Affiliate links on Android Authority may earn us a commission. Learn more.

Why did Trump stop the Broadcom-Qualcomm deal?

- Yesterday, President Donald Trump surprised the tech world when he put out a Presidential order prohibiting the sale of Qualcomm to rival Broadcom.

- Trump made the move in the interest of “national security,” but it’s not clear what that means unless you know the whole story behind the Broadcom-Qualcomm deal proposal.

- Unless significant regulatory standards are placed on companies by the government, the President will have to step in to stop deals with foreign agents more and more in the future.

Yesterday, President Donald Trump surprised the tech world when he put out a Presidential order prohibiting the sale of Qualcomm to rival Broadcom. While President Barack Obama did once step in to stop a private business deal in 2012, a sitting President intervening in private business affairs is a rare thing. Why did the President of the United States feel the need to stop one chip-maker from buying another chip-maker?

Background

To understand how we got to this point, you need to know some background. In November of last year, Broadcom offered about $105 billion to buyout rival Qualcomm. Qualcomm refused, citing the $105 billion number as “significantly undervaluing” its business. Broadcom responded by upping the bid to $121 billion. Qualcomm shot that one down as well and then said that $160 billion would be the number it would take seriously. If Broadcom bought Qualcomm for that much money, it would be the largest tech deal in history and the third-largest deal in business history altogether.

Once Qualcomm gave the $160 billion number, the United States government intervened. The U.S. Treasury Committee on Foreign Investment (CFIUS) sent a letter to both Broadcom and Qualcomm, which raised concerns about the merger. The letter called out two major problems: Broadcom’s reputation for research spending cuts and its business relationships with “foreign entities,” which is mostly referring to China.

CFIUS is concerned about Broadcom's business relationships with 'foreign entities.'

Yesterday, the President stepped in and stopped the deal in its tracks, even going so far as to prohibit the 15 members of Broadcom’s board from ever seeking election.

“Foreign entities”

CFIUS was established in 1975 under president Gerald Ford. Composed of members of different Federal agencies, its express intent is to monitor the national security implications of foreign investments in the United States.

Qualcomm is an American company, headquartered in San Diego, CA. Although most of its chips are made in China, the company itself is American and must adhere to American laws. Broadcom, however, is incorporated in Singapore (with a co-headquarters in San Jose, CA), which puts it out of American jurisdiction.

Singapore is a sovereign city-state, although it is closely related to China due both to its physical proximity to China and its understanding of the powerful influence China has over the Asia-Pacific region. In other words, Singapore is not China, but it would be hard for anyone to argue that the two countries are not strong allies which depend on each other.

Trump wants Qualcomm to stay in America.

Knowing what we know about where President Trump stands when it comes to nationalist ideals (just take a look at the tariffs he is pushing into law), it would be easy to conclude that Trump nixed the Broadcom-Qualcomm deal because he wants Qualcomm to stay in America and he wants China to stay out. America good, China bad. But it’s not that simple.

We have to remember that the other aspect of CFIUS’s letter called out Broadcom’s reputation for research spending cuts. Why did the organization feel that was a big enough issue that the government needed to intervene?

Research, patents, and shareholder interests

Why does Broadcom want to buy Qualcomm, anyway? Why is one company willing to spend hundreds-of-billions of dollars to create a merger?

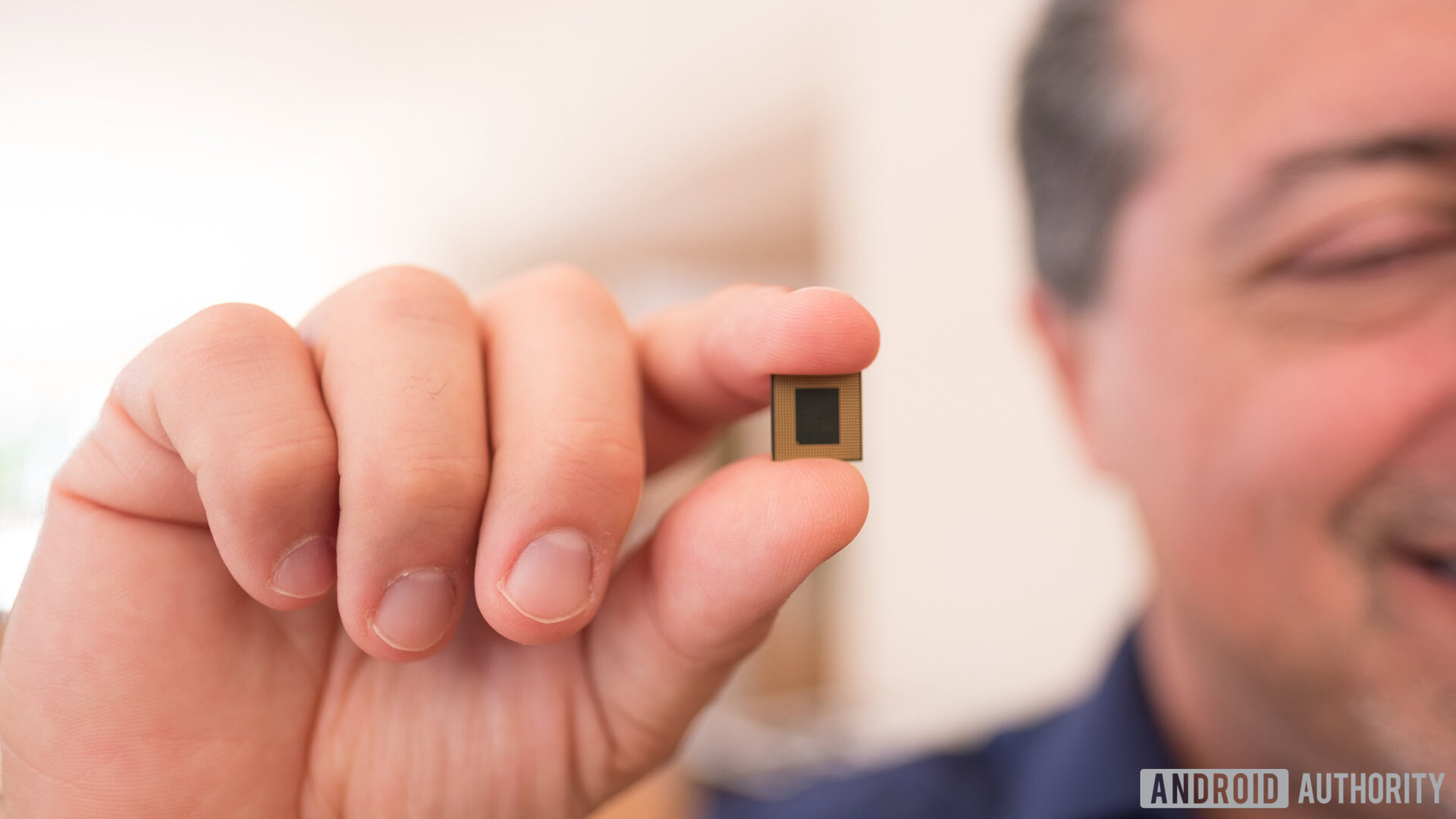

The answer is patents. Qualcomm has two divisions of its business: chip creation and patent licensing. The two branches create what’s called a “virtuous cycle” — one branch helps the other branch which then helps the other branch, on and on. When Qualcomm creates a new chip, it logs new patents into its portfolio. Those patents can then be licensed to other companies for massive profits, and those profits can go back into the creation of more chips.

The chip-making side of Qualcomm is lucrative because its Snapdragon chips are used in many of the world’s best smartphones. But, however lucrative that side of Qualcomm is, the patent licensing side is more lucrative than you can imagine. Qualcomm’s patents don’t just involve SoCs; they also involve the way modern smartphones connect to mobile towers (CDMA and LTE). In other words, almost every smartphone with a CDMA or LTE mobile connection, regardless of the SoC on board, needs a paid license from Qualcomm.

As it stands, Qualcomm could stop making chips entirely and just manage its patent portfolio and still bring in billions a year.

Broadcom wants Qualcomm's huge patent portfolio, not so much its chipsets.

Broadcom knows this, and wants control of those patents. With 5G connections right around the corner, Qualcomm’s patent portfolio is set to make even more money.

But the chip-making side of the business? Broadcom is not so interested in that. With Samsung now the biggest chip-maker in the world and Apple dominating the high-end smartphone market with the iPhone (which runs on an Apple-created chip), chip-making is not going to stay lucrative for long. It doesn’t take a financial genius to see the writing on the wall: Broadcom would buy Qualcomm, and then likely either stop all research and development on new chips or even dismantle that whole arm of the business entirely. Then sit back, and watch the cash roll in.

As one would expect, this would make shareholders in Broadcom a lot of money very quickly. Between the sales of Qualcomm’s current Snapdragon SoCs and the patents in 4G, 5G, and eventually 6G, Broadcom shareholders would see their bank accounts explode instantaneously.

But what about the long game? If a Broadcom-Qualcomm deal took place, and Broadcom stopped all research into new chipsets and only relied on patent licensing, what would it look like ten years down the road? That’s where the problems lie, and why Trump is stopping the merger.

China the only choice

It’s no secret that smartphones are a huge business. Yes, sales are starting to go down for the first time ever, but there’s still plenty of money in smartphones. But what will the future be like with 5G? What about the eventual rollout of 6G, or whatever the next step is?

Speed tests of 5G networks show that the mobile network of the future will be incredibly fast, even when accounting for real-world factors. It will be so fast, that when a true nation-wide, stable 5G network is in place, you won’t even need a regular internet connection anymore; your mobile phone will likely get as fast or faster speeds than your wired connection.

Chipsets and mobile network patents will become an even hotter commodity in the future than they are now.

If that’s the case, then chipsets and mobile network patents will become an even hotter commodity in the future than they are now. Citizens worldwide will rely heavily on chip-manufacturers to support our ever-more-connected world.

But what if China (or some other nation aside from America) makes all the chips and controls all the patents? What if mobile technology comes from one company with interests that don’t align with the U.S.?

That’s why Trump stopped this deal. Right now, it may seem like the President is getting involved with something that he should stay out of, but a Broadcom-Qualcomm merger does, in fact, pose a national security threat. If our connected world is controlled by Singapore (and thus, closely connected with China), that’s a serious transfer of power.

What else could Trump do? It would be incredibly difficult (and against Republican/business ideals) to regulate the eventual Broadcom-Qualcomm megacompany to ensure that it doesn’t stop research and development of new chipsets. And no political party wants to be the one to step in and start an overhaul of the patent system, which financially benefits many wealthy political supporters. So the next best thing is to stop the deal, keep Qualcomm in America, and keep its virtuous cycle churning along.

The future

This is not the last time we’re going to see issues like this pop up in the technology world. As long as we have separate nations with clashing ideals, we will have Presidents stepping in to squash foreign business deals.

But that can’t happen forever. For our connected world to truly thrive with innovation and progress, we must stop seeing ourselves as different nations all competing for power over each other. We also can’t entrust the connected world to companies that only care about maximizing profits. If Broadcom had its way, it would sell the industry for top dollar, so literally 15 already ultra-wealthy people could make even more money. It’s greed and unethical business practices on a disgusting level.

This is not the last time we're going to see presidents stepping in to stop foreign business deals.

As Tim Berners-Lee, the father of the World Wide Web, said today in his open letter to commemorate the Web’s 29th birthday, “The responsibility – and sometimes burden – of making [decisions about the Web] falls on companies that have been built to maximize profit more than to maximize social good. A legal or regulatory framework that accounts for social objectives may help ease those tensions.”

The President can’t step in to stop every deal. We need more regulations over companies like Broadcom and Qualcomm that keep them invested in the people of Earth, not just the bank accounts of the .01 percent. Because, ultimately, that’s what this Presidential order is all about.