Affiliate links on Android Authority may earn us a commission. Learn more.

This budgeting app is shutting down. Here are the best alternatives to switch to

While Mint has been a popular app for budgeting and expense tracking over the years, unfortunately, it will be no more by the year’s end due to Intuit focusing on its other finance app, Credit Karma.

Intuit has asked its users to migrate over to Credit Karma, with the financing platform having many of Mint’s features, including viewing bank accounts, transaction history, cash flow, and more. However, it is currently unclear whether Credit Karma will possess all of the same features as Mint, such as allowing users to create monthly budgets. Credit Karma may not be an adequate replacement if you were utilizing Mint for its budgeting features.

Thankfully, Mint isn’t the only player in the field, with many other great alternatives to the budgeting app. Whether you’re seeking a different set of features or a more intuitive interface, several other great options are worth exploring. In this guide, I review some of the best Mint alternatives to help you decide the best fit.

The best Mint alternatives

YNAB (You Need a Budget): Zero-based budgeting app

YNAB (You Need a Budget) is a standout choice if you’re looking for a comprehensive budgeting solution. YNAB employs zero-based budgeting, a method where every dollar has a designated purpose. This approach ensures that every aspect of your finances is accounted for, leading to better control and decision-making. YNAB’s user-friendly interface and robust features make it an excellent alternative to Mint, especially for those who prefer a hands-on approach to budgeting.

The app costs $14.99 a month or $99 annually, which works out to $8.25 monthly.

Goodbudget: Envelope budgeting app

Goodbudget takes a unique approach to budgeting with its envelope system. Users allocate funds to virtual envelopes representing different spending categories, promoting a disciplined and organized financial lifestyle. The app’s simplicity and focus on categorization make it an appealing alternative to Mint for individuals who prioritize clear, visual budgeting methods.

Goodbudget features both a free and paid plan, which costs $7 monthly or $60 per year.

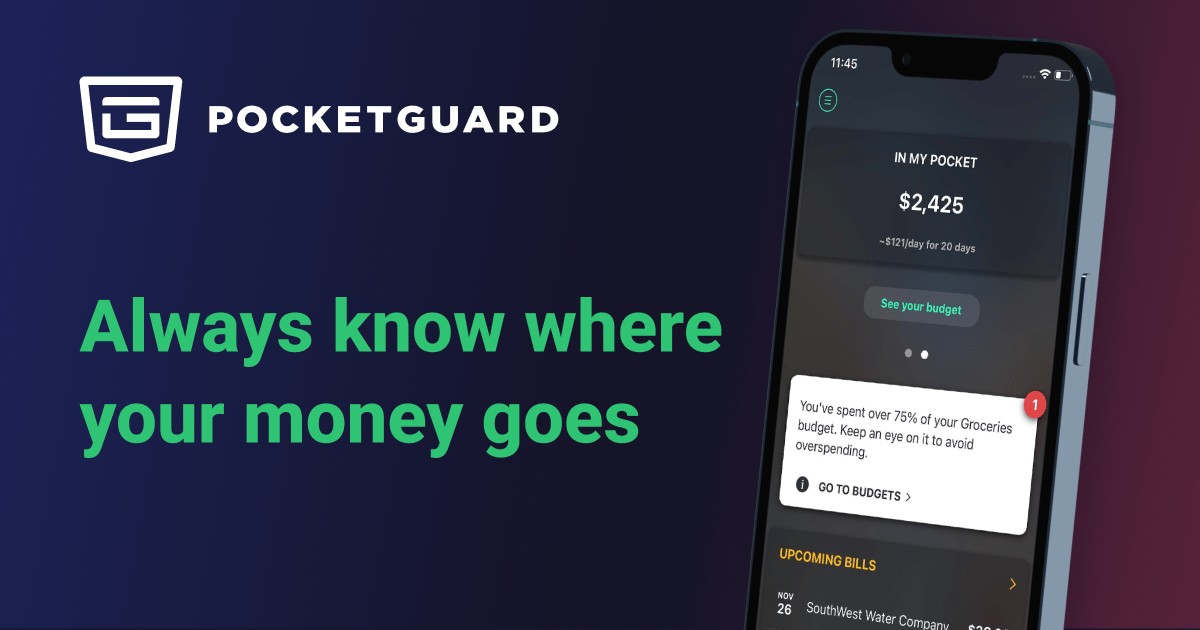

Pocketguard: Best deal

Pocketguard offers a holistic view of your financial health, combining budgeting, expense tracking, and savings goals in one intuitive platform. With its ability to sync with various financial accounts, Pocketguard provides real-time insights into your spending patterns. If you’re searching for a streamlined alternative to Mint that emphasizes simplicity and automation, Pocketguard might be the solution for you.

Pocketguard has arguably one of the best deals, with the monthly plan costing $7.99 monthly and the annual plan costing $34.99 per year (which works out to less than $3 per month!). There is also a free version.

Simplifi by Quicken: Best visually-based budgeting

Simplifi by Quicken is designed to simplify your financial life. This alternative to Mint offers a clean interface and robust budgeting tools, with tons of customizable categories for spending, visual charts, and monthly reports. It’s particularly suitable for users who want a quick and straightforward way to manage their money without unnecessary complexity. Simplifi focuses on presenting key financial information in an easily digestible format, making it a compelling choice for those who prefer a no-frills approach to budgeting.

Simplifi by Quicken normally costs $5.99 per month or $47.88 annually (about $3.99 per month). While there is no free version of it, Quicken is currently offering three months free for current Mint users for a limited time.

Rocket Money: Best for saving on monthly bills

Rocket Money combines budgeting with personalized financial advice, creating a comprehensive solution for users seeking guidance on their financial journey. The app’s AI-driven insights help users make informed decisions about their spending and saving habits. But without a doubt, the key takeaway feature of Rocket Money is its bill negotiation feature; users can use Rocket Money to negotiate for lower monthly expenses like utility bills, which may save you quite a lot of cash in the long run. If you’re looking for an alternative to Intuit Mint that goes beyond basic budgeting, Rocket Money might be the right fit.

Rocket Money offers a 7-day trial, with its premium version costing either $47.99 annually, $59.99 annually, or between $4 to $12 per month with users paying what they want via a sliding scale.

EveryDollar: Best app for long-term budgeting

EveryDollar, developed by financial guru Dave Ramsey, follows a zero-based budgeting approach similar to YNAB. This alternative to Mint focuses on giving every dollar a purpose, helping users take control of their finances. Like David Ramsey himself, EveryDollar emphasizes the planning and tracking of expenses over time in order to obtain long-term financial security. This makes EveryDollar a compelling option for those seeking a structured and goal-oriented budgeting tool.

EveryDollar offers both a free version and a Plus version that costs $129 annually.

Empower Personal Wealth: Best app for wealth management

Empower Personal Wealth stands out as an alternative to Mint by offering a holistic approach to financial management. In addition to budgeting and expense tracking, Empower provides investment insights and savings recommendations. Empower can even assign users a personal wealth advisor, with two free consultation sessions before deciding to pay. If you’re interested in consolidating your financial activities into one platform, Empower offers a comprehensive solution for both short-term budgeting and long-term wealth building.

Empower is entirely free to use, with only the personalized wealth advisors costing extra.

Honeydue: Best app for budgeting with a partner

Managing finances as a couple can be challenging, but Honeydue simplifies the process. This alternative to Mint is specifically designed for couples, allowing them to collaborate on budgeting and expense tracking. With shared accounts and real-time updates, Honeydue promotes transparency and teamwork in financial management, making it an ideal choice for couples seeking a unified financial approach.

Honeydue is entirely free to use, with no premium version currently.

Oportun: Best for saving money

Formerly known as Digit, Oportun takes a unique approach to budgeting by automating the savings process. Using AI algorithms, Oportun analyzes your spending habits and transfers small, manageable amounts to your savings account. This financing app is a great option for users who struggle with manual savings but still want to build a financial cushion. Oportun’s hands-off approach to saving makes it a convenient and effective solution for those looking to grow their savings effortlessly.

Oportun’s membership costs $5 monthly, with a free trial available to new users.

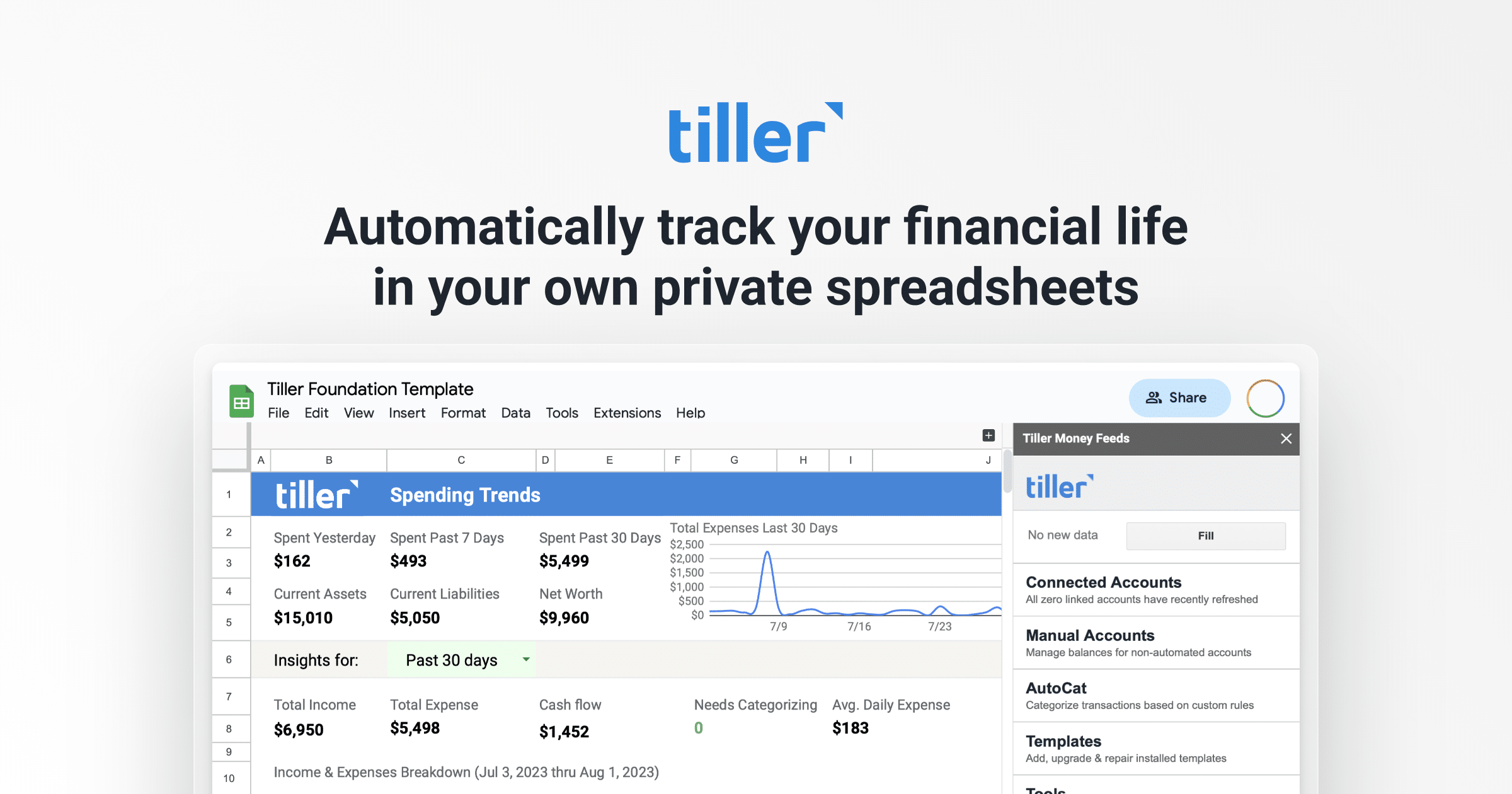

Tiller: Best for spreadsheet budgeting

For users who prefer the flexibility and customization of spreadsheet budgeting, Tiller is a standout alternative to Mint. Tiller automatically imports your financial data into a Google Sheets or Excel spreadsheet, allowing you to create a personalized budgeting system. If you enjoy the control and granularity of managing your finances through spreadsheets, Tiller provides a seamless integration between technology and the traditional budgeting approach.

Tiller costs $79 annually.

FAQ

Intuit’s decision to shut down Mint was reportedly made in order to streamline the company’s services. Users are now being encouraged to migrate over to Credit Karma, the popular credit monitoring app.[/faq

The app reportedly has an estimated 25 million users, according to Intuit Mint’s official website.No, Intuit Mint has never been hacked or had a data breach.[/faq

Mint was first launched in 2007 by Aaron Patzer. As of 2023, the financing app is 16 years old.