Affiliate links on Android Authority may earn us a commission. Learn more.

MediaTek is riding high, how far can it go?

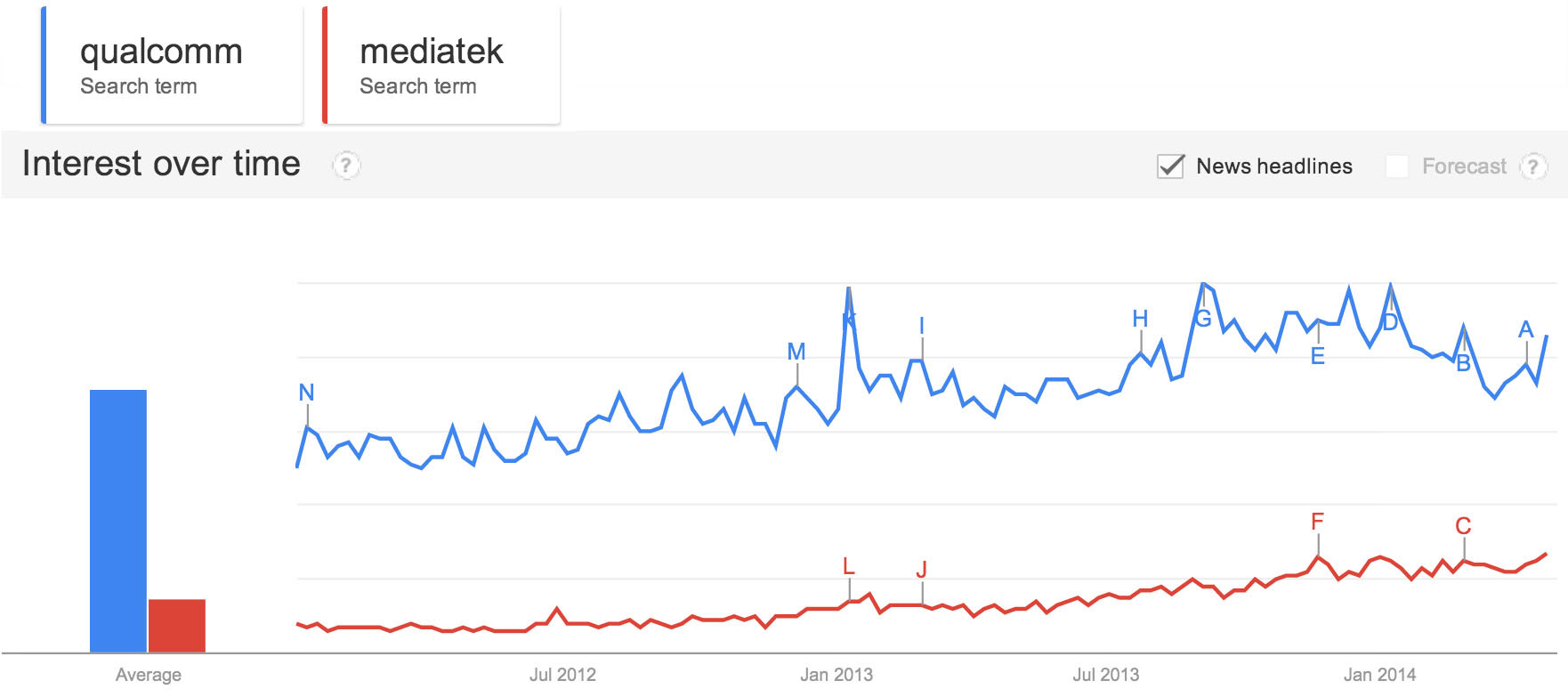

One of the fastest growing companies on the mobile scene today is the Taiwanese chipmaker, MediaTek. It has a solid base in the Asia-Pacific region, it’s doing well in emerging markets, and it’s now looking to expand into developed markets across the world, including the U.S. and Europe. It’s growing faster than the competition, largely by undercutting them. It’s already bigger than Broadcom and NVIDIA and it plans to challenge the dominance of Qualcomm.

This meteoric rise isn’t just about offering a low cost alternative, MediaTek developed a clever business model that enabled it to dominate the feature phone market and it’s applying that plan to smartphones. It appears to be working. Compared to 2012, MediaTek recorded a 36% increase in sales in 2013 worth $4.59 billion and became the 16th largest IC (integrated circuit) supplier in the world, according to IC Insights.

It recently unveiled the world’s first 4G LTE octa-core processor and set up shop in San Diego, Qualcomm’s Californian home. Big rebranding plans and major expansion are underway. Can MediaTek disrupt the market? Should Qualcomm be looking over its shoulder? Let’s take a look at how MediaTek reached this position and explore what might happen next.

From out of nowhere

In 1997 MediaTek was spun out of the United Microelectronics Corporation’s R&D wing. UMC was Taiwan’s first semiconductor company, originally founded in 1980. The aim of the newly founded MediaTek was to design chipsets for the home entertainment market and initially that meant home stereos and optical drives for computers, but it soon expanded into digital televisions, set-top boxes, and Wi-Fi routers. It was listed on the Taiwan Stock Exchange in 2001.

Starting in 2004 MediaTek entered the mobile phone market and expertly rode the feature phone wave to become a dominant player. This was achieved by developing a new business model that set the company apart from the competition. Instead of just selling SoC (system on chip) solutions and basic software, MediaTek would create a complete package, or reference design, that would provide their customers with a clear blueprint to build a basic feature phone.

This enabled smaller companies to sell inexpensive cell phones under their own brands without needing a large engineering or software development team. It broke down some of the barriers to entry by cutting R&D costs for manufacturers and leaving them to focus on branding and product differentiation strategies. It also enabled them to bring new devices to the market more quickly. This led to MediaTek-powered phones flooding into China and other emerging markets in Brazil, Russia, India, and beyond.

Rinse and repeat

Feature phones peaked in 2012 and they were outsold by smartphones last year. MediaTek had already switched gears to serve the smartphone market, offering hardware for low-end and mid-range devices at comparatively low prices. Employing the same approach that worked so well with feature phones, MediaTek has helped to drive the rise of smartphone manufacturers like Huawei, ZTE, and Alcatel, as well as names like Acer, Lenovo, BLU, Oppo, Goophone and more.

This approach is working well in markets where carriers have less control and consumers generally purchase devices and service separately. Emerging markets are where it’s at right now as sales swell and buyers seek out affordable devices. It is also well-timed to serve a growing demand for SIM-free devices in developed markets.

Despite MediaTek’s huge success in China and other emerging markets there’s still something preventing Chinese phone manufacturers from breaking into Western markets and as yet the Taiwanese semiconductor giant has not struck deals with the dominant brands in the west. The cheap and poor quality perception is slowly beginning to shift as MediaTek produces increasingly powerful and impressive hardware that can compete with its biggest foe’s much more expensive offerings, but it won’t be easy to muscle in.

MediaTek vs Qualcomm

As MediaTek pushes into the U.S. Qualcomm is pushing into China. MediaTek’s recent drive into octa-core territory at the end of last year with the MT6592 processor, which it claimed was the world’s first true octa-core processor, raised a few eyebrows.

One important head start that Qualcomm has is in LTE, but MediaTek didn’t take long to announce the 4G LTE octa-core MT6595 processor, unveiling it a couple of months ago. It still has a lot of catching up to do, as Qualcomm saw the shift to LTE early and has a very strong position. Strategy Analytics revealed that the lion’s share of revenue in the cellular baseband processor market in Q3 2013 went to Qualcomm on 66%, with MediaTek claiming second place on 12%, and Intel in third with 7%.

Qualcomm is not content to dominate the U.S. and other developed markets. It is already well-placed to capitalize on the biggest Chinese carrier, China Mobile, pushing out LTE and it is building bridges in the East. It’s interesting to note that the OnePlus One has a 2.5GHz Qualcomm Snapdragon 801 CPU in it and other Chinese manufacturers like ZTE and Xiaomi are not averse to using Qualcomm hardware in their devices. There’s a perception that this might help them break into Western markets.

If MediaTek wants to strike back in the West then it could really do with signing a deal to supply a manufacturer with good U.S. carrier relations. If it can help drive down prices for a decent-sized player and prove the hardware can deliver the same level of performance as Qualcomm at a lower cost, then it can definitely make inroads. The idea of a MediaTek chipset in a Nexus device is very interesting. Lenovo’s acquisition of Motorola Mobility is another big opportunity for MediaTek that could prove important.

War is coming

It’s no accident that MediaTek is setting up new offices near Qualcomm’s headquarters. If the company is daunted by the dominance of Qualcomm it certainly isn’t showing it.

“We need to redefine that we really are at this point serving the entire globe and not just small pockets of the world,” Kristin Taylor, MediaTek’s vice president of U.S. corporate marketing, told Reuters a couple of months back. She worked at Qualcomm for more than 15 years.

As the companies powering the smartphone revolution go head-to-head we all stand to benefit. The drive to faster, better quality hardware, at decreasing prices can only be a good thing. Even if you aren’t a fan of MediaTek, you have to appreciate the impact it is having.