controversy, other developing countries have indicated willingness to follow suit.

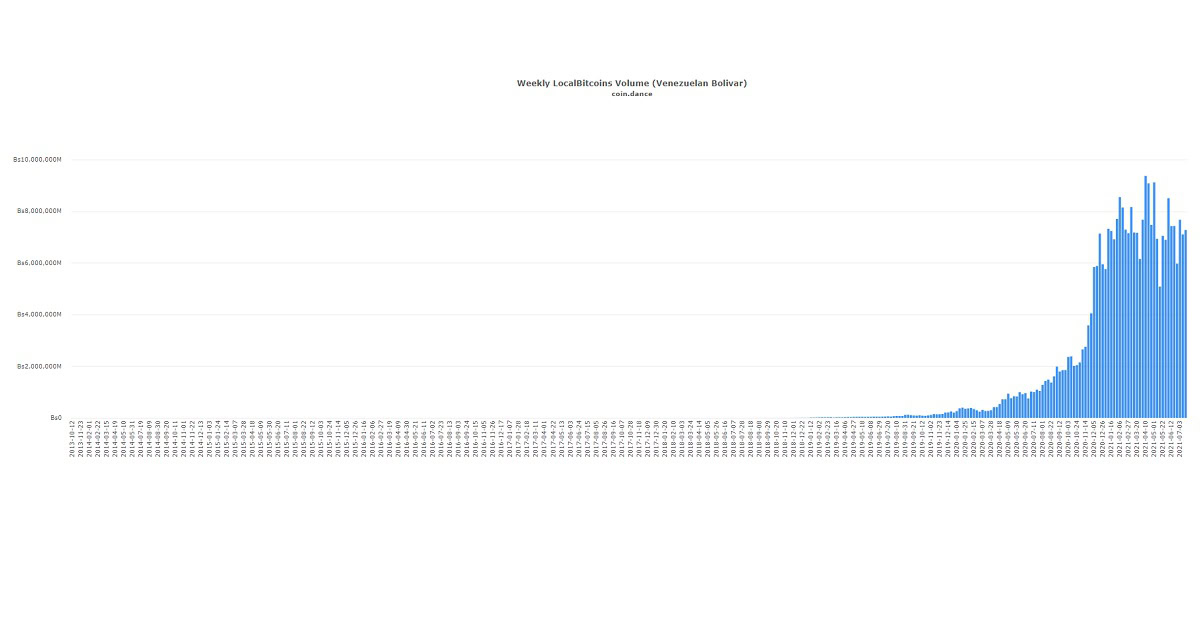

Even without official acceptance though, Bitcoin is already thriving in countries like Venezuela and Zimbabwe. Weak economies make Bitcoin look like an extremely attractive proposition. This is because even after accounting for the cryptocurrency’s volatility, it is often more stable than a hyperinflating fiat currency. To that end, Bitcoin may very well enable financial inclusion in these regions.

As for what Bitcoin can do for you today? Plenty. For starters, you’ll find that international transfers using Bitcoin are not only far cheaper than wire transfers, but also significantly quicker. Apart from that, if you’re bullish on the future of Bitcoin, a small exposure to it can’t hurt your investment portfolio.

If you have even more questions about Bitcoin, the bitcoin.org FAQ is definitely worth checking out.

FAQ

Q: Is Bitcoin overvalued or a bubble?

A: Bitcoin’s price is dictated by supply and demand. The supply equation is fixed, as described above. However, demand can rise and fall depending on a myriad of factors. This includes investor sentiment, news, adoption, community hype, and events such as the block reward halving. This is why it is important to not be blinded by short term gains or greed. Instead look at the bigger picture and the problems that Bitcoin attempts to solve. The same is true for most other cryptocurrency tokens.

Q: Can I mine some Bitcoin as a sole individual for some passive income?

A: You sure can! Bitcoin is meant to decentralize power, so the more miners the better. However, keep in mind that you will need specialized equipment, called ASICs, to mine Bitcoin. Acquiring them can be a bit difficult and you will have to factor in the electricity costs to compute profitability. Newer ASICs are readily available but they are only worthwhile if you have abundant solar or economical energy sources on hand.

Q: Can the Bitcoin network be hacked?

A: While nothing can ever be deemed unhackable, Bitcoin’s design reduces the probability of hacks to nearly zero. In other words, the odds of a successful attack against the entire network are extremely low. However, your individual wallet or an exchange you use can be the target of a hack. Remember to secure your wallets to the best of your ability and keep a backup somewhere safe.

Q: What if I lose access to my Bitcoin wallet?

A: Bitcoin wallets hold a unique private key that is vital to access your balance on the network. Without it, nobody can access the balance. If you lose your phone, laptop, or other device with a Bitcoin wallet, you can use a backup to restore it. Bitcoin has no central authority by design, so you cannot solve this any other way.

Q: How much do Bitcoin transactions cost?

A: As explained above, Bitcoin prioritizes security and decentralization. This comes at a small cost in the form of transaction fees. However, this can vary depending on current network usage. In general, you can expect to pay a few dollars worth of Bitcoin in fees. However, some exchanges are known to charge a higher fee, so do your research before depositing.

The wallet you use will recommend an optimal fee after considering the network capacity. On the plus side, you pay the same nominal fee regardless of the amount of BTC you’re sending, even if it’s worth billions of dollars.