Affiliate links on Android Authority may earn us a commission. Learn more.

Here’s to the next billion: major trends shaping the smartphone industry

There has been much talk about shipping the next billion smartphones ever since the market surpassed the 1 billion smartphones milestone at some point last year. Google believed, rather incorrectly with hindsight, that its Android One program would help bring the next billion customers into the fold, while others are looking to local low cost manufacturers in Asia to meet consumer demand.

There are a lot of different regions, trends and regional trends that are going to affect how and when the market reaches the 2 billion mark. Here is my take on where the next billion smartphones may come from, and who is in the best position to bring these consumers into the fold.

The market continues to grow

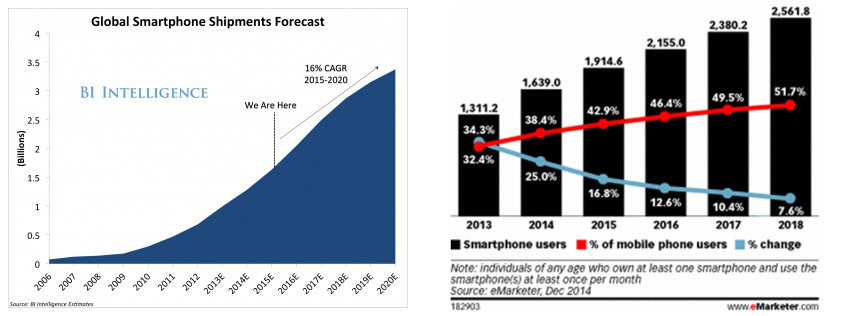

While the estimation of exactly when the industry hits the 2 billion customer mark varies a bit from firm to firm, the consensus is that it will take much less time to reach the second billion than it did the first. Since passing the first billion smartphones, shipments have continued to grow at a steady rate, with little sign of a slowdown predicted until near the close of the decade. Below shows a couple of sample charts from BI Intelligence and eMarketer, which both predict that the 2 billion milestone is likely to be hit at some point within 2016.

According to the latest BI Intelligence report, 1.3 billion smartphones were shipped in 2014, a growth rate of 29 percent over 2013. Growth in 2013 was around 45 percent, so although the rate of growth may be slowing, the firm is still predicting strong increase in the number of shipments year after year. By 2020, BI Intelligence suggests that 3.4 billion smartphones would have shipped, led not by continued momentum in the Chinese market, but by a continued boom in India.

Emerging markets leading the charge

Leading the growth in smartphones is a surge in upgrades in developed markets and the accelerated shift from feature phones to smartphones. This can be observed in the booming Indian smartphone market, which has attracted a number of manufacturers looking to expand out from the equally competitive Chinese market.

Turning to eMarketer projections through to 2018, we can see the largest growth in the next few years is projected to come from the Chinese and Indian markets, while established regions will continue to grow at much slower rates. In fact, the data suggests that India is set to overtake the US market as early as 2016.

Using this as a guide, from the next 1 billion smartphones, approximately 240 million will come from China, 170 million from India, and around 30 to 50 million each from a selection of growing economies, including Indonesia, Brazil and the Philippines. Even the US is expected to contribute around 70 million new units, but most other developed mobile regions are expected to contribute only around 10 million new units each.

It is perhaps not so surprising to have seen such large interest in the Indian market from both low cost Chinese manufacturers and more established smartphone bands. These Chinese market is not as skewed towards Apple and Samsung as many Western economies, and its latest list of top five manufacturers consist of Chinese manufacturers HUAWEI, Lenovo and the explosively popular Xiaomi. Furthermore, 41.7 percent of Q1 2015 shipments came from other companies, which is a much larger portion than in other countries.

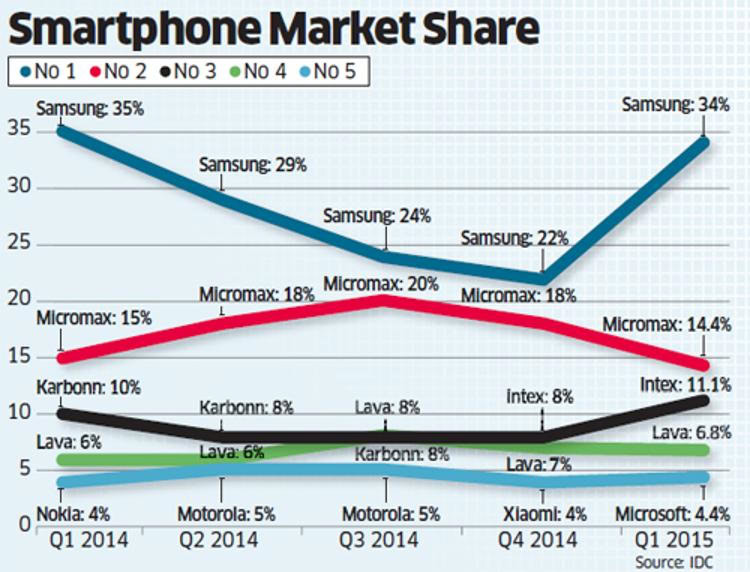

While China’s growth in the past few years has been fueled in no small part by its home-grown talent, the situation is a little different in India. India also has its own local players already established in the market, but these are facing competition from a huge number of outside manufacturers, which are both experienced in emerging and high-end market conditions.

Xiaomi, OnePlus and Lenovo (Motorola) are just a few of the Chinese companies competing against Micromax, Lava, Karbonn and other Indian companies. Samsung and Micromax current hold the largest share in India at 48 percent combined, leaving the remaining 52 percent of this growing market up for grabs.

When it comes to the more established brands, such as those from Korea and Japan, these companies are looking to emerging markets to offset the predicted slow-down in their traditional regional strongholds. Of course, there remains a market for converting customers to higher-end models, as Apple and Samsung have managed to do in China. However, this itself is not the driving factor that is bringing new customers to smartphones.

For example, LG is reaping the rewards of focusing a strong line-up of mid-range products on the South American market and has just announced a $155 million investment in R&D in India, with the possibility of opening up production in the country if its market share reached 10 percent.

New business models to meet demand

With the move to new markets comes a new set of consumer expectations and purchasing habits. Features such as dual-SIM compatibility and value for money are a little different from what we’re used to seeing in Western markets.

Price has been a major point of contest in these growing markets, which has seen the increasing use of e-commerce to help manage stock levels and keep prices under control. In India, Chinese brands have been undercutting established brands and this has been chipping away at their market share.

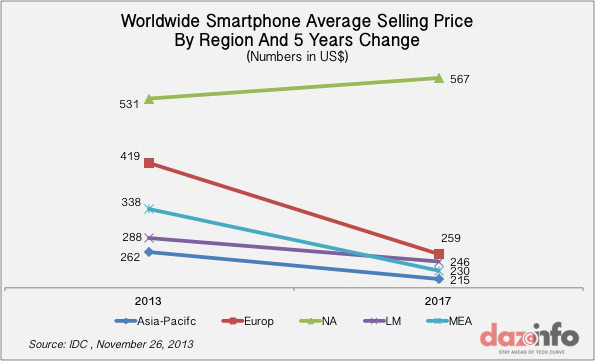

It is no coincidence that a reduction in hardware costs is encouraging higher sales volumes. The average smartphone selling price across most of the world is expected to continue to fall as we head towards 2 billion smartphones sold. That is with the exception of the North American market, but this is an older, more saturated market. IDC estimates that the average selling price will reach $265 in 2017, with the Asia Pacific region falling as low as $215.

Moving over to local manufacturing could be the next step in the price war, as setting up distribution networks for huge import numbers is very expensive and time consuming. Building products closer to their retail point could make companies more flexible both on price and on bringing products to market quickly. However, the drive for lower and lower prices will inevitably lead to some some casualties. The state of the Chinese and Indian markets is likely to look a little different in a few years, as competition squeezes out companies which are unable to continually lower their prices.

What is particularly interesting about the race to the next 1 billion smartphones is that two very different smartphone business models are now going head to head to carve themselves out a significant share of the fastest growing markets. The winner remains to be determined.