Affiliate links on Android Authority may earn us a commission. Learn more.

Xiaomi is going high-end in India, and 2021 will be its year of reckoning

2020 has been a transformative year for Xiaomi‘s high-end strategy in India. What started off as careful tiptoeing into a mostly new segment has turned into war footing. Shedding its budget roots, Xiaomi has been focusing hard on becoming a full-service player.

When I last commented on Xiaomi’s India strategy back in May 2020, the world, and India especially, were in the early stages of the ongoing pandemic. It was hard to imagine how big of an impact COVID-19 would have on the country’s economy. And yet, Xiaomi managed to grow its market share.

In fact, research firm Canalys reports that Xiaomi maintained a leading 27% share of India’s smartphone market.

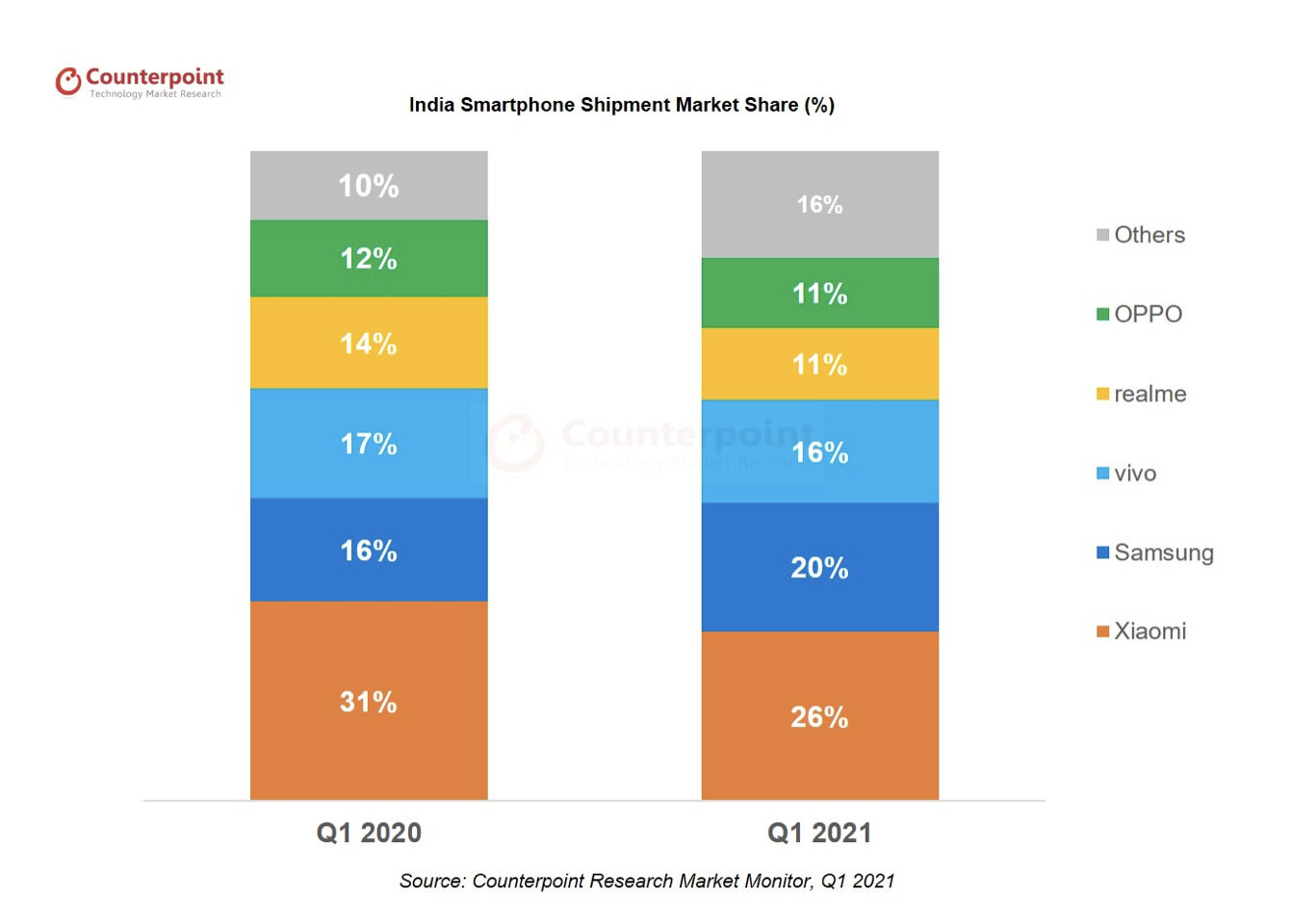

Meanwhile, Counterpoint Research’s report for Q1 2021 states that Xiaomi continued to hold the pole position, as smartphone shipments in India grew 23% year-on-year to 38 million units. This was, of course, largely thanks to entry-level smartphones, but Xiaomi has also reaped the benefits in the growing upper-end tier.

Xiaomi’s strong market share right now is built on the back of the Redmi 9 series, but also through a strong showing in the premium mid-range segment with the Mi 10i.

It’s obvious at this point that Xiaomi has mastered the formula for success in the entry-level segment. But there is significant room for growth in the upper-end segment.

Building customer confidence

Xiaomi’s earlier attempts at the high-end segment, mainly with 2016’s Mi Mix, didn’t win many fans. The phone sold a pittance, and the years of waiting for another flagship did not bolster confidence in the company’s high-end credentials. On the contrary, Xiaomi’s incessant focus on the entry-level market had the side effect of earning it, well… an entry-level reputation.

In 2020, the Mi 10 was the first high-end Xiaomi phone to come to India in a long time, and Xiaomi quickly followed up with the Mi 10T series. A long-pending return to the affordable flagship tier for the company, this one-two punch was Xiaomi pacing itself to go up against the fan-favorite OnePlus 8. It also played another role — demonstrating a commitment to the Indian market.

Three flagships in a row? That changes the equation and Xiaomi has kept up the charge with the aggressively priced Mi 11 series. In the premium mid-range segment, the launch of the Mi 11 lineup has reinforced Xiaomi’s commitment. You’ve got the Snapdragon 870-toting Mi 11x, starting under Rs. 29,999 (~$410), a bargain compared to the much more expensive OnePlus 9R. Then there’s the Mi 11x Pro starting at Rs. 39,999 ($550), which once again undercuts the OnePlus 9 and packs a better camera to boot. And, of course, there’s the Mi 11 Ultra, which is also giving you a lot more kit for your money than direct competitors.

Flagships are just one part of the story, however. From a broader perspective, it is clear that Xiaomi is looking to move its entire portfolio up the price ladder. Case in point, the Redmi Note series, which was traditionally priced well under the Rs. 20,000 (~$260) mark. The Redmi Note 10 Pro breached that barrier and drove up pricing for the entire Note 10 series. Customers continued to lap it up.

The reach for the high-end doesn’t stop at phones. Xiaomi has been expanding — and upscaling — across verticals, from the Mi Robot Vacuum Cleaner to laptops, and higher-end QLED televisions like the recently launched 75-inch behemoth.

An evolving smartphone market

Timing and execution are key, and Xiaomi’s expansion into more premium products has been long in the making.

It’s a good time for Xiaomi to make its move. The entry-level segment is chock-full of options in India. realme has flooded the market with derivative products under both the realme and Narzo brands. In this environment, Xiaomi only has that much room for diversification, and premium components come at a cost.

Related: The best Xiaomi phones you can buy

Additionally, the average selling price of smartphones is slowly, but surely going up. In this market, high volume sales at razor-thin margins can only get you so far. Xiaomi needed to establish a foothold in the premium smartphone market to maintain profitability.

Components are important, but a premium phone is not defined just by hardware. Software and support are just as much of a hallmark.

Hardware is a commodity, software needs finesse.

As my colleague Hadlee recently pointed out, MIUI inconsistencies across Xiaomi’s portfolio can ruin the user experience. Take, for example, the Mi 11 Ultra: scaling issues in notifications are not what you expect from a phone priced at Rs. 69,999 (~$950). The fast-paced rollout of MIUI updates usually fixes most bugs, but first impressions matter.

There’s also the matter of updates. Apple’s four to five years of support are unbeatable, and Samsung is bridging the gap with three years of support for many of its phones — not just flagships. The (at best) two years of updates offered by Xiaomi are rather lackluster in comparison.

Fixing these issues will be key to Xiaomi’s ongoing growth.

Ecosystems matter, so does innovation

It would be remiss to say that Xiaomi isn’t an innovative brand. Experiments like the Mi Mix Alpha show that the company is constantly dabbling with big ideas, even if they don’t always make it to market. Xiaomi is also part of the select club of companies that have released a foldable: the Mi Mix Fold.

It’s equally important to expose this innovation beyond China. When it comes to phones, Xiaomi has been expanding steadily in India, but the trickle approach towards fresh verticals could be folly. Between robot vacuums, laptops, smart speakers, and many other gadgets, it’s not that Xiaomi is risk-averse. But unless it speeds up their launch in India, it threatens to get caught up by all the other brands that are ramping up IoT portfolios.

Crossing the Great Wall is key to bolstering Xiaomi's smartphone success.

A solid ecosystem creates touchpoints for users to talk about the brand, increasing visibility. Xiaomi’s wide portfolio of TVs is a great example of how to corner much of India’s smart television market. The most recent release, the QLED 75, is bound to make waves and have an industry-wide impact.

That said, there needs to be more. Xiaomi’s expansive ecosystem, only partly available in India, is a perfect match for the growing spending power in the country, as well as the company’s premium ambitions.

This becomes all the more important in India, where Q2 smartphone sales are expected to nosedive on account of the second wave of the pandemic. While smartphone sales might slip, it is the surrounding ecosystem that has the potential to bolster Xiaomi’s revenues.

Xiaomi in 2021: Ready to leap

It’s taken 10 years and many hits and misses for Xiaomi to build up to this moment. However, the company can’t afford to hold back now. Its playbook is easy enough to copy. Indeed, the BBK-backed quadfecta of OPPO, vivo, OnePlus, and realme is going after the same prize and is able to drive prices down further by sharing components.

Xiaomi has momentum going for it. To truly go premium in India, all it needs is a steady cadence of releases, across price segments and, indeed, multiple verticals.