Affiliate links on Android Authority may earn us a commission. Learn more.

What's the best future for Samsung's present situation?

Since the release of the very first Galaxy S device, Samsung has been – arguably – the proverbial face of Android. No other OEM can move as many units worldwide. In many ways, the Galaxy brand is Android, at least for the mainstream consumer.

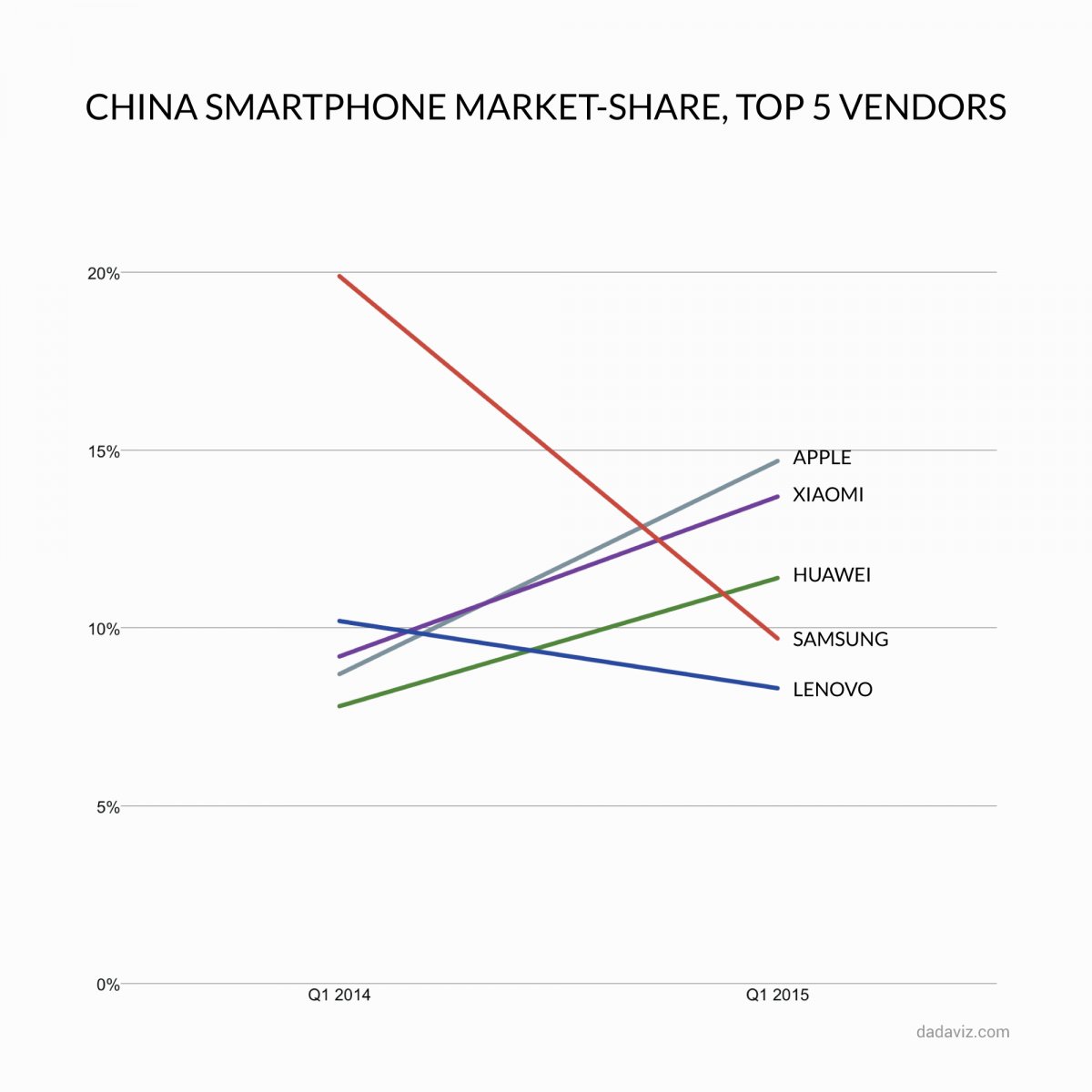

Things are changing though, at least in countries like China and India, two of the largest markets in the world. Whereas the Korean-based conglomerate once held high court among the people’s purchases, the emergence of highly aggressive competition has significantly altered the landscape. Huawei, Xiaomi, Oppo, OnePlus, ZTE, Lenovo, and various other Chinese companies are quickly becoming household names in their home market, and many have plans to expand their empire elsewhere or have already begun to do so. The Galaxy S5 certainly proved this point.

Samsung has found itself in a rather curious case as of late, for its products are being “attacked” from all angles. On the premium end, keen Chinese competition has seen the production of devices with specs on-par with the Galaxy S or Note series but at much lower price points, while Apple finally has a modern sized smartphone. The pressure is just as strong at the budget-friendly side of things, perhaps even more so.

The well-received Galaxy S6 and S6 Edge have bought Samsung some time, but one successful flagship won’t offer much protection against the larger forces at play.

Samsung today

The Galaxy S6 and S6 Edge have done very well in key markets. In others, there are some startling surprises, as well as those more anticipated. Regardless of whether the company can sell 70 million units or not, the response to the Galaxy S6 family has been very positive, even if damage control is in order. The lack of a removable battery and microSD card support notwithstanding, the glass and metal build has seen the S6 accepted as a truly premium device, comparable with the One series or the iPhone, complete with a top-notch display and camera.

It’s not just the Galaxy S6. The Galaxy A series has received good press as well for its all-metal build, another first for Samsung. While the A3 and the A5 are more mid-ranged affairs in terms of specs and price, the A7 is much closer to a genuine flagship. These three phones were once believed to be a progenitor for the Galaxy S6, though for reasons unknown (possibly related to production yield problems) glass was selected instead.

But it’s not all just sunshine and roses. While the more high-profile Galaxy devices are now made of metal, things aren’t all premium. The Galaxy E for example, while featuring a metal back, is a standard “old Samsung” type of product, as is the new Galaxy J. These products have low specs and are very much aimed at price conscious consumers, despite costing more than their Chinese competitors with equal-or-better internals. The same goes for the puzzling Galaxy Tab A series, which has an S-Pen but otherwise sub-premium specs.

Having budget devices at budget pricing is a necessity if Samsung wants to compete with Chinese players and other brands that are dominating this space. The question is, just how long can Samsung play this game?

Samsung tomorrow

The Samsung of tomorrow will be a direct result of the decisions made today, and this is where a bold decision might be necessary to maintain prosperity. Alas questions about the path for progress are myriad.

Focus entirely on premium products

One possibility for the future of Samsung is to focus exclusively on high-end products. In a sense, there is just no point trying to pursue the low-end market. Smartphones have begun to exist as a commodity, and indeed, any generic company is now capable of putting out a random product with some decent specs. Add this to the fact that the various Chinese OEMs mentioned at the start of this piece are dominating several key Asian markets with their cut-throat price points.

Samsung would be wise to just stop playing this destructive game entirely. It will never be able to compete unless it severely reduces prices, thus negatively affecting the bottom line with diminished profits. Even if Samsung does cut prices, just how long can it resist the onslaught of smaller, more nimbler competitors with little to lose?

While the Galaxy S6 may have done a great deal to establish Samsung as a “premium” company with premium products, the low-end devices mentioned earlier almost completely lack prestige. When it comes to mid-to-low end products, Samsung is still the Samsung of old, and that isn’t going to help it one bit.

To offer up some support for such a surprising suggestion, look no further than this graphic showing the Chinese market share evolution over the past year:

Consider that Apple has done quite well by focusing exclusively on the high end market, and even its Apple Watch – despite reports of diminished sales predictions – can’t stymie the huge number of pre-orders received, for a smartwatch of all things. There are definitely people with money to burn, and if Samsung can be seen as a company with products on par with Apple, suddenly even the fruit might start shivering.

Produce the un-producible

With respect to the focus on premium, Samsung has a lot of potential: the Edge display technology (curved AMOLED), the Galaxy S and Galaxy Note series, and whatever bendable, foldable, or flexible product it may seek to bring to market in the next year or so. It also has a lot of potential with its upcoming “Gear A,” the company’s first wearable to feature a circular display and with a unique interface that has presented itself in patent applications from earlier this year. In particular, the focus on making curved products will ensure that the company literally has no competition (save from LG), as currently there are no rivals that produce consumer electronics with such technology.

Even if Japan Display were to begin manufacturing such panels in the next few years (a large rival to be sure), there is seemingly no threat from Chinese OEMs and related component suppliers given the advanced nature of this kind of product. To illustrate this situation, look no further than the numerous Galaxy S6 clones, yet the lack of any Galaxy S6 Edge replicas. You can’t clone what you can’t make, and as such Samsung can definitely make a mainstay out of the proverbial impasse. The company has poured large amounts of financial resources into flexible technology, and it had best make the most of it to ensure its success.

One problem to consider, however, is that anything bendable or foldable is most certainly going to cost quite a pretty penny, as well as attract the inevitable ire of more conservative-minded consumers. That no one else can make a product like Project Valley might be is well-and-good, but if it retails for upwards of $1000 upon release, even high-end spenders might hesitate, less they be tech-heads. Add that to the fact that the first few products that make use of some new technology tend to have bugs or limitations involved: look no further than the original HDTVs and their high prices yet back-light burnout, or plasma TV burn-in. Suffice to say that Samsung’s gigantic curved 4K televisions are definitely high-end, yet they don’t seem to be flaying off the shelves.

Less is more

Realistically, Samsung’s capacity to simply “abandon” the budget market isn’t going to happen any time soon, at least not if investors and board members have anything to say about it: Despite the diminishing returns, something is still better than nothing, and thus even if the former top dog were to fall to the 10th rank spot in China or India, given their large populations, there is still a lot of money to be made.

A less dramatic solution then, might be to do away with the “one device for every and any possible need” mentality. Last year alone, Samsung released five tablet lines: Galaxy Tab PRO, Galaxy Note PRO, Galaxy Tab 4, Galaxy Tab S, and Galaxy Tab Active. Save for the Note PRO and Tab Active, the remaining lines each ranged from 4-6 different core variants (i.e. LTE or Wi-FI) when all available sizes were factored in. Is this really necessary? Perhaps nowhere could this be seen more questionable than the Tab PRO series, which was released only to be reduced to irrelevancy just a few months later when the superior Tab S line hit stores.

Samsung has pledged to streamline its future catalogs, yet there doesn’t seem to be any evidence of this. It’s now June, and the OEM has already released the: Galaxy A7, Galaxy S6, Galaxy S6 Edge, Galaxy E, Galaxy J, Samsung Z, with new rumors of even another flip phone for China now cropping up. We already know there will be a Galaxy S6 Active and a Galaxy Note 5 (presumably with a Note Edge 2) and of course inevitably more low-end devices as well. Do we really need a low-low end (J) and a standard low-end (E) product? Given the extremely low costs of making such products, there is still too much overlap, seemingly just to put as many devices in front of shoppers as possible.

Tout Tizen

The final main possibility is for Samsung to simply accept the inevitable: it will never regain the soaring heights it reached in the recent past simply because times have changed. Sony has been confronting this for the better part of the 21st century and less the Korean giant wants to fall into a similar pitfall, it needs to accept this and find a new strategy. There is a lot of logic to the desire to push Tizen as a major brand, and in that regard there is promise of a brighter future. Google, you see, is the real winner when it comes to AOSP Android: it doesn’t care who makes official builds of the OS (forked variants like the Kindle Fire not included) because it stands to benefit from the end result. Samsung, on the other hand, will end up being just another money making generator for Google, perhaps reversing the previous situation wherein Google, paradoxically, was largely the catalyst that ignited Samsung’s smartphones fortunes.

If Tizen can be truly established as a major platform, Samsung can gradually shift its focus and slowly redirect its loyal customers to its in-house OS. In theory, there is no reason it couldn’t make a Galaxy S6 Tizen Edition similar to how HTCmade an HTCOne M8 for Windows Phone. If it cost less than the Google variant, yet still featured the same specs and hardware, it would be of immense interest to those who want the product but aren’t willing to spend for it. Likewise, the prevalence of a diverse range of Tizen devices would mean that its scope could be expanded beyond India and Bangladesh (the two countries where the Samsung Z1 is currently on sale) and the Gear smartwatch series.

Samsung, in theory, could become a company like Apple or Google, or Microsoft. In theory.

Wrap up

Samsung is in a curious position, and one that could very well determine its fortunes over the next year. The budget market is becoming increasingly controlled by Chinese manufacturers, and unless Samsung can cut corners or pinch prices, there seems little possibility of it ever topping the sales charts again when it comes to the Galaxy series in countries like China or India.

One potential area of hope could be in truly budget friendly products like the Tizen-running Samsung Z1, which interestingly enough became the top selling phone in Bangladesh for Q1 2015. Still, as far as Android goes, we feel it might be time for the Korean conglomerate to finally accept the changing times and devote itself to making top-notch Android products with the best hardware, software, and support, or else truly slim down the pickings.

Any thoughts? Be sure to leave a comment below and let us know!