Affiliate links on Android Authority may earn us a commission. Learn more.

How Apple's mind-boggling run shows only Google can compete, if it wants to

Android OEMs can’t compete with Apple head-on. Android is showing some encouraging signs, which might eventually dislodge the iPhone-maker’s position in the market, but it’s going to take a company like Google to do it. Apple’s quarterly earnings release for the last fiscal quarter shows us why.

Apple released the new and hotly anticipated iPhone X (or 10) in 2017. It was priced at $999 for 64 GB and $1149 for 256 GB of storage and had two new attention-grabbing features: a much bigger new OLED screen, and FaceID, vastly improved facial recognition. It was the first significant change to an iPhone since 2015, and it underwhelmed many — including us.

Most analysts believed this wasn’t the real game changer Apple had up its sleeve for the 10 year anniversary of the iPhone. Many said the pricing was a bridge too far for consumers. Many said it wouldn’t sell, and that Apple might take a fall. Many headlines pointed to slower than expected iPhone X sales. It was easy to make fun of the notch and the limited appeal of Animoji.

Pundits were spectacularly wrong.

iPhone X has been our top-selling iPhone every week since it shipped in November

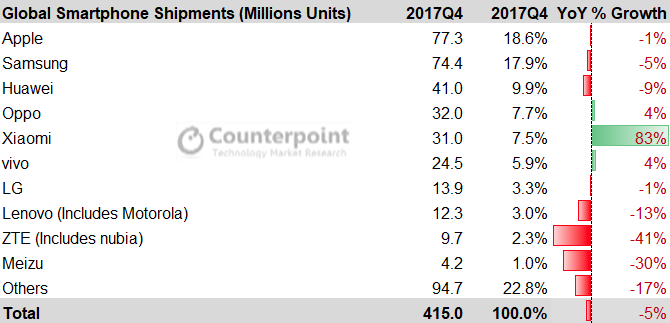

Apple again sold a staggering number of the world’s most expensive consumer smartphones, 77.3 million of them. There wasn’t any specific breakdown beyond the top-line, but the success of the device was obvious.

“iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” said Apple CEO Tim Cook.

Apple sold fewer iPhones than last year, down from 78.3 million iPhones, but here’s why it still dominated: global smartphone sales growth is over. Shipments are falling between at least 4.5% (IHS), 6.3% (IDC), or as much as 9% (Strategy Analytics) — the biggest fall in smartphone history; the market is in decline.

Apple succeeded in minimizing iPhone sales declines, despite having the most expensive product — where sales typically fall first. The numbers for Apple look even better when you consider that it was a 13-week quarter, against a 14-week quarter a year ago. Another week could’ve been added five million iPhones, pushing Apple firmly back into the green in growth. The total number of Apple devices in active use is up by 30 percent, to 1.3 billion.

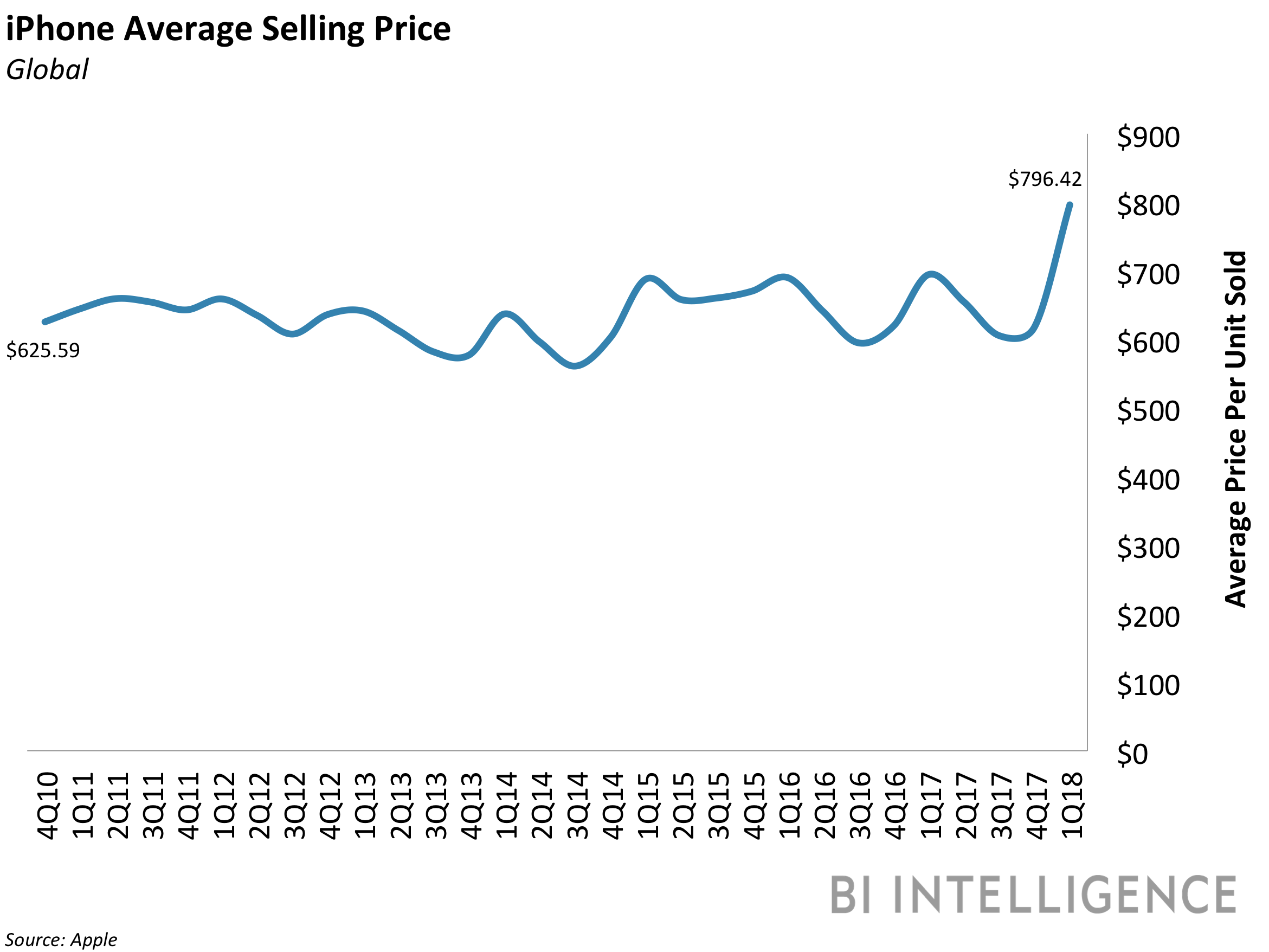

Better than selling more is selling similar at a much higher price. That leads us to one number: $796. That’s Apple’s average selling price (ASP), and it’s up $101 — 15 percemt — from $695 a year ago. That’s an incredible rise in a pressured market. It’s staggering.

The closest manufacturer to Apple is Samsung, whose ASP is $235. The South Korean manufacturer sold fewer phones than Apple in the same quarter, at 74.1 million units, and received $561-less per device. That’s down from a high of $289 in 2013. Apple more than triples Samsung’s revenue per phone and is growing. It helps that Samsung makes the expensive OLED screens in the iPhone X. It generally has a broader and different business model — of course they’d love to be in Apple’s position too.

Apple is in rare company historically

But this is one of the few times we’ve seen anything like this in history. Few companies in existence have had this much of an edge on its competition. Samsung is doing spectacularly well at capturing a large market share, but it still can’t hold a match to Apple’s never-ending bonfire of success.

One of the most intriguing battles for Apple is Wall Street expectations. Apple shares actually fell after these earning reports. Their frankly spectacular quarter still didn’t live up to hopes that the iPhone X might have lifted sales to a whole new level. Earlier reports speculated Apple overestimated iPhone X demand, too.

The growth strategy for Android OEMs is now clear

This is a moment of clarity. The only path forward for Android OEMs hunting for growth is at the value end of the market. Samsung in the U.S. and Huawei everywhere else will receive enthusiast support for their premium smartphones, but that market isn’t growing.

HTC burned out trying to offer high-end smartphones. Sony has cut back. Essential tried and fizzled, forced to cut prices. Razer is already offering generous inclusions and discounts on its gaming Razer Phone. LG is shaking up its smartphone releases.

Samsung, HUAWEI, LG, and the like will obviously continue producing high-end phones. Their smartphones command respect and drive innovation. Development of premium smartphones actually boost the brand appeal of lower-tier mid-range or value phones. There’s a place for these companies in the high-end market — Apple will never be alone in premium sales.

The low-cost and ultra low-cost end of the market is the only one showing growth. Xiaomi has managed considerable growth in this market, with IDC data pointing to an additional 39 million smartphones sold year-on-year, rising to 92 million. They’ve only just been able to surpass what Apple and Samsung achieved in one quarter, but they’re on an upward trajectory:

With the iPhone entrenched in the premium market, it would appear the main risk for the disruption of Apple is to leave it isolated and slowly shrinking. In this scenario, the increasing quality and value of the lower end of the market would lead to an increasingly hard choice when buying a new phone.

Can value phones disrupt Apple?

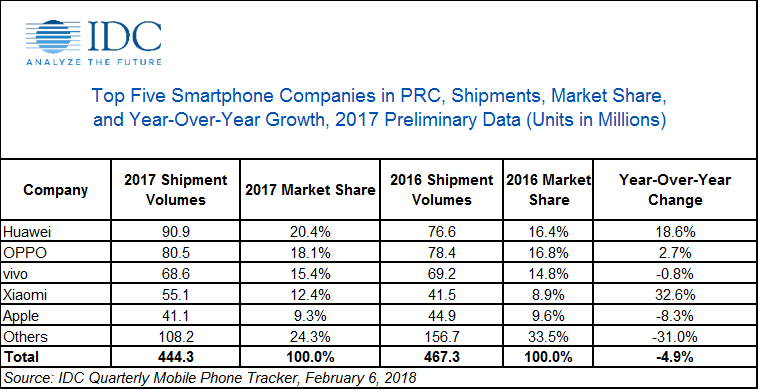

China is ground-zero for the question of if a bottom-up approach will work to unseat Apple. Local brands are attempting to find market-share not at the top of the market, but in the low and mid-tier range. Outside of major Tier 1 cities, Apple is too expensive for many consumers, and the growth of manufacturers like HUAWEI (and its HONOR brand), Xiaomi, OPPO, and vivo are producing better phones than ever.

IDC data confirmed Apple is still responsible for 85 percent of sales for smartphone over $600 in China, but their broad market share declined between 2016 and 2017 by 8.3 percent.

Reducing Apple’s market share to just the premium end of the market could make company may lose a hold on potential consumers.

Apple’s ecosystem is more powerful the more you integrate with it, but that comes with additional cost with which newcomers may struggle. Apple CEO Tim Cook indirectly referenced this in the recent earnings call, noting how useful hand-me-down iPhones are to its continuing dominance.

“The previously-owned market has expanded in units over the years and you see, in many cases, carriers and retailers having very vibrant programs related to trading in older iPhones. Many customers hand down their iPhones now — I view this as a positive — more people on iPhone the better.”

It’s clear Apple’s above-average in-store support to keep iPhones alive and offer replacements for users has a broader goal: get people on early via hand-me-downs and lock them in. Hard.

Ecosystem battles and Google

Only Apple offers iOS and the iCloud world. It may not suit you, but there’s a age bracket where wealth, motivations, demand for premium, and arguably confidence with technology, mean that Apple’s marketing, network effect, and positioning, just works.

Samsung and Sony have attempted to foster the kind of software ecosystem which makes Apple attractive, but failed to execute or offered limited value. Samsung’s hardware efforts are credible — smartphones, smartwatches, laptops, tablets — but there’s not a quality software ecosystem between them to lock people in. Most just use a mix of Google apps and third-party apps like Dropbox.

Only Google can compete with Apple. Finally, this might be happening

This makes Google seem like the only company with a real chance at matching Apple with both super-premium hardware, and, in time, premium unit sales. Google’s unrivalled software ecosystem works anywhere, and it’s largely free. Nexus and Pixel phones have shown it also works best on devices “Made By Google.” That’s where Google could deliver a premium experience on hardware and software.

It’s already happening — there were encouraging signs for Google’s Pixel 2 premium devices over the holiday period too. The Pixel 2 reportedly captured more activations than the iPhone X over the same period, per Localytics. Google Assistant is unequivocally better than Siri. The Google Photos app AI on Android is better than Apple’s Photos for iOS, and it’s free.

The 2,000 HTCengineers Google acquired is a very obvious pointer to further and better hardware endeavors, and not just in smartphones.

Apple’s absurd dominance locks away all the negative iPhone X narratives and throws away the key. It has a stranglehold on premium phones. Sure, Apple makes mistakes and missteps. Just as many people shun the Apple world as embrace it. The short-term trend of selling less iPhones at a higher price looks set to continue if Apple can’t find necessary innovation to spike sales for an iPhone X Plus/iPhone XS, and later, iPhone XI or 11.

Apple’s marketing prowess, network effect benefits, and rigid focus on premium products has made it extremely tough for Android OEMs to compete the premium market, but the low end has significant potential.

Only Google seems able to fight at the top end of the market. As software company with an arguably better and cheaper ecosystem, but still making only small steps into hardware — and with one arm tied behind their back by partners who demand that it does them no harm — It’s going to be an intriguing and difficult battle. Right now, Apple’s dominance is at an all-time high, and that’s no exaggeration.