Affiliate links on Android Authority may earn us a commission. Learn more.

Are online banking mobile apps all you need to handle your finances?

Online banks and mobile banking apps are growing rapidly on Android and iOS, and while they can’t do all your banking, many people are giving them a go.

In the U.S., Chime adds 100,000 accounts every month. In Europe, banking app N26 announced this week it had reached one million customers.

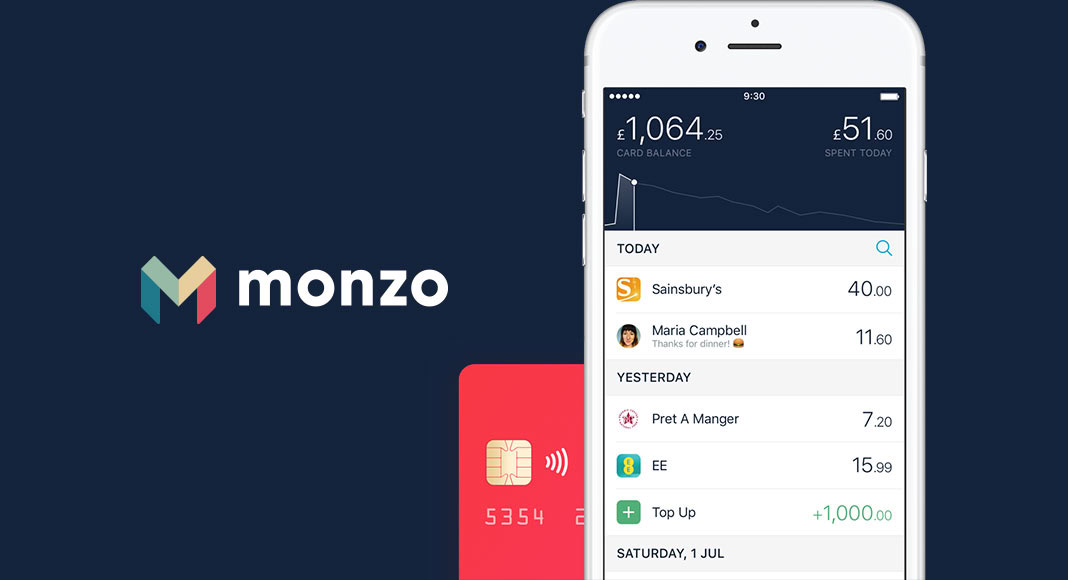

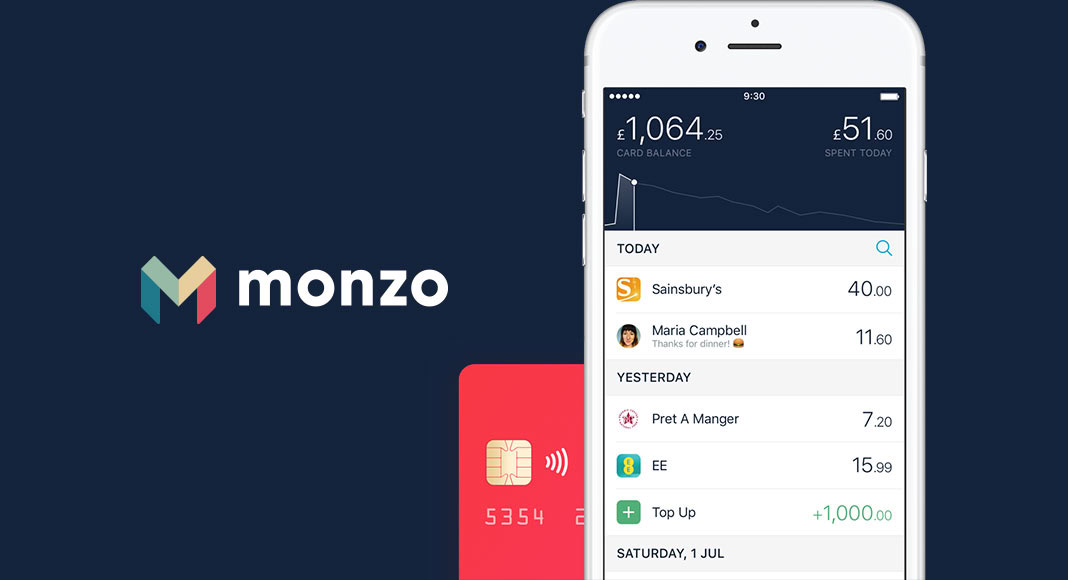

The online banking app Monzo leads the U.K. and grabs attention with its bright coral cards and dedicated community forums. Revolut has cult status among digital nomads as a great banking option while traveling through countries and currencies.

Many of these brands look like tech companies doing banking, rather than the musty banks who spend a fortune to offer an app that doesn’t always work as well as it should. Their platforms offer very low fees, rewards, easy-to-use apps, and a friendlier approach. It’s tempting, but should you take the plunge?

Who are online banking mobile apps for?

Many of these online banks offer key advantages, such as very low (or no) fees, free ATM withdrawals (even worldwide), rewards programs, automatic savings by rounding-up transactions, and empowered mobile banking. In the U.S., Chime charges no fees at all, while online bank Aspiration offers “conscience” banking, where you can set your own fees (including zero). There’s also Ally, Simple, Due, and many more app-first banks that compete for your banking.

Low fees, but not always a lot of help or service if things go wrong

Monzo’s website in the U.K. says it’s “a bank for everyone,” though founder Tom Blomfield acknowledged in an interview with Bloomberg that wasn’t the case, admitting it’s not something his grandmother would use.

These online-only banks are targeted at young people and the technologically savvy. Those that don’t mind using an app for all their banking, don’t need to talk to someone in a bank regarding finances, and don’t require over-the-counter assistance with cash, checks, or paying bills.

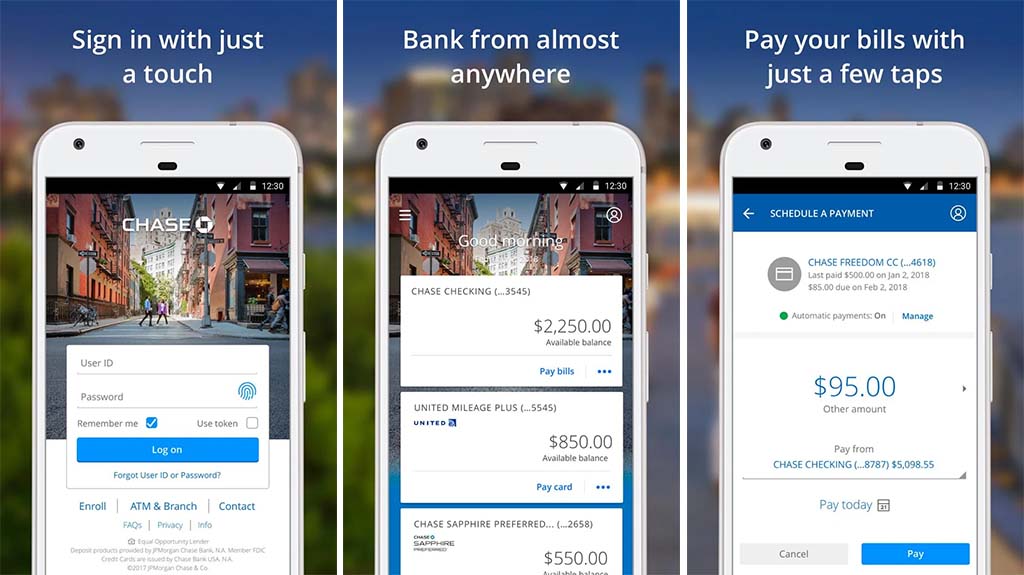

The apps tend to be attractive, snappy, and do most of what you need in sending and receiving money (the receiving part being most important, of course), paying bills, and keeping track of transactions to figure out where your money goes.

Online banking apps are still run by real banks

Financial regulators have more or less managed to keep up with technology in this case. Just because it’s an app-based bank or an online-only bank doesn’t mean it can skimp on regulations. These banks must be approved by regulations like FDIC in the U.S., the European Central Bank in Europe, as well BaFin in Germany, and PRA and FIC both need to sign off in the U.K.. That provides a good deal of trust for consumers considering those hurdles — although we all know banks can fail in their duties through negligence, misaligned incentive schemes for employees, or fraud.

Are online banks safe?

Given that online banks are online only, the threat of a holdup from the old balaklava-toting bad guys with getaway cars is reduced. The services are obviously just as vulnerable to being hacked and online bank startups don’t always know what they’re doing when it comes to security. N26 was dealt a blow when its incredibly inept security was shown off in this infamous presentation by IT security researcher Vincent Haupert at Chaos Computer Club in Leipzig, Germany:

(Haupert and his team are white-hat security experts, meaning they informed N26 and the numerous shocking flaws were fixed well before they were demonstrated at the conference. But still!)

Does it hurt your credit to open multiple accounts?

Getting another online banking app to try isn’t quite the same as just downloading another weather or gaming app. You may well be reluctant to try out a different banking app, worried it may hurt your credit score. Don’t worry, it’s not hard to find out and definitely worth doing before you dive in.

Here’s how it works in the U.S. — other countries follow a similar pattern, but you’ll still need to do some research.

When opening a new savings or savings account, the bank in question may elect to do a credit check as part of their approval process. The bank has two options, what is known as a hard or soft pull. A soft inquiry generally doesn’t affect your score but a hard inquiry will show up on your credit history. It’s understood that the number of inquiries you have can affect your score, and therefore each hard inquiry can reduce your score by 5 or even 10 points.

If you quickly open multiple credit card, loan, or bank accounts, you may experience a temporary drop in your score that lasts around 12-months.

What you need to do when planning to open a new account is check with the bank first to see what kind of inquiry is required. It’s an important question, so any good bank online or otherwise will tell you. If it’s not obvious, you may need to dig further. Chime says applying for an account “won’t impact your credit score,” which sums it up.

Aspiration says the same in a little more detail:

“We do not run the kind of credit check that will ding your score. Federal law does require us to verify your identity and the information you’ve provided to us in the account opening process. This is sometimes called a “soft credit check” but it won’t show up on your credit report!”

Simple doesn’t explain how it might affect your credit score without going through the sign-up flow. Even then, it isn’t as clear as it could be. It’s important to know up front.

Assuming you’ve now decided to go with an online bank, what are you missing out on?

Why you might still just want a regular old bank

The decades of history (and fees) that made regular banks fat and happy also armed them with some advantages. Regular banks offer more comprehensive financial services, covering the entire spectrum of banking a person might need.

These include both savings and debt instruments, establishing a credit record for loans, as well as 401k or retirement savings plans. They also offer services for small, medium, and large businesses. Most online banking options offer a basic savings account and an associated debit card, but haven’t yet opened up their options much further.

Android Authority’s own newshound C. Scott Brown switched from GoBank to a regular bank for the more advanced financial tools, which online banks can’t always provide.

“I was looking to revamp my financial life and wanted a bank with people I could go and talk to about credit, loans, 401k, etc,” said Scott.

“GoBank was great for just a checking account and debit card, but that’s all it does.”

A great forum post by a Monzo customer in the U.K. who switched to a regular bank showed how these kinds of teething problems can become showstoppers.

Read next: 10 best money management apps.

By definition, online banks don’t have a brick and mortar presence. If anything goes wrong, you’re stuck with a potentially frustrating live chat or support email, or you’re waiting on a phone to speak to someone.

iOS vs Android – Still an issue for some

One issue Android users will be familiar with is the old problems with not always being as well served as iOS users. Numerous reports (and personal experience) have shown how many banks focus on their iOS app without always duplicating their apps on Android.

U.K.-based Monzo made Android users wait years before adding basic features that had always been offered on their iOS online banking mobile app. Behavior like that might force some Android users to switch to a different banking option, or thumb their noses at the disrespect.

Have you got a bank that’s an app only? Let us know if it’s been smooth sailing or not up to your financial requirements.

Related: