Affiliate links on Android Authority may earn us a commission. Learn more.

Lenovo misjudged what it would take to revive the Moto brand

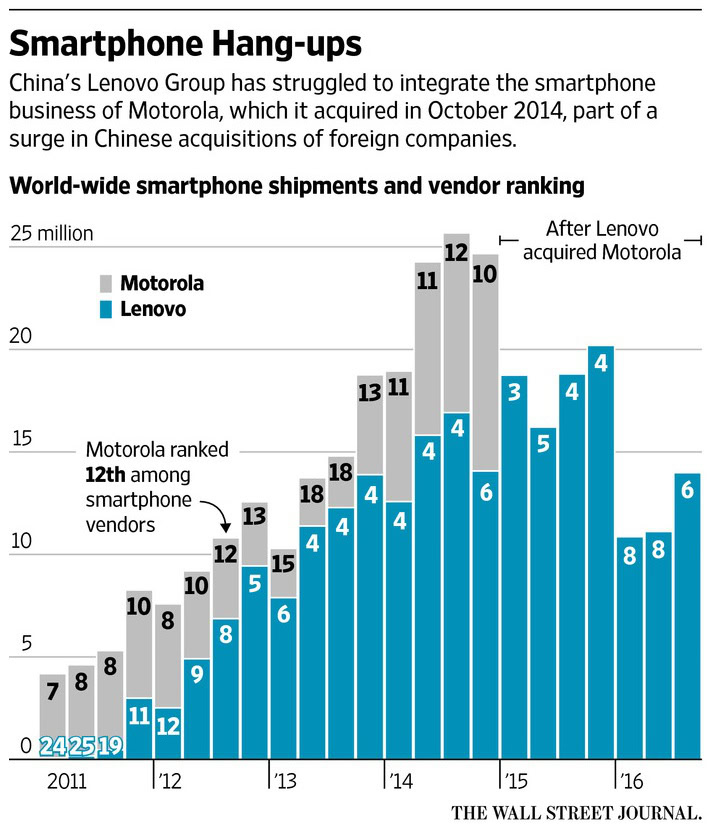

Despite releasing the intriguing Moto Z series and continuing with the popular Moto G range, Lenovo’s assimilation of Motorola into its smartphone business has not been a smooth story. Since Lenovo’s $2.91 billion purchase back in October 2014, the company had has to contend with falling smartphone sales, losing its top 3 global ranking, axing around 3,000 jobs, and posting its first annual loss since 2009. An insider look from the Wall Street Journal reveals some major mistakes and miscalculations made following the purchase.

According to interviews with current and former employees at the two companies, Lenovo CEO Yang Yuanqing’s previous success with the acquisition of IBM created “a certain aura of invincibility”and led to him making a number of strategic errors with Motorola. One of the biggest missteps taken by Lenovo was forcing the Moto brand back into China in 2015. The company left the Chinese market after being acquired by Google. Meanwhile, Lenovo already had a strong presence in the market at the time, having flirted with first place back in 2014. The theory was that nostalgia for the old Motorola brand would propel sales, so spending on marketing was not forthcoming.

However, the Moto X was only sold online and cost between $600 and $700, which was approaching iPhone prices in the country. As you may have expected, Moto releases also clashed with Lenovo’s own products, and it wasn’t long before the idea was pulled. IDC’s research suspects that only 200,000 Motorola handset sold in China in 2015. Over this period, Lenovo saw its share of China’s smartphone market decline to just 2 percent from around 12 percent just three years earlier, according to IDC.

Lenovo’s strategy for making headway in the US market also remained unclear. The Moto X Force had been designed specifically for the US market and initial advertising revenue had been boosted in the country. However, marketing expenditure was almost immediately slashed, as was spending on US product development. Motorola’s advertising budget in the US hit $21.6 million in the first half of 2015, according to ad tracker Kantar Media, however, this was never going to compete with market leader Samsung’s $187.8 million ad budget. A reluctance to invest and struggling sales eventually led to a loss of at least 2,000 jobs in the country. Furthermore, much of Motorola’s product development would end up being moved to China.

At the same time, Lenovo started up its Zuk sub-brand to compete with the likes of Xiaomi. Although this meant transferring a large number of staff to its new company, leaving few to help deal with the struggling situation unfolding at Motorola. In August 2015 the company unveiled a plan to cut $1.35 billion in costs annually and to shed some 3,200 jobs.

“We underestimated the differences of the culture and the business model,” – Lenovo Chief Executive Yang Yuanqing

Fast forward to today, Mr Yang believes that Lenovo’s smartphone business is poised for success. Lenovo moved back up to the 6th largest global smartphone brand, according to IDC, in Q3 2016. The company has also increased its global advertising budget up 30 percent for the Moto brand and plans to build on the strong reception of the Moto Z flagship series unveiled last year. 2017 will tell if this is enough to return Lenovo and Motorola to their former heights.

[related_videos align=”center” type=”custom” videos=”716581,713509,711099,709619,697734″]