Affiliate links on Android Authority may earn us a commission. Learn more.

How to use Google Tez

The demonetization and resulting cash crunch in India last year has given rise to a slew of digital payments apps. These apps go a long way towards making our lives easier, with everything from online transactions to paying at your previously cash-only tuck shops now possible with just your mobile phone.

Not to be left behind, Google jumped into the digital payments game with the launch of the Tez app a few months ago. Tez, which means ‘fast’ in Hindi, offers a few different ways to send and receive money, including one that makes it stand out from all the competition. If you haven’t used Google Tez already, here’s everything you need to know to get started!

Things to know

Google Tez utilizes the Unified Payment Interface (UPI). UPI was launched by the National Payments Corporation of India (NPCI), an umbrella organization for all retail payment systems in India. While the NPCI is a private entity, it is regulated by the country’s central bank, the Reserve Bank of India, and is supported by the Indian Banks Association.

When using UPI, you get a Virtual Payment Address (VPA) that serves as a unique identifier for your bank. You can easily send and receive money using this ID, which looks like an email address (name@upi) and eliminates the need to divulge sensitive information like your bank account number, debit card and credit card numbers, netbanking details, and more. UPI is an advanced version of the Immediate Payment Sevice (IMPS), which allows transactions to occur 24/7.

UPI is very different from the e-wallets that have become popular in India. E-wallets require maintaining a balance that you need to load before performing any transactions. UPI allows for the debit or credit directly from or to your bank account, removing the additional step of pre-loading a digital wallet. Even popular e-wallet apps like Paytm have now introduced an UPI option.

Installation and setup

Here is a step by step guide to install and set up Google Tez.

- Download the Tez app from the Google Play Store here.

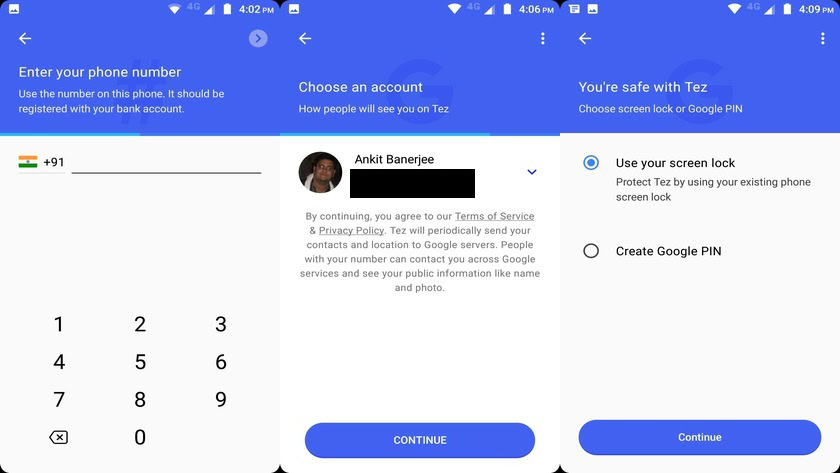

- When you open the app, you will first be asked to select a language. English is selected by default, but Tez also supports various regional languages like Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil, and Telugu. Select the language of your choice and tap on the arrow key at the top right corner.

- Enter your phone number. Keep in mind that this phone number is the one that should be linked to the bank account you plan to use.

- You will have to allow Tez to view and send SMS for authentication.

- You will also be asked for permission to access your Contacts. If you allow it, the app will be able to recognize others on your contact list who use the app, making it easier to send or receive money from these users.

- Select a Google account to link with the app.

- The app will then verify your phone number. If you haven’t given permission to access SMS, enter the One Time Password that is sent to you. With permission, the app will automatically do it for you.

- You will now have to set up security. You can either use your phone screen lock or fingerprint scanner, or set up a Google PIN.

- A quick tutorial will show you the various features of the app.

Adding a bank account

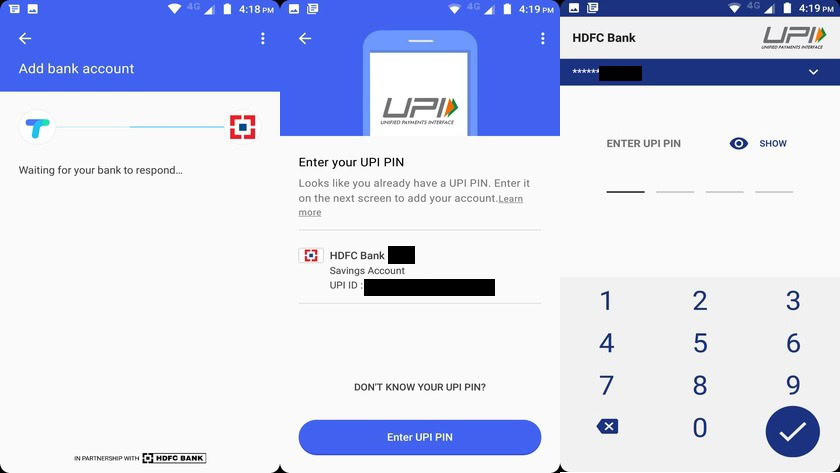

- At the top of the screen, tap “add bank account.”

- Select your bank from the list. 60 banks are listed, including Paytm Payments Bank and Airtel Payments Bank, so you should be able to find your bank easily. You can check out the full list of supported banks here.

- Once you select your bank, an SMS will be sent from your phone to verify your number. Again, remember that the phone number you first entered during the setup process is the one that is linked to your bank account.

- If you already have an UPI ID set up, you will just have to enter your UPI PIN. The PIN will be verified and your account will be added.

- If you don’t have an UPI PIN already, you can easily set it up using the app. Once the account information shows up, tap on Proceed. You will then have to add the debit card details for the card that is linked to your account and phone number. Then select a 4-digit code for your UPI PIN.

- You are now ready to use Google Tez!

Making or receiving payments

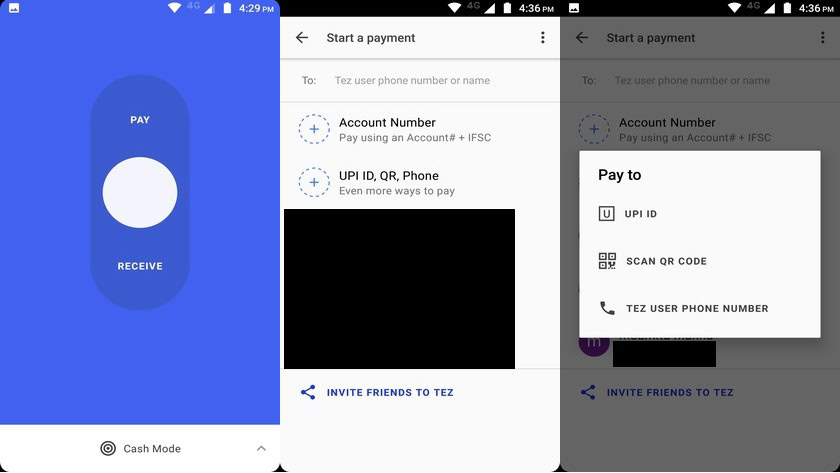

- Cash Mode – The first thing you will see on the app is a large button for Cash Mode. This is very unique and one of the fastest ways to send or receive money. The app utilizes ultrasonic audio (Audio QR or AQR) to recognize nearby Tez users. Move the slider to Send or Receive, and the app will search for nearby users. Once it finds the person you want, all you have to do is enter the amount and confirm.

- Bank account – If the person isn’t with you, you can send them money using their bank account information. You will need details like the account number, and IFSC code though.

- QR code – You can also identify another user by scanning a QR code. To receive money, you can find your QR code by tapping on the three dots at the top right corner on the app’s main screen and selecting “Display QR code.”

- Phone number – Using a phone number is another easy way to transfer money. Just like Cash Mode, the person will have to be a Tez user. Contacts who use Tez will automatically show up below the various payment options.

- UPI ID – Finally, you can transfer money easily if you know the UPI ID of the other person.

Usage limits

Google Tez is a great way to send or receive money. As far as online transactions are concerned, only a few stores and businesses currently support Tez, which include RedBus, PVR Cinemas, Domino’s Pizza, DishTV, and Jet Airways. While its online capabilities are quite limited for now, this list will definitely continue to grow in the coming months.

UPI has a daily transaction limit of Rs 1 lakh and a maximum of 20 transactions a day. Keep in mind that this is a limit set by the RBI. This means if you use another UPI app to send someone Rs 20,000, you can only use Tez to send another Rs 80,000 that day. There are no limits on how much you can receive.

Offers and rewards

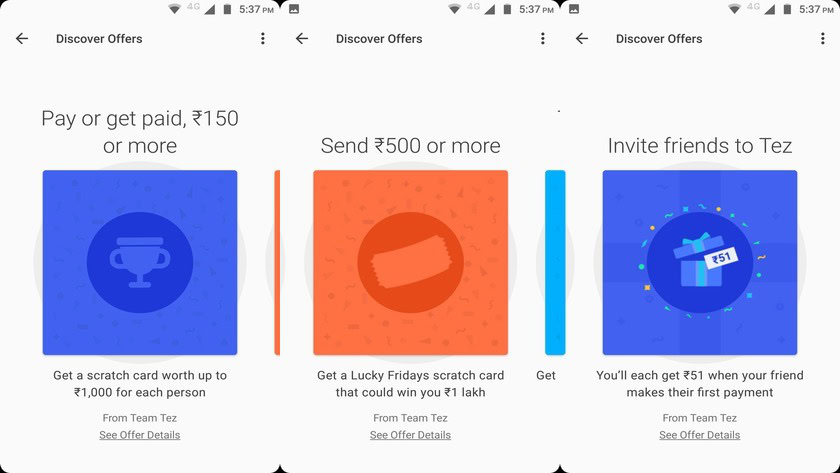

Google has a few offers and rewards available to attract consumers which are pretty great. While some of these offers expire pretty soon, new offers should be available after that.

- Pay or get paid Rs 150 – With a transaction of just Rs 150, you can get a scratch card worth up to Rs 1,000 for each person, up to 5 cards per week. This offer expires on November 20.

- Send Rs 500 or more – When you send Rs 500 or more, you will get a Lucky Fridays scratch card with a value up to Rs 1 lakh. The card activates every Friday at 10 AM.

- Travel with Tez – If you complete three payments of Rs 150 or more on Uber or RedBus, you will receive a scratch card worth up to Rs 500. This offer also expires on November 20.

- Referral program – You get Rs 51 for every referral when they make their first payment. This offer expires on April 1, 2018.

Google Tez vs the competition

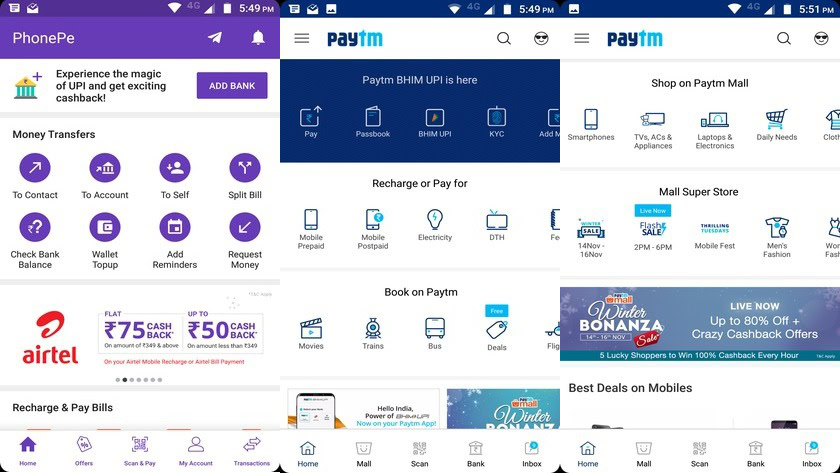

There is a lot of competition in this space already, with apps like PayTm, Phone Pe, BHIM, and a slew of others already available directly from banks. Google was late to the party with Tez, but has something unique in the form of Cash Mode that helps it stand out from the crowd. That said, apps like PayTm and Phone Pe offer a lot more features and transaction capabilities than Tez.

PayTm and Phone Pe are quite similar in what they offer. Apart from transactions using UPI, which Paytm added only this month, both also work as a digital wallet. You can also transfer and pay money using your debit or credit card, as well as netbanking. Both also allow for bill payments, phone recharges, and more. Paytm takes things to another level by serving as an e-commerce store as well. Paytm is also more widely supported when it comes to online transactions.

A more direct competition for Tez is the Bharat Interface for Money (BHIM), which is a public sector app. Like Tez, BHIM uses only UPI and the transaction capabilities are similar, except for Tez’s Cash Mode. However, BHIM comes with offline transaction support, so you don’t have to worry about having an internet connection.

One advantage Google Tez has over the other apps is with regards to cashback and rewards. Both Paytm and Phone Pe have fantastic cashback offers and rewards available as well, but the reward money is credited only to their respective digital wallets. With Tez relying solely on UPI, all rewards are credited directly to your bank account, allowing you to withdraw it as cash or use it where digital wallet payments aren’t accepted.

Tez rewards are credited directly to your bank account, allowing you to withdraw it as cash

Final thoughts

Google Tez falls behind apps like PayTm and Phone Pe when it comes to features and capabilities. Not only do they come with support for more payment options like debit/credit cards and netbanking, but are also full fledged e-wallets, and can be used for more than just transferring money to another person.

Tez still has a long way to go as far as store and online payment support goes. However, if that’s not what you need and are looking for a quick and easy way to send or receive money, Tez’s Cash Mode is an intriguing prospect that works really well.